Why Bitcoin investors are increasingly focused on the long term.

The market is thinking about Bitcoin differently

This chart shows the duration of how long investors have been holding onto the cryptocurrency, by the percentage of supply.

- Bitcoin investors are increasingly long-term focused. In 2020, 57% of bitcoin’s (BTC) supply was held onto for more than a year

- Today, nearly 22% of BTC supply is held for more than five years

- Bitcoin hit a $1 trillion market cap milestone in the first quarter of 2021

According to research from Ark Invest, investors are holding onto bitcoin for longer and longer durations. By holding the asset rather than selling, it decreases the supply of coins available on the market at any given moment, which can drive up price. This suggests that market participants see the long-term value and potential future payoff the asset possesses.

In the past, durations of days and months were the most common holding periods for bitcoin investors, while holding for more than a year was practically non-existent up until recently.

| BTC Duration Held | % of BTC Supply |

|---|---|

| >5 years | 21.80% |

| 3 to 5 years | 13.38% |

| 2 to 3 years | 10.99% |

| 1 to 2 years | 10.70% |

| 6 months to 1 year | 8.30% |

| 3 months to 6 months | 7.07% |

| 1 day to 3 months | 27.76% |

Bitcoin should be worth about $400,000 says Guggenheim Partners CIO Scott Minerd

- Bitcoin should be worth $400,000 based on its finite supply and value compared with gold, Guggenheim's Scott Minerd told Bloomberg on Wednesday.

- "Our fundamental work shows that bitcoin should be worth about $400,000," he said. "It's based on the scarcity and relative valuation such as things like gold as a percentage of GDP."

- His comments came on the day bitcoin crossed $20,000 for the first time.

Guggenheim Partners CIO Scott Minerd asserted on BloombergWednesday that bitcoin's current price is well below fair value and that given its scarcity and the “rampant money printing” by the Fed, the digital token should eventually climb to about $400,000 per coin.

By the numbers: Bitcoin rose above $23,000 overnight (our data viz team made this chart at 3:40pm yesterday) bringing its 2020 gain to more than 200%.

- Last month, Guggenheim filed to reserve the right to invest as much as 10% of its $5.3 billion Macro Opportunities Fund in the Grayscale Bitcoin Trust, which invests solely in the cryptocurrency.

What he's saying: “Our fundamental work shows that bitcoin should be worth about $400,000,” Minerd said. “It’s based on the scarcity and relative valuation such as things like gold as a percentage of GDP. So you know, bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.”

- Similarly, hedge fund manager Paul Tudor Jones said earlier this year he’s been buying bitcoin as a hedge against inflation after years of muted price increases.

Bulls on parade: “We have a new line in the sand and the focus shifts to the next round number of $30,000,” Antoni Trenchev, co-founder and managing partner of Nexo, a crypto lender, told Bloomberg.

- This “is the start of a new chapter for bitcoin. It’s a narrative the media and retail crowd can properly latch onto because they’ve been noticeably absent from this rally.”

Many of bitcoin's attributes are similar to gold, and it also has an unusual value in terms of transactions carried out, he said. Minerd's comments echo those of an incoming Senator Cynthia Lummis who thinks bitcoin is a better store of value than paper money because of its finite supply. The Senator-elect plans to teach Congress how to use bitcoin to reduce US national debt when she assumes office in January.

Guggenheim is among the institutional players that are validating bitcoin's legitimacy as a reserve asset. The firm last month filed to reserve the right for 10% of its $5.3 billion Macro Opportunities Fund to invest in the Grayscale Bitcoin Trust, a bitcoin-focused investment vehicle.

Three major players are holding up the massive interest around bitcoin this year. That can be pinned down to enthusiasm from institutional investors, Wall Street professionals, and retail investor participation, according to Garrick Hileman, head of research at Blockchain.com.

According to Hileman, as many as 100 million people own crypto assets.

Tyler Winklevoss thinks the Realization ‘cash is trash’ could have Bitcoin hitting $500,000

Also Read:

- Bitcoin Could Hit $500,000, the Founder and CEO of ARK Invest Says Catherine Woods - MarketWatch

-

Winklevoss twins say bitcoin will be the decade’s best-performing asset, see ’25x’ gains from here - CNBC

‘Cash is trash…and [high-profile investors] realize it…At some point, it is hard to look at those data points and say that bitcoin isn’t an incredible store of value.’

— Tyler Winklevoss

The Winklevoss twins see bitcoin’s market value one day hitting $9 trillion

“Our thesis is that Bitcoin is gold 2.0 and it will disrupt gold. If it does that it has to have a market cap of $9 trillion. So we think bitcoin could price one day at $500,000 a bitcoin. So at $18,000 bitcoin it’s a hold or if you don’t have any its a buy opportunity because we think there’s a 25x from here,” Tyler expounded.

“We think bitcoin’s here to stay,” said Tyler, who explained that his prediction for much higher prices for bitcoin are based on a number of factors but not least of all the recognition by high-profile investors, including Paul Tudor Jones and Stanley Druckenmiller, who have recently “extolled the virtues” of the nascent asset, which was created in 2009.

Ark Investment CEO Cathie Wood appeared at the virtual investing in tech seminar put on by Barron's where she discussed the rise of Bitcoin.

What Happened: Wood told viewers the 160% year-to-date increase for the price of Bitcoin could be just the beginning.

Wood said the decision by the Fed to keep interest rates low, Bitcoin being a digital alternative to gold and an insurance policy against inflation as reasons why Bitcoin has increased in price.

The increase in institutional investors getting involved in Bitcoin is where Wood sees the price increasing further.

Wood said it reminds her of the early days of institutions beginning to make small allocations to real estate and emerging markets. She said the allocations started at 0.5% and then rose to 5%.

If institutions allocated mid-single-digit amounts to Bitcoin, it would take the price to a range of $400,000 to $500,000.

There will only be a supply of 21 million Bitcoin, with 18.5 million currently in existence.

PayPal Unveiled Plans to Enable the Purchase and Sale of Cryptocurrencies

RELATED ARTICLES

- Novogratz calls PayPal’s Bitcoin news 'the shot heard around the world on Wall Street’ - Cointelegraph

![]()

By Yassine Elmandjra | @yassineARK

Analyst

PayPal and its subsidiary Venmo have announced plans to enable cryptocurrency purchases. Within the next few weeks, users of Paypal’s Cash or Cash Plus will be able to buy, sell, and hold bitcoin, ether, litecoin, and bitcoin cash.

In June, CoinDesk surfaced rumors of PayPal’s crypto plans, suggesting that its 346 million users around the world would be able to buy and sell cryptocurrencies.

Next year, PayPal plans to enable crypto purchases through its network of more than 26 million merchants and through Venmo, its P2P payments app. According to its FAQ, “Once launched in 2021, when a consumer selects cryptocurrency as the funding source, the cryptocurrency will be instantly converted to fiat currency and the transaction will be settled with the PayPal merchants in fiat currency.” PayPal has not disclosed when or if it will enable cryptocurrency withdrawals, a cause for concern for the crypto community.

With 346 million active users around the world, PayPal will be the first network capable of introducing crypto to a mainstream audience.

Traditional Traders Are Ready to Go Crypto and Prefer Bitcoin

In a report named Institutional Adoption of Digital Asset Trading, compiled by the Acuiti management intelligence platform, in conjunction with the CME Group and the Bitstamp crypto exchange, authors claimed that survey data “suggests the digital assets market is on the cusp of significant growth from traditional trading firms.”

The findings were based on a survey of 86 senior executives “across the sellside, proprietary trading firms and the buyside.” The authors stated that its respondents from non-bank Futures Commission Merchants, proprietary trading firms and the buyside “tended to be C-suite [the executive-level managers],” while banking and brokerage respondents were primarily “heads of function at managing director level.” The findings were announced this week. However, the authors did not specify whether the survey was conducted before or after the market crash in March.

In either case, according to the survey, although most “traditional trading firms” still refuse to handle crypto, the tide could be about to turn.

The authors wrote,

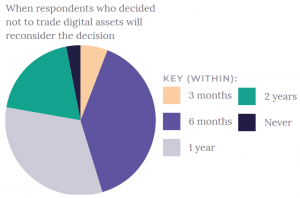

“97% [of trading firms] will consider the opportunity again in the next two years or less and 45% are planning to revisit the idea in six months or less.”

What’s stopping them? Yes, you guessed it – it's regulation again.

Bitcoin making the payments world better

Bitcoin is the digital currency which is created and held electronically and is the first successful digital coin that can be transferred over the web. Bitcoin is a peer-to-peer payment network which in simple words means that it can be transferred from a person to another directly over the internet, taking out middlemen such as banks and credit agencies

The crypto crash of 2019 considerably changed the dynamics in the crypto market and ensured a clean-up of the crypto market. Cryptocurrency price changes are no longer dramatic and the Bitcoin has become significantly stable. The new crypto market is being driven by institutional money in combination with the new wave of innovation and adoption which will come from security tokens combined with stable coins. The crypto market is also becoming more regulated, and therefore more accessible to the public and efficient. The New York Stock Exchange’s operator is to start working with Bitcoin futures in 2020, while Nasdaq will follow their lead a year later. Bitcoin has matured as an investment vehicle, primarily with the introduction of Bitcoin futures, allowing for adoption, as investors short Bitcoin and settle contracts in real money, as well as trade-off Bitcoin even when they do not own bitcoin.

Bitcoin users can accept and send Bitcoin payments of any size from anywhere in the world in seconds instantly which allows users to minimize the amount of cash and plastic they need to carry around. People comfortable and conversant with bitcoin may travel solely with it as a means to an alternate source of income. An Australian beach town in Central Queensland became the first digital currency-friendly tourist town.

As bitcoin can be used to initiate global payments around the world at insignificant costs and in near real-time, it offers an opportunity for crowdfunding by anyone around the world to help support charities and any foundations. You can offer aid to any foundation from anywhere in the world to help a cause. You can also scan a QR code to make payment into a bitcoin wallet. This use of bitcoin is an initiate of Project 256.

If an woocommerce coupon company permits bitcoin to be used to complete purchases, it has advantages such as cutting out middlemen, cutting down transaction fees, increasing the speed of transaction and can boost trade in some developing countries. It is also very secure, and so can be used to encrypt keys of a digital wallet. Because Bitcoin is instantaneous, users have peace of mind that a transaction is completed for sure, and so reduces time where a payment remains pending for a period of time. The instantaneous nature of bitcoins, along with its security means that chargebacks are very unlikely to occur. You can accept Bitcoin through the use of payment buttons, invoices or custom integrations. Bitcoin is still very relatively new in the woocommerce smart coupons space, so if you are going to use it, ensure there are FAQs to guide the customer and make the UX as intuitive as possible.

Bitcoin may be used to integrate the unbanked. It can be used for digital micro-loans, on monetary exchanges and for cross border remittances.

As bitcoin is a digital asset, it can be moved automatically, allowing for programmable money and smart contracts. Escrow accounts are already used for transactions, such as real estate deals. Customers’ deposits can have held in the escrow accounts and only goes to the seller after what the buyer paid for has been delivered. In a digital age where trust can be crucial to people who want to transact with sellers or buyers they don’t know, this system can be used for varying amounts.

Researchers are working on ways to map bitcoin transactions in the ledger to IP addresses. Although this system is not perfect yet, this exploration into computer science, economics, and forensics will help nab criminals and can also serve as a guard against money laundering.

Bitcoins are not associated with a bank account or cash funds, and because they're only transferred electronically through blockchain ledger systems, they are likely to reduce fraud overall in the future.

National banks of countries that are subject to extreme conflict or financial mismanagement might begin supporting cryptocurrencies by supplementing the gold reserves with bitcoin as it is a trust-minimized cryptocurrency solution.

About the author:

Junaid Ali Qureshi is an ecommerce entrepreneur with a passion for emerging tech marketing and ecommerce development. Some of his current ventures include Progos Tech (an Woocommerce mix and match), Elabelz.com , Titan Tech and Smart Marketing.

Taxing Crypto: Currency or Commodity?

The world saw its first bona fide cryptocurrency in 2009 with the advent of Bitcoin. Since then, cryptos have taken the realm of fintech by storm. Its rise in popularity billowed so rapidly, in fact, that nations are unsure how to regulate it. The truth is, cryptocurrency is such a novel technology that we still don’t quite know how to handle it.

Should we consider cryptocurrencies commodities or actual currencies? The answer to this question is not so simple. In fact, tax regulations around the world differ on the interpretation.

Our current understanding of cryptocurrencies is that they can basically be either, depending on how they’re used.

Crypto as Currency

As the name itself implies, cryptocurrency can function much like fiat money. By that token, one may use them for the purchase of goods and services (in some countries, anyway). They may also be exchanged into other currencies, making them functionally the same.

So that settles it, right? After all, cryptos do everything money does, for the most part. Well, not quite. While they may operate like currency, and intuitively it makes sense, some traits make cryptos difficult to classify as currency.

For one, it is a decentralized currency. In other words, it is not tied to any third party authority (country, bank, etc.); there’s the sender and the receiver, nothing more. This stands in stark contrast to how traditional money has worked up until now.

Secondly, cryptos cannot be produced arbitrarily according to a country’s current economic state. It instead requires “mining,” and only a fixed amount of them exists. This makes cryptos more of an asset, like gold.

Crypto as Commodity

From a certain perspective, cryptos can also be considered a commodity. Granted, the line between currency and commodity is quite fine. The key difference between the two is that the former acts as a clear-cut facilitator for exchange which quantifies the value of an item or service.

That being said, a cryptocurrency does possess fungibility, i.e. the ability to be interchangeable with other commodities on the market. Beyond that, commodities can afford to be volatile, whereas currencies don’t have that luxury. Having in mind Bitcoin’s value history, it certainly fits the profile of a commodity.

This view certainly isn’t without legal precedent. In early 2019, Indonesia greenlit legislation that treats Bitcoin as a commodity for trade. Meanwhile, the Australian Tax Office (ATO) suggested the same ruling on the matter for other cryptos as well, rendering them subject to the Goods & Services Tax. Australia ultimately dubbed Bitcoin as money.

The main idea that stops cryptocurrencies from being pure commodities, however, is the idea of value. Commodities have intrinsic value, like crops, for example. Cryptos, on the other hand, hold only the value that current market expectations give them. It’s only worth what it can buy, and nothing else.

In the Eye of the Beholder…

As things currently stand, crypto seems to dip its toes in both ponds, performing as both commodity and currency. And until we reach a deeper understanding of crypto, regulation cannot consistently come to the same decision on the matter. Thus, for now, it’s up to each individual country to make up its mind about this conundrum. Until then, take a look at this insightful infographic below:

Erisx Launches Regulated Bitcoin Futures Market BTC $BTC

Crypto trading platform Erisx has launched a bitcoin futures market regulated by the U.S. Commodity Futures Trading Commission (CFTC). Its physically-settled bitcoin futures contracts trade alongside its spot market which supports four cryptocurrencies. Erisx has obtained a license from the U.S. Financial Crimes Enforcement Network (FinCEN) and is currently approved to operate in 44 states, with a plan to expand to 53 states and U.S. territories.

Article Published on Bitcoin.com

Physically Settled, Regulated Bitcoin Futures

Erisx announced on Tuesday the launch of its regulated bitcoin futures market. The platform’s physically-settled bitcoin futures contracts are offered alongside its spot market for “price transparency and collateral efficiency,” the company detailed. Initially, only monthly and quarterly contracts are offered.

Since the contracts are physically settled, “settlement will be made by the movement of the digital currency to the buyer of the futures contract and US dollars to the seller of the contract,” Erisx’s website describes. The current requirement to become a member of the platform is a minimum balance of $10,000.

Erisx’s current futures product.

Prior to Tuesday’s launch, the company ramped up its team and developed technology for its exchange’s matching engine (TME) and clearinghouse’s clearing system (TCS). The company also developed risk-mitigating functionality to enable efficient price discovery such as self-match prevention, price banding, and maximum order sizes. Its futures clearing platform was built from scratch. Currently, Erisx’s spot trading platform supports BTC, BCH, ETH, and LTC, which can be traded against the USD or BTC >> READ MORE

The SEC Temporarily Suspended Trading in Bitcoin Generation Miner’s Shares

Author: Nikhilesh De / Source: CoinDesk

The U.S. Securities and Exchange Commission (SEC) is temporarily suspending trading of shares in a little-known, self-described crypto exchange and mining firm called Bitcoin Generation (BTGN).

The regulator announced Monday that it was suspending trading until 11:59 P.M. Eastern Daylight Time on May 10, 2019 (or 03:59 UTC May 11) due to concerns that some information BTGN has made public may be inaccurate.

Specifically, the SEC is concerned about a bond that BTGN “purportedly acquired from an entity based in the United Kingdom”; how much BTGN stock is outstanding; promotional activity related to BTGN; and the “accuracy and adequacy...

Are Stiffer Bitcoin Regulations Brexit’s Surprising Side-Effect

Author: Mark Emem / Source: CCN

By CCN: The prolonged process for withdrawing from the European Union may have resulted in great uncertainty, but the UK’s financial watchdog is sure about what it wants post-Brexit – more muscle to oversee bitcoin and the crypto industry at large.

According to the Financial Conduct Authority’s business plan for 2019/2020, the regulator will urge Her Majesty’s Treasury to boost its enforcement powers in the crypto sector ahead of Brexit. Per FCA’s chief executive, Andrew Bailey, UK’s EU withdrawal is the body’s most pressing and urgent challenge.

Andrew Bailey on our Business Plan 2019/20 https://t.co/4Juptx0QcY pic.twitter.com/d5guGsyJtV

— FCA (@TheFCA) April 17, 2019

The financial watchdog intends to first hold public consultation first, though, before its enforcement powers can be increased:

“Following our consultation on cryptoassets we will publish a Feedback Statement and finalised Perimeter Guidance. We will also provide technical advice to the Treasury on extending the perimeter for utility and exchange tokens and on extending our financial crime provisions to certain activities related to cryptoassets.”