Tyler Winklevoss thinks the Realization ‘cash is trash’ could have Bitcoin hitting $500,000

Also Read:

- Bitcoin Could Hit $500,000, the Founder and CEO of ARK Invest Says Catherine Woods - MarketWatch

-

Winklevoss twins say bitcoin will be the decade’s best-performing asset, see ’25x’ gains from here - CNBC

‘Cash is trash…and [high-profile investors] realize it…At some point, it is hard to look at those data points and say that bitcoin isn’t an incredible store of value.’

— Tyler Winklevoss

The Winklevoss twins see bitcoin’s market value one day hitting $9 trillion

“Our thesis is that Bitcoin is gold 2.0 and it will disrupt gold. If it does that it has to have a market cap of $9 trillion. So we think bitcoin could price one day at $500,000 a bitcoin. So at $18,000 bitcoin it’s a hold or if you don’t have any its a buy opportunity because we think there’s a 25x from here,” Tyler expounded.

“We think bitcoin’s here to stay,” said Tyler, who explained that his prediction for much higher prices for bitcoin are based on a number of factors but not least of all the recognition by high-profile investors, including Paul Tudor Jones and Stanley Druckenmiller, who have recently “extolled the virtues” of the nascent asset, which was created in 2009.

Ark Investment CEO Cathie Wood appeared at the virtual investing in tech seminar put on by Barron's where she discussed the rise of Bitcoin.

What Happened: Wood told viewers the 160% year-to-date increase for the price of Bitcoin could be just the beginning.

Wood said the decision by the Fed to keep interest rates low, Bitcoin being a digital alternative to gold and an insurance policy against inflation as reasons why Bitcoin has increased in price.

The increase in institutional investors getting involved in Bitcoin is where Wood sees the price increasing further.

Wood said it reminds her of the early days of institutions beginning to make small allocations to real estate and emerging markets. She said the allocations started at 0.5% and then rose to 5%.

If institutions allocated mid-single-digit amounts to Bitcoin, it would take the price to a range of $400,000 to $500,000.

There will only be a supply of 21 million Bitcoin, with 18.5 million currently in existence.

Taxing Crypto: Currency or Commodity?

The world saw its first bona fide cryptocurrency in 2009 with the advent of Bitcoin. Since then, cryptos have taken the realm of fintech by storm. Its rise in popularity billowed so rapidly, in fact, that nations are unsure how to regulate it. The truth is, cryptocurrency is such a novel technology that we still don’t quite know how to handle it.

Should we consider cryptocurrencies commodities or actual currencies? The answer to this question is not so simple. In fact, tax regulations around the world differ on the interpretation.

Our current understanding of cryptocurrencies is that they can basically be either, depending on how they’re used.

Crypto as Currency

As the name itself implies, cryptocurrency can function much like fiat money. By that token, one may use them for the purchase of goods and services (in some countries, anyway). They may also be exchanged into other currencies, making them functionally the same.

So that settles it, right? After all, cryptos do everything money does, for the most part. Well, not quite. While they may operate like currency, and intuitively it makes sense, some traits make cryptos difficult to classify as currency.

For one, it is a decentralized currency. In other words, it is not tied to any third party authority (country, bank, etc.); there’s the sender and the receiver, nothing more. This stands in stark contrast to how traditional money has worked up until now.

Secondly, cryptos cannot be produced arbitrarily according to a country’s current economic state. It instead requires “mining,” and only a fixed amount of them exists. This makes cryptos more of an asset, like gold.

Crypto as Commodity

From a certain perspective, cryptos can also be considered a commodity. Granted, the line between currency and commodity is quite fine. The key difference between the two is that the former acts as a clear-cut facilitator for exchange which quantifies the value of an item or service.

That being said, a cryptocurrency does possess fungibility, i.e. the ability to be interchangeable with other commodities on the market. Beyond that, commodities can afford to be volatile, whereas currencies don’t have that luxury. Having in mind Bitcoin’s value history, it certainly fits the profile of a commodity.

This view certainly isn’t without legal precedent. In early 2019, Indonesia greenlit legislation that treats Bitcoin as a commodity for trade. Meanwhile, the Australian Tax Office (ATO) suggested the same ruling on the matter for other cryptos as well, rendering them subject to the Goods & Services Tax. Australia ultimately dubbed Bitcoin as money.

The main idea that stops cryptocurrencies from being pure commodities, however, is the idea of value. Commodities have intrinsic value, like crops, for example. Cryptos, on the other hand, hold only the value that current market expectations give them. It’s only worth what it can buy, and nothing else.

In the Eye of the Beholder…

As things currently stand, crypto seems to dip its toes in both ponds, performing as both commodity and currency. And until we reach a deeper understanding of crypto, regulation cannot consistently come to the same decision on the matter. Thus, for now, it’s up to each individual country to make up its mind about this conundrum. Until then, take a look at this insightful infographic below:

Rakuten to Launch Their Crypto Wallet March 30th

Author: Matthew Proffitt / Source: CCN

Rakuten Inc. just announced their intention to terminate “All Bitcoins Inc.” and launch their own “Rakuten Wallet” on March 30. Businesses launching crypto wallets is nothing new, following companies like Line, KIK and KakaoTalk. The news comes after Rakuten completed their filings as a virtual currency exchange company (VCEX.)

The company stated:

Rakuten Wallet will contribute to the sound growth of the market as a virtual currency exchange company and will further enhance security and provide enhanced services so that more customers can use it safely and with confidence.

Rakuten will be filing another VCEX application for Rakuten Wallet in September 2019.

Rakuten Inc. (4755: JP) holds a market capitalization about one-tenth the size of GM’s profits, number ten on the Fortune 100 list.

What Does Rakuten Do?

Earning cashback on purchases can make large purchases a little more enticing if you pair it with decent discounts. Rakuten aggregates discounts and helps customers receive cash back on their online purchases.

Their offerings have struck a not-so-nice chord...

Huobi Prime offers digital currency investors a new way to Trade

Author: Nick Marinoff / Source: CCN

Tuesday, March 26 will see customers of the cryptocurrency exchange Huobi experience a whole new way of getting their fingers around cryptocurrencies. Known as Huobi Prime, the system is a coin-launch platform that ensures all currencies purchased by Huobi users are immediately deposited into their accounts and tradable against the Huobi Token (HT) with minimal delays, according to a company press release.

Customers will also have access to coins at below-market prices, as well as new projects and currencies not yet listed on major exchanges. Huobi’s executive team works with the project leaders of every coin or token listed, forming close partnerships and determining fair market values for users. Executives have also implemented tiered price limits to relieve customers of extreme volatility.

Speaking with CCN, Ross Zhang – head of marketing for Huobi Group – explains what inspired the new platform’s creation:

Low-quality coins and lack of access to ones with real potential are a perennial problem in the crypto space. While that is nothing new, I do think it’s taken on new importance in the ongoing bear market we find...

Silvergate ‘Bitcoin Bank’ crypto client base climbed 122% in 2018

Author: Mark Emem / Source: CCN

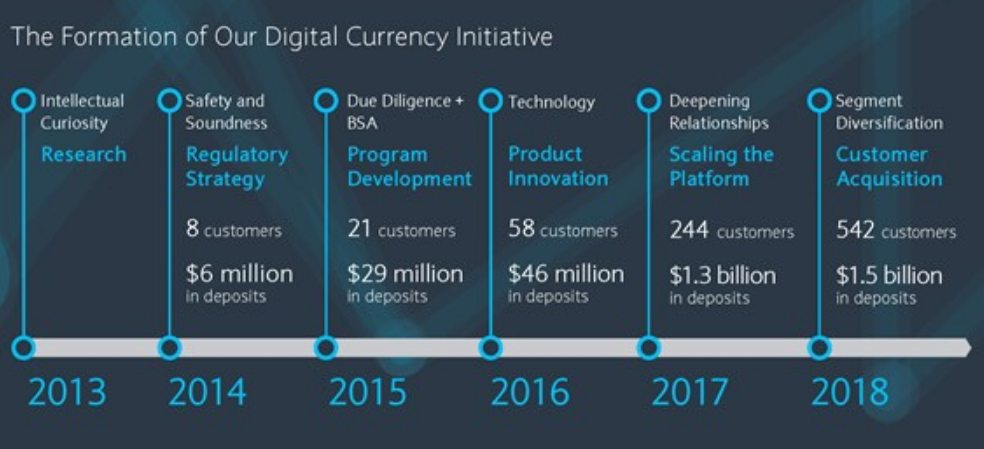

Silvergate Bank, which bills itself as the “leading provider of innovative financial infrastructure solutions and services to participants in the digital currency industry,” has disclosed in a preliminary prospectus filed with the U.S. Securities and Exchange Commission that despite the bearish conditions in the bitcoin market, its number of crypto industry clients surged in 2018.

Silvergate Crypto Client Deposits Rise to $1.58 Billion

By the end of last year, Silvergate revealed that it had 542 cryptocurrency-related customers. This was an increase of 122.1 percent from 2017 when the total number of customers was 244, per the prospectus. Total deposits also increased approximately by 8 percent from $1.46 billion to $1.58 billion.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Additionally, Silvergate disclosed that it was also in the process of onboarding some 232 customers.

Key Clients? Bitcoin Exchanges and Institutional Investors

Among its most notable customers, digital currency...

Industry sees crypto bottom as Bitcoin nears $4,100 and tokens gain 20%

Author: Joseph Young / Source: CCN

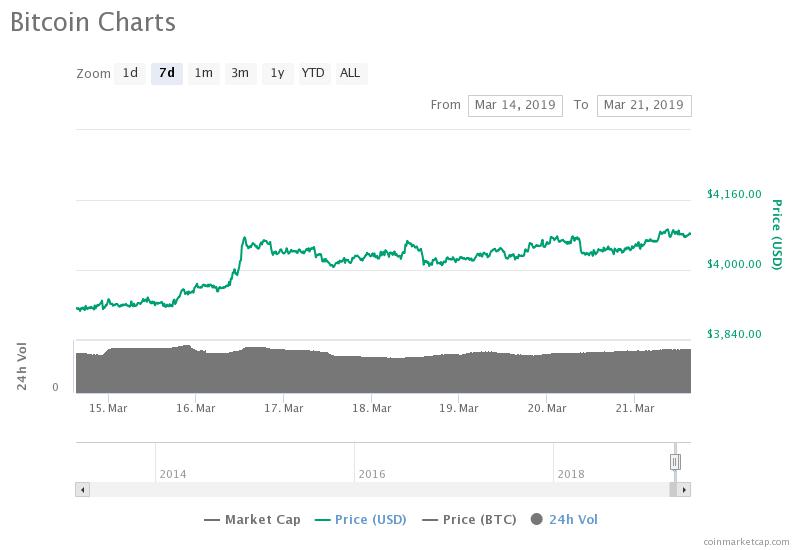

The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner...

Ethereum Governance is Currently Underrated says Vitalik Buterin

Author: P. H. Madore / Source: CCN

In the most recent episode of Into the Ether, Vitalik Buterin appears to discuss all things Ethereum. One of the subjects that came up was the Ethereum governance model. Eric Conner asked Buterin about on-chain governance models, and his thoughts on how Ethereum’s governance stacks up against them.

Current Governance Model Underrated: Vitalik Buterin

Buterin says that the current Ethereum governance model works pretty well, considering the problems it has guided the protocol through.

I actually think that Ethereum governance is under-rated at this point. Because it’s not something that we can attach a cool name to and advertise. And honestly, moderation is a less exciting pitch for people than either on-chain votes, maximum coin holder engagement, or on the other hand immutability. We as a community have never tended to go for extremes. But in reality, on the one hand people complain about governance as a process. But on the other hand, in terms of concrete outcomes that Ethereum governance has achieved, it’s done really well.

It’s implemented the issuance reductions. The issuance reductions seem to be something that most people tend to agree with. […] When there was a crisis back in the year 2016 DOS attacks, it managed to implement, roll, stack out, test and roll out a hard fork all within a time span of 6 days. That’s not something we want to repeat but it’s clearly something we can do if we really wanted to.

When there was a Constantinople bug, it managed to delay the fork within a few hours. It is achieving the things that you might reasonably want a governance of a protocol to achieve, which is to make changes people want and not make changes people want. The one thing that it’s not achieving is dispute resolution or...

Insights from the "future of crypto trading" meetup with FRST in Chicago

What do you get when you add a bitter cold and windy city, over 50 cryptocurrency enthusiasts, and three informative presentations? The Chicago Ethereum Meetup of course!

As you may have read, we made a short presentation to the group about our smart order router and algorithms we’re developing. We talked to founders of a handful of digital asset traders and we’re humbled by the feedback we received about our technology.

If you weren’t lucky enough to be at the meetup, don’t despair, I’ve embedded a video of my presentation below. Take a look at let us know what you think!

FRST’s presentation was mind-opening, it’s unreal to see how much information is available at the wallet and transaction level and how it can be used to trade cryptocurrencies more intelligently. You can read more about FRST here

The final presentation was by Andrew Gordon, an accountant specializing in cryptocurrency tax law. Tax time for crypto traders can be a nightmare, but he shared some great information about how to streamline and simplify the process. You can learn more about him here.

If there was one main takeaway from the meetup it’s that there are so many areas of the digital assets ecosystem that are currently unexplored. It’s said that 99% of the ocean floor is currently unexplored and I believe we are currently in the same place with blockchain and digital assets.

Why Every Portfolio On The Planet Should Be Holding Bitcoin

Editor’s Note: Art Jonak is an investment analyst with both a wide and deep synthesis approach to research data. His commentary threads on titans like Netflix, Amazon and Facebook are a minor legend for their insight, detail and clarity. He also navigates venture funding, and emerging sector data, in a narrative, often with striking visualization, that reveals trends in their formation long before they are visible. It should not need to be said for investment disclosure that Art is holding crypto assets himself. He is obviously making a case of why everyone should.

Here is Art’s 2019 message thread for investing in Bitcoin, in particular. In our eyes, it slams the case for why every single portfolio on the planet should be holding Bitcoin, and treated as a portfolio asset class.

Here's one case for why some should consider adding Bitcoin to their investment portfolio:

Here's one case for why some should consider adding Bitcoin to their investment portfolio:

* Bitcoin is a non-correlated asset — This is the holy grail of any portfolio. Bitcoin’s current 180 day correlation to the S&P 500 is 0 and the correlation to the dollar index is near zero as well. Investing in non-correlated assets should reduce the risk and increase the returns of a portfolio according to modern portfolio theory.

* Bitcoin has an asymmetric return profile — There is much more upside than downside in owning the asset. The downside (loss of capital) is capped at the total amount of capital invested, yet the upside is ~100X+ (if Bitcoin only becomes gold equivalent).

The modern portfolio theory argument for investing in Bitcoin is quite strong. But how has theory played out in practice?

Bitcoin has been the best performing asset over the last 10 years. It has experienced a 1,300,000X+ increase in value from $0.003 to ~$4,000 today. It has beat the S&P 500 for the last 10 years, the last 5 years, and the last 2 years. As a fixed supply asset, I believe Bitcoin will continue to outperform traditional assets in the future as demand continues to increase too.

Although I believe in Bitcoin’s future outlook, most people should not put significant funds at risk in this investment opportunity. It is risky and speculative. They could lose 100% of the money that they invest. For that reason, each person needs to evaluate their current situation, their goals, and the amount of capital they would be willing to lose.

If the thesis plays out how many smart people anticipate though, an investment of 100 basis points or less would materially change the performance of your portfolio fund, which ultimately changes the quality of life you will live when you retire. Most institutions have permanent, long-term capital which allows them to stomach more volatility than most investors.

For example, an investment of 1% of assets at $4,000 BTC price would yield a 25% increase in your portfolio total assets if Bitcoin reached $100,000. If you decided to invest 0.1% of assets, the same price appreciation would increase total assets by 2.5%.

However, the exciting part is that many people believe Bitcoin will not only reach $100,000 one day, but rather be worth $1,000,000+. If that comes to fruition, a 0.1% investment today could lead to the same 25% increase in total assets for your portfolio. These types of trade-offs are the definition of an asymmetric return profile.

And still, most people's portfolios have 0% exposure to Bitcoin and crypto. Something to consider as we head into 2019.

The Good And The Bad Sides Of Initial Coin Offerings

Cryptocurrencies are the new craze in the world of finance. Anywhere you look, one financial enthusiast is trying to get a grip with the world of cryptocurrencies. They are digital currencies; they are not minted in a central bank or regulated by a sole administrator.

They, however, hold a whole lot of value and are used for transactions. Their secure and decentralized nature made them an almost indispensable asset for several industries.

This brings us to initial coin offerings (ICOs). They would not have been possible without the existence of cryptocurrencies. In the short time that they have been in existence, ICOs became the latest trend in business circles. Simply said, they are are the best way for a startup business to generate investments.

How Do ICOs Work?

Startups offer investors a chance to purchase their tokens at considerably low prices in exchange for valuable cryptocurrencies such as Bitcoin, Ripple, and Ethereum. Due to the low prices of tokens, successful ICOs usually end up raking in millions in investment for the startups. Depending on how successful the startup businesses turn out to be in the future, investors can sell tokens for huge profits.

When Did ICOs Come Into Existence?

This might be very surprising to you, but ICOs are very young. The first one ever took place in 2013 and was held by Mastercoin. The next big ICO was done by Ethereum, which raised over two million dollars worth of investments within the first twelve hours of the process. Today, this cryptocurrency is one of the world's most valuable digital currency.

ICOs became the norms for startups soon after that. By the end of 2016, over a hundred million dollars were raised this way. Last year, that total figure grew to an unprecedented $1.25 billion.

There is no denying it, ICOs have been very vital to the economic and business development of the world as a whole. However, like with every new idea, there are many people very skeptical about this way of funding startups. To be honest, this is a very controversial topic.

Many financial analysts have raised the fact that it is highly unregulated as a major turnoff. Such concern is backed up by the fact that many ICOs were followed by some serious scandals. There have been huge scams and cases where investors have lost entire investments.

However, there are also several important advantages of this way of funding, which continue to attract an increasing number of worldwide investors. Some of the advantages include:

-

Middlemen are cut out

-

ICOs are available regardless of your location and nationality

-

Offer cheap avenues of investments

-

Allow you to contribute to the technological development of the globe.