7 Technologies Disrupting Finance Industry

In recent years, people have experienced the wonders of modern technology when it comes to managing their finances and accessing financial services. This trend is only expected to improve and continue with the advancements in technology like AI, cryptocurrency, blockchain, VR, and AR, among many other things.

But getting to this point has been a bit slow for the financial industry as compared to other industries who have arguably fewer developments in the technology department.

It’s understandable for the financial sector to have a slower response in the digital disruption due to the sensitive data that they hold.

There’s also the issue of established legacy systems that they have relied on for years. Something that newer and more agile financial companies are not facing due to less dependency on the system. These FinTech companies have the luxury of constantly re-evaluating and re-organizing their business model to give modern solutions to modern financial problems of customers today.

Rules and regulations have also hampered down the advancement of traditional financial companies. Most regulating bodies still don't know the capabilities of some of these technologies and the negative impacts they might have on both the ecosystem and the customers.

Despite these obstacles and due to the fast-changing behavior of customers and increasing competition from FinTech companies, a lot of financial companies have no choice but to digitally transform to provide the best service to their customers

Since fintech companies, normally, don't fall under the jurisdiction of these regulating bodies, they have been pushing the envelope and have experienced successes in implementing them. A great example of this is cryptocurrencies like Bitcoin and Ethereum that have experienced tremendous growth in the last decade. Now, traditional companies are exploring how they can use cryptocurrencies and blockchain technologies to carry out traditional tasks that are considered rigid, slow, and insecure. Some companies have also started accepting cryptocurrencies to pay for specific services.

We could say that, somehow, traditional financial companies are trying to keep up with the changes. But if they continue at this pace, they will always find themselves lagging behind modern and more flexible service providers. Soon they'll find that traditional financial advisors may not be as effective as an AI who can predict the most ideal investment streams or that people don't want to be bothered driving to physical banks since financial transactions can now be securely done through mobile phones.

The key to the industry's survival is to spearhead the implementation or experimentation of these technological tools instead of waiting for the next move of technology companies.

In this infographic created by Prototype, a digital transformation company, you'll see a list of modern technologies disrupting the finance industry, the factors driving these changes, and trends these companies should watch out for.

Infographic by: Prototype

Bitcoin making the payments world better

Bitcoin is the digital currency which is created and held electronically and is the first successful digital coin that can be transferred over the web. Bitcoin is a peer-to-peer payment network which in simple words means that it can be transferred from a person to another directly over the internet, taking out middlemen such as banks and credit agencies

The crypto crash of 2019 considerably changed the dynamics in the crypto market and ensured a clean-up of the crypto market. Cryptocurrency price changes are no longer dramatic and the Bitcoin has become significantly stable. The new crypto market is being driven by institutional money in combination with the new wave of innovation and adoption which will come from security tokens combined with stable coins. The crypto market is also becoming more regulated, and therefore more accessible to the public and efficient. The New York Stock Exchange’s operator is to start working with Bitcoin futures in 2020, while Nasdaq will follow their lead a year later. Bitcoin has matured as an investment vehicle, primarily with the introduction of Bitcoin futures, allowing for adoption, as investors short Bitcoin and settle contracts in real money, as well as trade-off Bitcoin even when they do not own bitcoin.

Bitcoin users can accept and send Bitcoin payments of any size from anywhere in the world in seconds instantly which allows users to minimize the amount of cash and plastic they need to carry around. People comfortable and conversant with bitcoin may travel solely with it as a means to an alternate source of income. An Australian beach town in Central Queensland became the first digital currency-friendly tourist town.

As bitcoin can be used to initiate global payments around the world at insignificant costs and in near real-time, it offers an opportunity for crowdfunding by anyone around the world to help support charities and any foundations. You can offer aid to any foundation from anywhere in the world to help a cause. You can also scan a QR code to make payment into a bitcoin wallet. This use of bitcoin is an initiate of Project 256.

If an woocommerce coupon company permits bitcoin to be used to complete purchases, it has advantages such as cutting out middlemen, cutting down transaction fees, increasing the speed of transaction and can boost trade in some developing countries. It is also very secure, and so can be used to encrypt keys of a digital wallet. Because Bitcoin is instantaneous, users have peace of mind that a transaction is completed for sure, and so reduces time where a payment remains pending for a period of time. The instantaneous nature of bitcoins, along with its security means that chargebacks are very unlikely to occur. You can accept Bitcoin through the use of payment buttons, invoices or custom integrations. Bitcoin is still very relatively new in the woocommerce smart coupons space, so if you are going to use it, ensure there are FAQs to guide the customer and make the UX as intuitive as possible.

Bitcoin may be used to integrate the unbanked. It can be used for digital micro-loans, on monetary exchanges and for cross border remittances.

As bitcoin is a digital asset, it can be moved automatically, allowing for programmable money and smart contracts. Escrow accounts are already used for transactions, such as real estate deals. Customers’ deposits can have held in the escrow accounts and only goes to the seller after what the buyer paid for has been delivered. In a digital age where trust can be crucial to people who want to transact with sellers or buyers they don’t know, this system can be used for varying amounts.

Researchers are working on ways to map bitcoin transactions in the ledger to IP addresses. Although this system is not perfect yet, this exploration into computer science, economics, and forensics will help nab criminals and can also serve as a guard against money laundering.

Bitcoins are not associated with a bank account or cash funds, and because they're only transferred electronically through blockchain ledger systems, they are likely to reduce fraud overall in the future.

National banks of countries that are subject to extreme conflict or financial mismanagement might begin supporting cryptocurrencies by supplementing the gold reserves with bitcoin as it is a trust-minimized cryptocurrency solution.

About the author:

Junaid Ali Qureshi is an ecommerce entrepreneur with a passion for emerging tech marketing and ecommerce development. Some of his current ventures include Progos Tech (an Woocommerce mix and match), Elabelz.com , Titan Tech and Smart Marketing.

JPMorgan to Launch JPM Coin Digital Currency

JP Morgan is rolling out the first US bank-backed cryptocurrency to speed up payments.

In a move commentators may see as unlikely, the multinational lender will use its newly developed asset, dubbed “JPM Coin,” to increase settlement efficiency, initially within three of its operations.

Speaking to CNBC, Umar Farooq, who leads JPM’s blockchain focus, appeared buoyant on blockchain technology’s perspectives at the bank.

“So anything that currently exists in the world, as that moves onto the blockchain, this would be the payment leg for that transaction,” he told the network:

“The applications are frankly quite endless; anything where you have a distributed ledger which involves corporations or institutions can use this.”

JPM Coin will initially focus on international settlements by major corporations, helping speed up transactions that currently take a day or longer using extant options such as SWIFT.

Author: Nathan Reiff / Source: Investopedia

JPMorgan Chase & Co. has officially become the first U.S. bank to launch its own digital token representing a fiat currency. Per a press release and interview issued on Valentine's Day, the bank has announced the creation of JPM Coin, a blockchain-based technology which will facilitate the transfer of payments between institutional clients. The coin has important differences from preexisting cryptocurrencies like bitcoin, primarily because it is redeemable at a 1:1 ratio for fiat currency held by JPMorgan.

JPM Coin is essentially a tool to help with the instantaneous transferring of payments between some of JPMorgan's clients. In order for an exchange of money between client parties to take place over a blockchain ledger, a digital currency must be used to facilitate the transaction. JPM Coin is the tool which helps to complete that process in a more efficient manner than traditional settlements.

JPM Coin itself is not money in the traditional sense. Rather, it is a digital token which represents U.S. dollars which are held by JPMorgan Chase. It maintains a value equal to one USD. Assuming that JPMorgan Chase deems the initial launch of JPM Coin to be successful, the bank has indicated its plans to use JPM Coin for additional currencies as well in the future.

The process by which clients will utilize JPM Coin is relatively straightforward. First, a client deposits a sum in a particular account and receives corresponding JPM Coins. Next, these coins can be used to facilitate transactions across a blockchain network and...

Bitcoin Cash payment API Gateway.cash launches new features

Author: Jamie Redman / Source: Bitcoin News

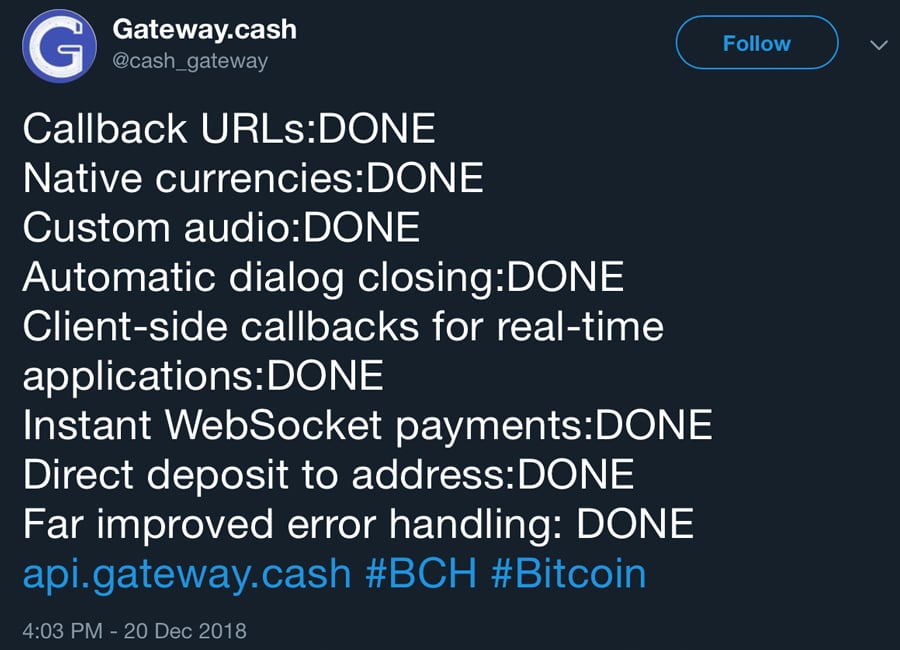

Last October, news.Bitcoin.com reported on a new Bitcoin Cash (BCH) payment processor called Gateway.cash. Since then the Gateway developers have added a variety of features to the BCH platform like instant web-sockets, custom audio, and client-side callbacks for real-time applications.

Also read: How to Spend and Give Bitcoin Cash Over the Holidays

After the BCH Split Organizations Like Gateway.cash Have Emphasized ‘We Will Compete’

After the Bitcoin Cash split, the Money Button and Yours.org creator Ryan X Charles told his Twitter followers his apps would be following the BSV network. Four days later on Twitter, Charles said: “I look forward to seeing the ABC competitors to Yours and Money Button — Best of luck to you all.” Not too long after the post, a new Bitcoin Cash blogging website was launched called Honest Cash and the payment processor Gateway responded to Charle’s tweet.

“Hi, Gateway.cash will be a Money Button competitor for Bitcoin Cash and is now released open-source — The project is led by Ty Everett and he is looking for contributors,” the Gateway organization stated responding to Charles on Nov. 19.

New API Enhancements

Since the Gateway bitcoin cash-powered payment button and the processing application launched, the developer has added a slew of new features to the application program interface (API). Added enhancements include callback URLs, native currencies, custom audio sounds, client-side callbacks for real-time applications, instant web-socket payments, direct deposit to an address, and more. The Gateway developers have also published specifications for the Gateway.cash API which gives...

Facebook is planning to launch its own stablecoin digital currency

The United States-based global social tech giant would be the largest entrant to the consumer blockchain, and cryptocurrency space.

- Facebook is trying to build a cryptocurrency that would power money transfers on WhatsApp, according to a new report from Bloomberg.

- Earlier this month, business news outlet Cheddar reported that the Facebook employees had discussed with blockchain industry insiders "the idea of creating a decentralized digital currency for the social network's 2 billion users,"

Facebook could become the most important company in Crypto.

News broke yesterday that Facebook is building a stablecoin (crypto coin) that will be launched to allow WhatsApp users in India to transfer money. Of course, the immediate reaction of those in the space was to start yelling. Many people were excited, others were upset about the company’s recent privacy issues, and some felt that a Facebook stablecoin didn’t fit the authentic ethos of the crypto industry.

All of these reactions missed the mark though.

Zuckerberg and the Facebook team have never been interested in playing it safe. The highly talented team consistently looks to invent and/or grow products that change the world. If Facebook is building a stablecoin for WhatsApp, this is less about crypto and more about building a globally dominant product that changes the way billions of people live their lives.

David Marcus who leads the blockchain team is the former President of PayPal. Kevin Weil is the VP of Blockchain Product, previously served as the VP of Product at Instagram, and was once the SVP of Product at Twitter. Evan Cheng is the Director of Blockchain Engineering and was a former senior manager at Apple. And finally, Morgan Beller is the unsung hero of the group — the woman who leads blockchain strategy, but worked solo on the project for a period of time before she was able to build internal support and recruit some of the company’s best talent.

Couple these individuals with Facebook’s notorious "Growth Team" and you have a recipe for success. The Growth team is the company’s secret weapon. They are brought in like a SWAT team to solve the hardest problems by leveraging immense amounts of data and the proprietary analytical tools that have been built over the years. This team has helped four separate Facebook product teams scale their offerings to over a billion users each (Facebook main app, Messenger, Instagram, WhatsApp).

So what exactly is the potential for this team?

The holy grail would be to build the world’s dominant payment system. This would be a direct competitor to Visa and Mastercard, but it is more likely to happen than you may think. Facebook has billions of users and tens of millions of merchants. This gives the company a leg up on competitors as they bootstrap the network effects needed to lock in both sides of a marketplace.

If Facebook could successfully build the product and drive adoption, they will have a chance to transition from a social network to one of the largest financial services companies in the world. This move would allow them to take a small percentage on each transaction and reduce the dependency on their advertising-based model.

This won’t happen overnight though. Facebook needs to

(1) create a viable stablecoin (not that easy)

(2) launch the product in India’s large market (significant opposition from government and financial institutions)

(3) drive sustainable adoption,

(4) expand to other jurisdictions and other digital currencies, and then

(5) build out additional financial services to serve their customers.

It wouldn’t be surprising to see Facebook back their way into becoming a new-age bank for digital natives outside the United States.

Facebook could be the most important company in crypto. They have 2+ billion people who use their services daily. Anything they launch will quickly become the most popular product in the industry….maybe even one of the most popular products in the world.

Mark Zuckerberg has dedicated his life to changing the world. Most people in tech don't trust him and would love to see him fall. Many people no longer trust him ... and still, get your popcorn ready — I wouldn’t bet against this team (and in most cases, it boils down to the team)

TechCrunch Covered The Breaking News

Jon Russell @jonrussell For TechCrunch

Facebook looks to be jumping on the blockchain wagon with plans to introduce its own stablecoin, according to a report from Bloomberg.

The social network company — under fire for a seemingly constant stream of privacy snafus of late — created an internal blockchain divisionin May and, while there has been plenty of speculation, the exact nature of its work is unclear.

The Bloomberg report is a first solid suggestion at what will come from the new division and, according to the publication, it’ll be a stablecoin that “let[s] users transfer money on its WhatsApp messaging app, focusing first on the remittances market in India.”

Facebook offered a non-committal response.

“Like many other companies, Facebook is exploring ways to leverage the power of blockchain technology. This new small team is exploring many different applications. We don’t have anything further to share,” it told Bloomberg in a statement.

If the U.S. giant does carry out the plan that Bloomberg is reporting it would (easily) be the largest company to embrace consumer blockchain service. That’s both in terms of the size of the business — a $376 billion market cap and annual revenue of more than $40 billion — and the user base it touches. Facebook reaches more than 2.2 billion people for its core social network, 1.5 billion for WhatsApp, 1.3 billion for Messenger and a further one billion via Instagram.

That makes this a thread worth pulling, so let us get into it.

Former PayPal CEO David Marcus heads up Facebook’s blockchain division — Marcus is also a former board member at crypto exchange Coinbase

Yet another stablecoin

Stablecoins have become all the rage in the blockchain space during the second half of this year, with scores of projects popping up to provide solutions — but let’s start with why.

The concept is simple: a cryptocurrency that is pegged to a fiat currency and therefore immune to the often wild valuation swings.

Blockchain as programmable and border-less money has potential, but stability is a huge concern. Bitcoin, for example, hit a record high of nearly $20,000 one year ago; today its price is just over $4,000 but, symbolically, it fell below that figure in recent months. The ride for “altcoins” has been even bumpier.

Stablecoins offer a way to deposit money ahead of buying into Bitcoin, Ethereum or other tokens more quickly than a bank account. They also allow profits to be moved from volatile tokens and, among other things, are a more stable way of sending crypto to another person (or business) without being subject to moving prices.

Yet, despite a simple premise, there are no current examples of a proven and successful stablecoin, despite the many who have thrown their hats into the ring.

Tether, the highest-profile project, is dogged by concerns around its financial backing. The organization behind it has never shown that it has the required fiat currency to back the tokens in the market, while its value has previously slipped below $1.....

Coinbase Cryptocurrency Exchange Adds Cash Withdrawals to PayPal

Big news for the digital currency economy with Paypal payments integrating with CoinBase. Growing the bridge between cryptocurrency and digital payments for consumers.

Author: Ana Alexandre / Source: Cointelegraph

Major American cryptocurrency exchange Coinbase has introduced free of charge cash withdrawals to online payment system PayPal, according to an announcement published Dec. 14.

From now on, Coinbase’s United States-based customers are able to withdraw their cash balances to Paypal. The service for other countries will reportedly be rolled out some time in 2019.

Coinbase and PayPal previously integrated in 2016, when Coinbase added support for the payment platform in addition to major credit cards. At the time, Coinbase users were able to sell Bitcoin (BTC) and have their fiat funds deposited to a PayPal wallet. The integration was subsequently terminated due to technical difficulties.

With this move, Coinbase has enhanced its range of services,...

SWIFT pilots a payment tech system to take on fintechs and blockchain tech

Source: CCN

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) has announced its decision to launch a pilot Global Payment Initiative (GPI) service which aims to compete with the growing threat of competing blockchain and fintech solutions provided by institutions like Ripple, JP Morgan and Transferwise.

Still in its initial stages, the ambitious pilot aims to “build the foundation of a new integrated and interactive service that will significantly improve efficiencies in the payments process and which will ultimately be made available to all 10,000 banks across the SWIFT network.”

A recent GPI test, was successfully conducted in October, carrying out instant cross-border payments with banks in China, Singapore, Thailand and Australia. Equipped to enable speedy identification and elimination of errors and omissions in payment data such as missing or incorrect beneficiary information or incomplete regulatory information, SWIFT hopes the GPI payments service will enable speedy and seamless transactions, thereby reducing delays and costs, as well as improving customer experience.

Taking on Blockchain’s Threat

With the move, SWIFT has turned its attention to containing the threat of blockchain-based fintech startups offering...

Coinbase Rolls Out System to Addressing Bitcoin Payments

Author: Daniel Palmer / Source: CoinDesk

With transaction fees "volatile and unpredictable," sending cryptocurrencies can sometimes be frustrating.

So says U.S.-based crypto exchange Coinbase in a new blog post that sets out the issues rising from shifting miner fees, and exactly what it has been doing to address the problem.

As most who have sent or received bitcoin will know, the primary problem is that the fee variations can mean significant changes in the amount of time it takes for transactions to be confirmed. Coinbase says this wastes company time in pointless support requests and provides users with a "frustrating experience."

The reason fees rise and fall so readily is that rather than clawing back transaction costs via a percentage – as card firms like Visa and Mastercard do – bitcoin and other cryptocurrencies pay miners a fee to confirm transactions. And that's based on a model not dissimilar to bidding at an auction.

At times when the bitcoin network is busiest, miners have a queue of transactions to process and these are prioritized by dealing with the transactions offering the highest fee first.

But the method can cause lengthy delays before transactions are confirmed and the funds have "arrived." It can also cause spiking fees...