Powerful Algorithmic Trading Strategies

Intelligent algorithms for trading cryptocurrency

Proprietary algorithms crafted to enable investors to execute their trading strategies smarter.

Smarter Trading Algorithms

All trading algorithms are not created equal. Our team has decades of experience creating algorithmic crypto trading strategies and writing algorithms for hedge funds on the street.

Our suite of algorithms empowers you to execute your digital currency trading strategy smarter.

Value Trades

Get the best price on your trades by using our suite of value-based algorithms.

Stealth Trades

Don't give away your position by executing your trades using our stealth algorithms.

Timed Trades

Automatically execute your trades using TWAP, IWAP, and other time-based algorithms.

Basket

Executes multiple trades of multiple coins simultaneously over a period of time using TWAP or other time-based strategies.

TWAP

[Time Weighted Average Price] Executes trades evenly over a specified time period.

VWAP

[Volume Weighted Average Price] Executes trades evenly based on trading volume.

PEG

Follows the best bid and best offer when buying and selling.

ICEBERG

Executes orders in random slice sizes over a period of time over multiple venues to minimize market impact.

Pairs Trades

Executes two trades of individual coins while maintaining a balance between the long and the short side of the trade.

IWAP

[Information Weight Average Price] A custom Mainbloq algorithm that trades in windows of fixed notional while varying the duration.

ISR

[Implementation Shortfall Reducer] A custom Mainbloq algorithm that reduces slippage and balances market impact by controlling the rate of execution.

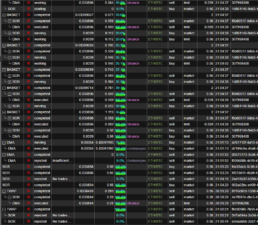

34

exchanges supported

4000+

currency pairs supported

15