Author: Marshall Taylor / Source: CoinCentral

Whether it’s Power Mining Pool today or Bitconnect yesterday, the crypto space is festering with parasitic scams and opportunistic swindlers. The conditions are ripe for them and there’s money to be made.

Among the dangers, Bitcoin mining scams are a tough one to identify and parting the good from the nasty can be tricky. Mining scams are wrapped up in an already technically demanding task of Bitcoin mining. They are billed as a consumer-friendly method for building exposure to Bitcoin mining, and when run like this, they really do provide value for investors looking to diversify.

Legit Bitcoin cloud mining pools are too often buried in search results and outranked by throngs of fly-by-night operations. Finding the legit pools can be a tall order and require sifting through Reddit posts and Bitcointalk forum entries.

With that said, there are legit mining operations out there. As always, do your own research and stay skeptical as we settle and develop this wild frontier. For now, let’s take a look at what a crypto mining scam looks like to hopefully better prepare us to identify the key red flags.

Cloud Mining Pools and Ponzi Schemes: A Match Made in He….

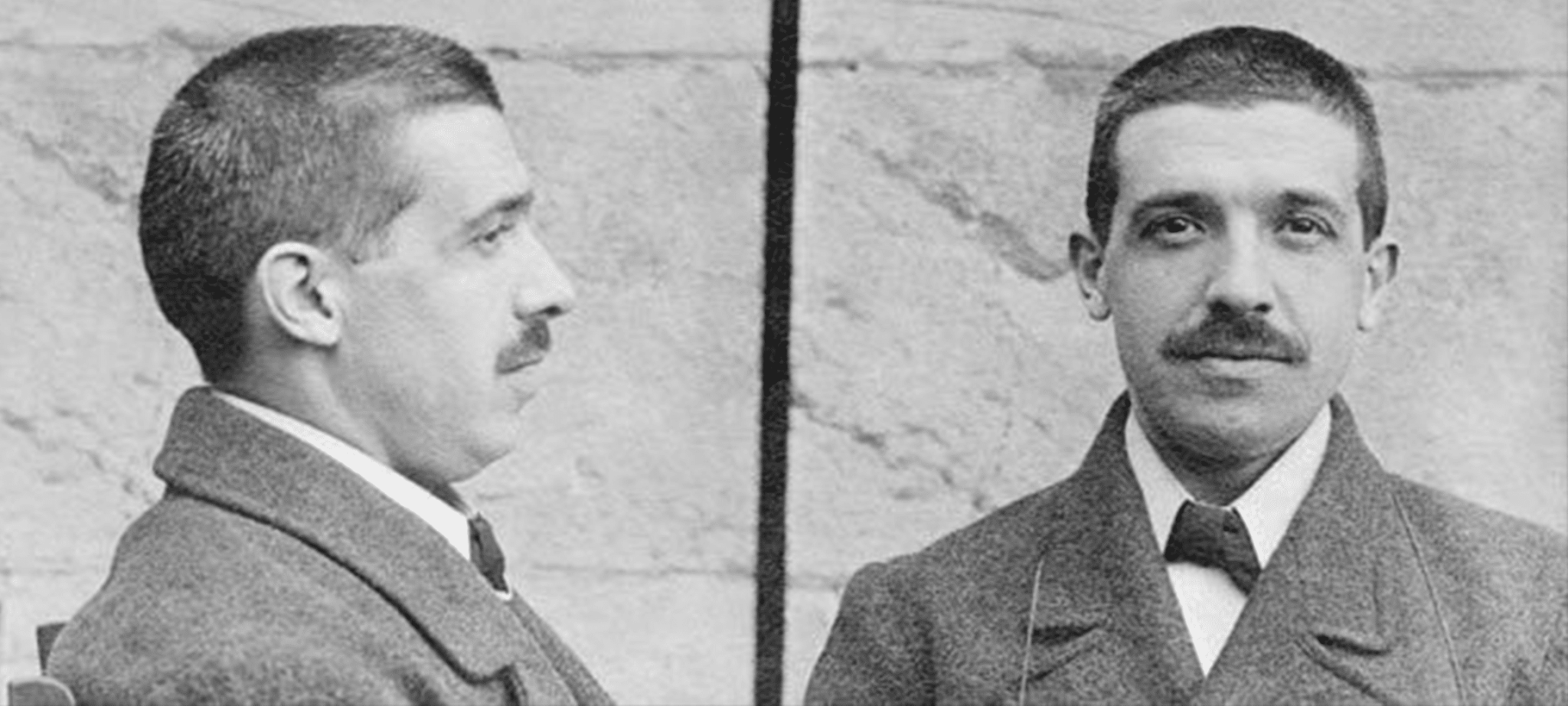

Let’s take a moment to clear up what a cloud mining pool is and why they attract Madoff-like Ponzi schemes faster than ants at a picnic.

What’s a Cloud Mining Pool?

A cloud mining pool is the most hands-off version of crypto mining you can get. They allow a participant to rent or lease hashing power not directly owned by themselves. The rented hashing power is then pooled and paid out proportionally to the members (after fees and operational costs).

A traditional mining pool instead requires participants to supply their own hashing power and pool it with other miners. The participant owns and operates their own hardware and contributes to the pool’s overall hashing power.

The critical difference between a cloud mining pool and a traditional mining pool is the ownership of the hardware.

Cloud mining: you don’t own the hardware (hashing power).

Traditional mining: you own hardware (hashing power).

Why pool at all? In short, block rewards become more difficult to obtain as overall hashing power of a particular blockchain increase.

Take Bitcoin as an example. There was a time in Bitcoin mining when a standard CPU could mine whole blocks itself. Gone are those days. Bitcoin mining is now big business with plenty of stakeholders leveraging their resources into the security of the blockchain.

Miners with serious hashing power make it improbable for small miners to reasonably expect block rewards. Their hashing power is just not enough to compete.

The solution: gather together all these smaller players and pool their hashing power. Miners in a pool no longer compete for blocks of their own, instead, they work together and proportionally share the booty.

What’s a Ponzi Scheme?

It’s theft, let’s just clear that up. If you’re in a Ponzi scheme you are either being robbed or doing the robbing yourself.

A typical Ponzi scheme involves enticing participants to invest their money into a fund or investment strategy that has seemingly guaranteed returns. In reality, and with variation, the returns are not gained by real-world trading or superior business acumen. Conversely, new investments to the funds are distributed around existing investors and represented as market returns.

Ponzi schemes require a constant flow of new investment to keep the machine moving. Once things fall apart or new investment slows, the scheme is often revealed for what it is. In the world of crypto Ponzi schemes, a collapsing Ponzi scheme is followed by a hasty exit scam.

Keep in mind that Ponzi schemes thrive in times of economic expansion and speculative bubbles. Capturing collective optimism is pivotal to its success. Bitconnect is a choice example of the market fervor getting the best of investors.

Identifying the Red Flags of a Cloud Mining Ponzi Scheme

Firstly, the duck test. If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

The duck test isn’t scientific by any standard but can be used to leverage your gut feeling to identify early warning…