The market is thinking about Bitcoin differently

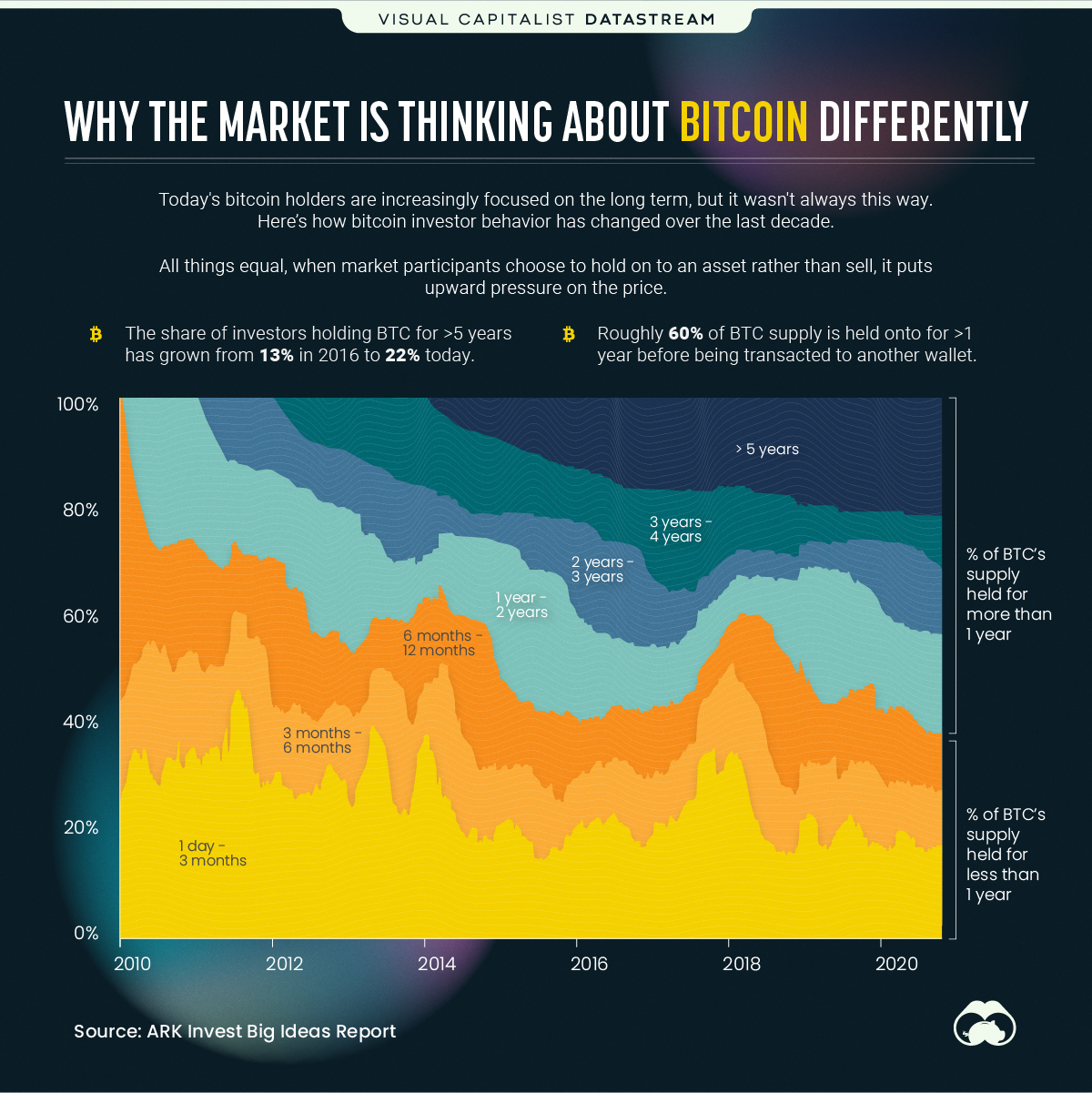

This chart shows the duration of how long investors have been holding onto the cryptocurrency, by the percentage of supply.

- Bitcoin investors are increasingly long-term focused. In 2020, 57% of bitcoin’s (BTC) supply was held onto for more than a year

- Today, nearly 22% of BTC supply is held for more than five years

- Bitcoin hit a $1 trillion market cap milestone in the first quarter of 2021

According to research from Ark Invest, investors are holding onto bitcoin for longer and longer durations. By holding the asset rather than selling, it decreases the supply of coins available on the market at any given moment, which can drive up price. This suggests that market participants see the long-term value and potential future payoff the asset possesses.

In the past, durations of days and months were the most common holding periods for bitcoin investors, while holding for more than a year was practically non-existent up until recently.

| BTC Duration Held | % of BTC Supply |

|---|---|

| >5 years | 21.80% |

| 3 to 5 years | 13.38% |

| 2 to 3 years | 10.99% |

| 1 to 2 years | 10.70% |

| 6 months to 1 year | 8.30% |

| 3 months to 6 months | 7.07% |

| 1 day to 3 months | 27.76% |