MainBloq launches next generation micro service cloud infrastructure for trading digital assets

Fernhill Corp (OTC Markets:FERN), a Web3 Cloud Based Infrastructure platform focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to provide the following corporate update.

Fernhill Corp is pleased to make a big announcement that MainBloq Cloud has just launched as a newly rearchitected version of its platform that can connect users with over 50 digital asset exchanges and DeFi venues. This next generation platform is based upon Microservices, Cloud based, Modular Plug-in architecture which is geared to be highly scalable, incredibly stable, and have extensive interoperability with a wide range of other platforms and partners. MainBloq Cloud is also built to be delivered via API, a White Label basis, or On-Premise based upon the needs of institutional and enterprise clients and their preferred deployment requirements.

We are now stronger as a unified team with one mission and one vision," said Ryan Kuiken, CEO of MainBloq. With the recent volatility in the market and removal of our former CTO, it enabled us to take a step back and look at our platform through a different lens, which has set us up to create a more stable and scalable product leveraging the latest technology and the new microservices architecture. Were very excited about MainBloq Cloud and its future potential!

Although losing a CTO can be detrimental to growing a company, and it did set the company back a bit on its timelines and resources, in this case, moving on has already had a very positive impact. Most importantly, the technology has advanced by leaps and bounds under the new development team led by Fernhills VP of Engineering, Nathanael Coonrod.

Fernhill President Marc Lasky added At this point, the development is being done based upon the highest of standards and professionalism, which includes the proper integration of unit testing and software documentation which has created a superior product that is leading to a far better user experience. In fact, with the feedback we are receiving, users are expressing greater satisfaction. This new, more stable platform will also enable the Company to better market its services to targeted institutions and enterprise clients that seek professional digital asset trading solutions and data aggregation tools. This has already led to a much more engaged sales team at MainBloq given the dramatic improvements to the platform and the increased quality of the product.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading digital asset trading venues exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / WebSocketSOCKETS / and REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit the MainBloq Website www.mainbloq.io

MainBloq Facebook

Company Contact Information: info@fernhillcorp.com or sales@mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

$FERN #FernhillCorp #Web3 #DIGXNFT #CryptoLending #CryptoCurrencies #MainBloq #AdditionbtSubtraction #DigitalAssetTrading #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #Metaverse #NFTCommunity #BTCMaxi #DeFi #MetaverseForum #BuildingBloqs #LendBloq

Forward-Looking Statements

This release includes forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words estimate', project', intend', forecast', anticipate', plan', planning', expect', believe', will likely', should', could', would', may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

MainBloq launches new digital asset lending service LendBloq

Fernhill Corp (OTC Markets:FERN), a Web3 Cloud Based Infrastructure platform focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to provide the following corporate update.

Fernhill is excited to announce the launch of another complementary service as part of our broader branding initiative for the Fernhill subsidiary, MainBloq. The new offering is called LendBloq. LendBloq is part of a larger strategy to roll out several plug and play, modular building Bloqs that will comprise the MainBloq ecosystem. LendBloq is a new Digital Asset Lending offering for hedge funds, family offices, trading firms, miners and institutional investors or for anyone that wants to monetize their Digital Asset holdings without selling them. Interested parties can get highly competitive non-recourse loans against their digital assets such as BTC, ETH, BCH, etc.

In partnership with a corresponding multi-billion dollar international financial institution that specializes in lending against digital assets, several programs are available. These loans are designed as non-recourse loans, with competitive low fixed rates, high LTVs and have flexible margin maintenance structures. Having access to well established lending partners will allow MainBloq to provide customized solutions with some of the most competitive rates and terms found in the digital asset lending industry today. Targeted loan sizes range from $1,000,000 - $25,000,000+ with quick closings in as little as 5 - 10 days.

“We believe there is a substantial gap in the marketplace to serve small to large sized trading firms, family offices, miners and hedge funds seeking liquidity with a well managed digital asset lending solution that is custom designed to meet a company’s specific needs. Partnering with one of the leading firms in the alternative lending space is a great fit with our current service offerings and we look forward to serving our clients at a higher level and providing them as much value as possible,” stated Chris Kern, Fernhill’s Chairman and CEO.

Ryan Kuiken, MainBloq’s Founder and President commented “The addition of lending capabilities has arrived at a critical time. With the market heating up, we are seeing renewed interest in and around the space. This lending offering serves as another block of the MainBloq platform and drives us closer to bringing our full vision to fruition as a leading digital asset infrastructure company delivering next-generation financial services and technology solutions.”

In other housekeeping news, Fernhill would like to address the departure of the former CTO of its wholly-owned subsidiary, MainBloq. We provide an excerpt of the disclosure made in our most recent Annual Report:

On January 6, 2023, we terminated the employment of the former CTO of Qandlestick LLC, (a wholly owned subsidiary of the company), for cause. On March 6, 2023 the Company filed a complaint in Clark County, Nevada District Court against the former employee and his wholly owned company. The Claims include Breach of Fiduciary Duty, Disparagement and Conversion. The relief sought has yet to be determined or finalized.

Given the sensitive nature of this case, the Company is unable to provide additional details at this time.

The Company also further confirms that it is still focused on up listing to a senior exchange and is in ongoing discussions with potential strategic partners and acquisitions.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading digital asset trading venues exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, WebSockets & REST gateway, and consulting services to help banks and hedge funds simplify and optimize their trading strategies. For more information please visit the MainBloq Website www.mainbloq.io

MainBloq Facebook

Company Contact Information: info@fernhillcorp.com or sales@mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

$FERN #FernhillCorp #Web3 #DIGXNFT #CryptoLending #CryptoCurrencies #MainBloq #DigitalAssetTrading #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #Metaverse #NFTCommunity #BTCMaxi #DeFi #MetaverseForum #BuildingBloqs #LendBloq

Forward-Looking Statements

This release includes ‘forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute ‘forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words ‘estimate', ‘project', ‘intend', ‘forecast', ‘anticipate', ‘plan', ‘planning', ‘expect', ‘believe', ‘will likely', ‘should', ‘could', ‘would', ‘may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

Fernhill Updates on MainBloq 2.0 Cloud infrastructure for trading cryptocurrency & more

The latest updates from Fernhill and the MainBloq

FOLLOW The MainBloq Twitter Facebook Linkedin

Fernhill Corp (OTC PINK:FERN), a Web3 Cloud Based Enterprise Infrastructure firm focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to announce the following initiatives:

- MainBloq 2.0 The MainBloq platform is not only being rebranded around Web3 and the Bloq naming strategy but it is also being upgraded around microservices and plugin architecture to better support scale and interoperability. V2.0 of the platform will be both highly modularized and provide delivery via a Cloud-based API infrastructure. This architecture helps to further fortify the foundation of the platform and will enable better management as we approach our Hyper Growth Stage and integrate with a variety of new clients and partners. This ongoing effort is being spearheaded by Fernhill VP of Engineering, Nathanael Coonrod.

"Essentially what we have done over the past several weeks, from a development perspective, is to modernize and strengthen the MainBloq foundation, to allow for increased scale and manageability. This was a very necessary step and it really gets me excited about the next phases. Not only will we be able to scale with more confidence, we will also be able to integrate new services and partners much more easily.

- Audit - we are making great progress with the respective accounting work towards completing our financials in order to become fully audited and reporting with the SEC. This is an ongoing effort, which is a considerable undertaking and takes time and effort above and beyond growing a business and developing new technology.

- Acquisitions Fernhill has begun ramping up its pursuit of growth oriented revenue generating acquisitions that are profitable. Due to current market conditions, were seeing some very interesting companies become available at significant discounts with which we have identified and initiated discussions..

- New Products & Services - MainBloq will be launching a variety of new products and service Bloqs that further extends our brand offering and enables us to establish a more engaged and long term relationship with our corporate and institutional clients. The new offerings will be announced with additional details in the near future. Stay tuned.

The so-called Crypto Winter has, more than anything, just served to strengthen our resolve, said Fernhill President Marc Lasky. Although it has pushed back our timelines a bit, we are confident that not only will we survive, but we will thrive. The fog is rolling out, the digital asset market is picking back up and our vision is more clear now than ever before.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / SOCKETS / REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit the MainBloq.

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

Forward-Looking Statements

This release includes forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words estimate', project', intend', forecast', anticipate', plan', planning', expect', believe', will likely', should', could', would', may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

Fernhill launches DIGXNFT Marketplace and NFT infrastructure platform Beta

We have a new member of the FernHill MainBloq blockchain family. The beta launch is official of the DIGXNFT Marketplace that's powered by the NFTX cloud infrastructure. We now offer API infrastructure to enable anyone to be able to easily build and launch an NFT offing. All with a single frictionless API.

Fernhill Corp (OTCMKTS:FERN), a Web3 holding company focused on software solutions and marketplace infrastructure for digital assets, is pleased to announce the beta launch of its NFT Marketplace, DIGXNFT.

DIGXNFT caters to high-quality and exceptionally curated collections of art, music, videos, gaming, photography, domain names, real estate, and sports memorabilia, among other categories. Additionally, the company will provide white glove service with a full turn-key solution to assist creators with the minting, marketing, and selling of their non-fungible token (NFT) collection.

“Although the NFT world is a very competitive landscape, we feel confident that with our state-of-the-art infrastructure and our management team in place, we will not only succeed but thrive,” said Marc Lasky, President of Fernhill Corp. “We have a detailed roadmap that is strategically planned to continually build upon and improve our Marketplace, and with our decades of experience growing businesses, we know how to run a process and execute on our goals.”

In beta, users will be able to:

- Connect their MetaMask wallets and create an account.

- Learn more about our first showcased collection: Fraud – The Game of White-Collar Crime (artwork by world-famous artist Rick Parker).

- Join our Discord channel.

- Review our roadmap and read our white paper.

The first NFT collection, Fraud – The Game, will launch on the DIGXNFT marketplace for viewing on July 21st. The official drop date is scheduled for Wednesday, July 27th.

Fraud – The Game of White-Collar Crime, was conceived as a satirical card game by Pete Newman, a cybersecurity professional and fraud expert. Artwork was completed by world-famous comic artist Rick Parker, best known as the artist behind MTV’s Beavis and Butthead Comic Book and staff artist at Marvel Comics.

”Fraud is not only a fun, tongue in cheek game, but at its core it’s really an amazing collection of art,“ said creator Pete Newman. “Thanks to the outstanding artwork of my partner in crime, artist Rick Parker, it makes perfect sense to sell this as an NFT game and as exclusive artwork.”

This is a limited release collection with multiple NFTs to choose from. The NFTs are intended to be part of a larger community and online game that is currently in development. The sale will last one week and all NFTs will be available on a first-come, first served basis.

“Ultimately, everything will become – or be attached to – an NFT,” said Chris Kern, Chairman of Fernhill. “The NFT and metaverse industry are expected to grow in excess of $3 trillion over the next decade and experience unprecedented growth – no temporary market downturn can stop what NFTs will surely become. There are an infinite number of use cases for NFTs and we feel it’s necessary to establish ourselves in the market and seize this unique opportunity now. We’re very excited about launching DIGXNFT, and that more collections will come as we get through beta.”

About Fernhill:

Fernhill Corp is a Web3 holding company focused on developing and acquiring software companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

#$FERN #FernhillCorp #Web3 #DIGXNFT #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading #Metaverse #NFTCommunity #DeFi

Forward-Looking Statements

This release includes ‘forward-looking statements’ within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute ‘forward-looking statements.’ Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words ‘estimate’, ‘project’, ‘intend’, ‘forecast’, ‘anticipate’, ‘plan’, ‘planning’, ‘expect’, ‘believe’, ‘will likely’, ‘should’, ‘could’, ‘would’, ‘may’ or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company’s actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company’s ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company’s limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company’s control.

MainBloq launches cloud-based crypto trading platform TradeBloq PRO

It's official! We are thrilled to announce we have launched TradeBloq PRO. Our cloud-based cryptocurrency trading platform that can easily be integrated into any environment, and give our partners the most sophisticated trading capabilities and algos for their users to trade under their brand.

READ MORE ABOUT TRADEBLOQ PRO.

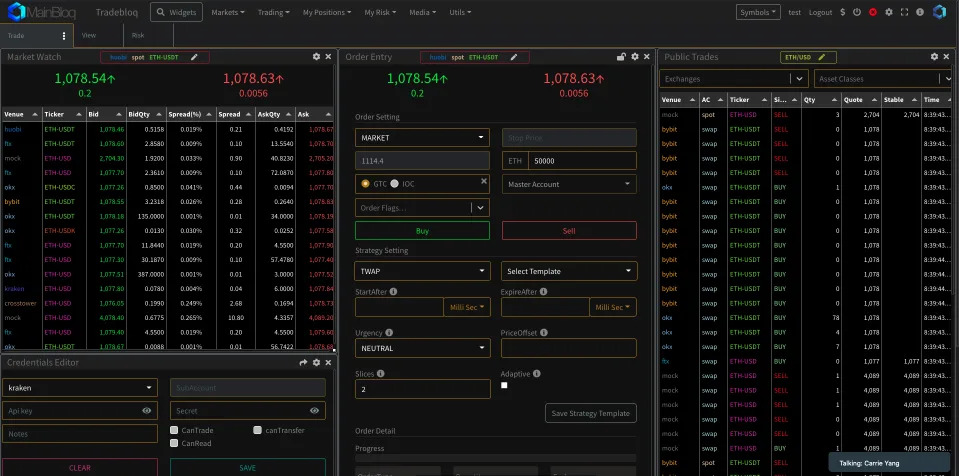

Fernhill Corp (OTCMarkets:FERN) announces that its digital asset trading division, MainBloq, has completed the build of their innovative, white-label ready, premier trading dashboard. It is designed for existing and new exchanges to offer an upgraded level of service to their customers that demand more robust trading capabilities, including new trading tools, increased configurability, and more algorithmic trading strategies.

"As we were building out a white-label platform for one of our recent clients we decided that we should be offering this level of service to every venue, not just the company that approached us" stated Ryan Kuiken, CEO of MainBloq. "Having been the CEO of MainBloq for 3+ years now, we know exactly what companies in the industry want and need, and so a white-label Digital Asset Trading Platform could not come at a better time."

MainBloq's VP of Business Development Patrick Egan added that "This is the same style of dashboard that professional traders at major hedge funds are utilizing for their traditional trading, and it's about time that they have the ability to utilize TWAP and VWAP orders or even execute an arbitrage strategy if they so desire within Crypto. This should also help exchanges attract and retain institutional clients with a robust suite of services not commonly found in the market. This now allows exchanges to offer these advanced order types to all of their clients within 30 days of signing up and create new revenue streams and enhanced trading for their professional trading clients.

MainBloq's Whitel Label Solution, "TradeBloq PRO", is now available for all new and existing exchanges and trading venues on a global basis. By providing advanced algorithmic trading capabilities, risk analytics, sub account access and a wide range of additional benefits - it solves many of the pain points in the industry and bridges the gap between Web2 and Web3 digital asset trading.

For more information please reach out to Patrick Egan at patrick@mainbloq.io

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / SOCKETS / REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io

MainBloq Website: mainbloq.io

About Fernhill:

Fernhill Corp ($FERN) is a Web3 holding company focused on developing and acquiring software companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Fernhill Website: FernhillCorp.com

Company Contact Information:

PHONE: 775-400-1180

MainBloq powers India's crypto trading super app Cryptowire's Smart Order Routing and Algorithmic Trading

We are thrilled to announce our digital asset trading cloud API's are now powering one of India's fastest-growing crypto communities super app for trading cryptocurrencies.

Fernhill Corp OTCMarkets:FERN is pleased to announce that its digital asset trading division, MainBloq, a groundbreaking digital asset trading API infrastructure platform serving both banks and hedge funds, has signed a multi-year Agreement to deliver automated algorithmic trading, smart order routing, and customized trading solutions to optimize trading performance across multiple strategies, for India based, CryptoWire.

The CryptoWire global crypto-super app

The CryptoWire global crypto-super app

Is the first port of call for entry into blockchain and cryptocurrencies. It enjoys the rare distinction of going beyond exchanges to render comprehensive, unbiased information to empower participants to make informed decisions. Under the umbrella of the CryptoWire super app they have the world’s 1st Crypto University, a digital university, the world’s 1st CryptoTV, a dedicated 24*7 YouTube channel and smart mobile IPTV, and the world’s first CryptoWire, a wire service with tools like arbitrage opportunities identification, watchlist creation, lending and borrowing rates among others

To date, CryptoWire has been experiencing a rapidly growing user base, and now with the help of MainBloq, will be adding Smart Digital Asset Trading to its menu of features that include Knowledge, Research, Training, Awareness, Information, and Data.

“Having worked with the CryptoWire team for the past month it became clear that we share the vision of bringing digital asset trading technology to the masses” commented Ryan Kuiken, Founder and CEO of MainBloq, “CryptoWire already has a substantial user base who desire the ability to execute in the best possible manner and now that their Super-App will be updated to include MainBloq technology, I see a bright future for India and beyond.”

“We are happy to get into a strategic alliance with Mainbloq to provide a multi-market transaction execution solution with multiple trading features for a diversified group of users globally. With our rapidly growing community of over 1.7 million Crypto-focused users built during the last nine months, we are confident that these users would love to have the ability to trade digital assets using a user friendly mobile and desktop solution.” said Joseph Massey, MD & CEO of CryptoWire. “After much research and due diligence, we realized that MainBloq’s infrastructure was exactly what we needed, to provide a seamless connection from our App directly to over 30 of the top Exchanges and multiple other ecosystem partners. This will allow all of our users who wish to trade, a way to trade better with smart order routing, arbitrage trading and Algorithmic trading on the CryptoWire App. This in addition to our unique global offering of CryptoTV and Crypto University converging the needs of the entire Blockchain and Crypto Community. We cannot wait to get started.”

"CryptoWire is a great relationship for us and we're honored to work with them and be recognized as the software solution to drive digital asset trading strategies globally. As we continue to expand upon MainBloq's market presence, working with world-class hedge funds, financial institutions and super apps like CryptoWire - this helps to establish increased utility and accelerates acceptance of digital assets in the broader market," stated Chris Kern, Fernhill's Chairman.

“It’s impactful to know that our technology is assisting with market access for so many. It’s refreshing that we have the opportunity to simultaneously deliver unparalleled value to a massive market as well as create meaningful revenue for our Company,” said MainBloq CEO, Ryan Kuiken.

About CryptoWire:

CryptoWire is the first port of call for entry into blockchain and cryptocurrencies. It enjoys the rare distinction of going beyond exchanges to render comprehensive, unbiased information to empower participants to make informed decisions. At CryptoWire, we are converging the system to engage with all stakeholders and expand the sphere of influence to a wider community. Under the umbrella of the CryptoWire super app, we have the world’s 1st Crypto University, a digital university, the world’s 1st CryptoTV, a dedicated 24*7 YouTube channel and smart mobile IPTV, and the world’s first CryptoWire, a wire service with tools like arbitrage opportunities identification, watchlist creation, lending and borrowing rates among others. CryptoWire offers its services through www.cryptowire.in and Android / iOS app

Facebook - https://www.facebook.com/realcryptowire

Twitter - https://twitter.com/RealCryptoWire

LinkedIn - https://www.linkedin.com/company/oncryptowire

Instagram - https://www.instagram.com/realcryptowire

About MainBloq:

The one-stop-shop platform for digital currency trading API infrastructure

Plug and play tools that enable cryptocurrency traders and digital asset institutions to transact efficiently, manage assets effectivly and reliably with frictionless connectivity.

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / SOCKETS / REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io

MainBloq Website: mainbloq.io

MainBloq Twitter

MainBloqFacebook

MainBloq Linkedin

About Fernhill:

Fernhill Corp ($FERN) is a Web3 holding company focused on developing and acquiring software companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

OTC Markets

Nevada SOS

Fernhill Twitter

Fernhill Facebook

Fernhill Linkedin

Fernhill Website: FernhillCorp.com

Company Contact Information:

PHONE: 775-400-1180

MainBloq expands digital asset trading infrastructure cloud team into the EU and UK

MainBloq, a digital asset connectivity platform connecting customers to exchanges and OTCs around the world, has expanded its presence within the United Kingdom and European Union, which will be headed by UK based Mr. Larry Grant.

MainBloq, a digital asset connectivity platform connecting customers to exchanges and OTCs around the world, has expanded its presence within the United Kingdom and European Union, which will be headed by UK based Mr. Larry Grant.

“We are thrilled about the MainBloq expansion into Europe and the addition of Mr. Grant to our team,” said MainBloq CEO Ryan Kuiken. “I’ve known Larry for years, and his knowledge and connections in this space are truly second to none. I am confident that Larry will become another valuable member of our team in short order.”

Mr. Grant’s experience includes being the Managing Director of Tick Trend, LTD since 2011 and being Co-Founder and COO of Argentium Digital Asset Management since 2020.

Mr. Grant’s Objectives with MB Europe will include

- ● Taking the lead on all sales, support, and marketing activities relating to UK/EU clients

- ● Using his knowledge and skillset to grow the business, brand, and awareness in UK/EU

- ● Growing the team and leading expansion efforts to help us better serve our clients around

the world. - ● Ensuring client success from testing through deployment.

“I am looking forward to this opportunity,” said newly appointed head of MB Europe, Larry Grant. “I’ve known the MainBloq folks for years and I am confident that with my skill set in business development, strategy, and trading, coupled with their superior trading technology, we can rapidly grow the sales pipeline for MB by delivering real value to funds, family offices, and others in the asset management and trading space.”

About Fernhill:

Fernhill Corp is a Web3 holding company focused on developing and acquiring companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA). For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

OTC Markets

Nevada SOS Fernhill Twitter

Fernhill Facebook

Fernhill Linkedin

Fernhill Website: FernhillCorp.com

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

About MainBloq:

MainBloq, a Fernhill Company ($FERN), is a digital asset connectivity platform connecting to leading exchanges to serve the needs of clients around the world. MainBloq offers a modular platform including a smart order router, a suite of algorithmic tools, FIX / SOCKETS / REST gateway, sub-accounts for exchanges, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io MainBloq Website: mainbloq.io

MainBloq Twitter MainBloq Facebook MainBloq Linkedin

#$FERN #FernhillCorp #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #LFG #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading #SmartOrderRouter #AlgorithmicTrading

Forward-Looking Statements: This release includes 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute 'forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words 'estimate', 'project', 'intend', 'forecast', 'anticipate', 'plan', 'planning', 'expect', 'believe', 'will likely', 'should', 'could', 'would', 'may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

FernHill Announces Mainbloq Integration with CoinBase Prime Services for Institutions

Fernhill Corp's (OTC PINK:FERN), Digital Asset Trading platform, MainBloq is continuing to expand its impressive lineup of connectivity. Already a leading algorithmic trading platform, MainBloq is rapidly ramping up to meet the growing institutional demand.

MainBloq CEO Ryan Kuiken commented "We could not be more excited to bring this integration to fruition. Having access to dozens of pre-built exchange offerings is one of the many reasons institutional investors choose to utilize MainBloq and given the high visibility of CoinBase Prime, this particular integration proved to be one of the most highly valued to serve clients globally."

Coinbase Prime, currently the largest cryptocurrency exchange in the United States by trading volume, is an integrated solution that provides secure custody, an advanced trading platform, highly secure cold wallet storage and prime services so digital asset trading firms can manage their crypto assets in one place. It is worth noting that Coinbase launched its Prime Service for all the institutions to benefit from and leverage its highly versatile platform. Coupled with MainBloq - Coinbase Prime combines cutting-edge technology within a single solution to allow more assets to be traded with best price execution across multiple exchanges while also allowing algorithmic trading strategies to optimize performance.

CTO Marc Deveaux stated that "Clients continuously count on us to provide complex digital asset trading solutions that improve liquidity, performance and pricing. Our integration with CoinBase Prime allows us to facilitate a higher level of service for the most discerning financial institutions that want to take their trading operations to the next level."

Integrating with CoinBase Prime is just another step along the road in the overall plan by Fernhill Corp and MainBloq in creating a larger Digital Asset Ecosystem that encompasses mining, minting, trading and DeFi services.

About MainBloq:

MainBloq, a Fernhill Company ($FERN), is a digital asset connectivity platform connecting to leading exchanges to serve the needs of clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / SOCKETS / REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io

MainBloq Website: mainbloq.io

About Fernhill:

Fernhill Corp is a developer and acquirer of high-performance proprietary software solutions focused on crypto currency mining, digital asset trading and infrastructure applications that are designed to simplify, optimize and automate the blockchain ecosystem, including Mining, Minting, Trading and DeFi Fernhill is a Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Fernhill Website:FernhillCorp.com

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

#$FERN #FernhillCorp #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #LFG #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading

Forward-Looking Statements: This release includes 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute 'forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words 'estimate', 'project', 'intend', 'forecast', 'anticipate', 'plan', 'planning', 'expect', 'believe', 'will likely', 'should', 'could', 'would', 'may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

MainBloq is thrilled to announce being acquired by Fernhill Corp, a blockchain infrastructure platform optimizing & automating the digital asset ecosystem

LAS VEGAS, NV / ACCESSWIRE / November 15, 2021 / Fernhill Corp (OTC PINK:FERN) is pleased to announce that it has completed its acquisition of MainBloq, a groundbreaking digital asset trading platform serving both banks and hedge funds. MainBloq's software platform, API and services deliver automated algorithmic trading, smart order routing, and customized trading solutions that optimize digital asset trading operations with connectivity to over 30 of the top crypto exchanges globally. MainBloq's platform bridges the gap for digital asset trading and provides institutional capabilities similar to more traditional fx, derivative, and equities trading platforms.

"We could not be more excited about this acquisition," said Marc Lasky CEO of Fernhill. "As we searched for an acquisition target, MainBloq met and exceeded all of the criteria we had put in place. Not only is MainBloq an exceptional product, with a world class management team, but their state-of-the-art proprietary technology fits perfectly with our short term and long-term goals of becoming a leader in the blockchain and digital asset industry. In addition, the synergies are very compelling when combining MainBloq with our Crypto Mining OS, PerfectMine. This truly enables Fernhill to become a one stop shop for all things crypto, from mining to trading and beyond."

With the MainBloq acquisition in place, Fernhill plans on developing a larger digital asset mining and trading ecosystem that combines the capabilities and resources to simplify, optimize and automate the ability for people and businesses globally to participate in the crypto industry.

Fernhill is proud to announce that the acquisition of MainBloq also comes with the addition of three new members to the Company's Board of Directors, Chris Kern, Peter Bordes, and Ryan Kuiken.

Chris Kern, Fernhill's strategic advisor and investor, is a 25+ year technology finance and M&A specialist that has been involved in several high-tech companies as an investment banker, senior executive, board member, investor and advisor where he completed over $650 million in transactions. Over the past 20 years, Chris has worked with a wide variety of financial service firms and investment banks such as Fisher Francis Trees and Watts, Lehman Brothers, Maximum Venture, Gunn Allen and New Century Capital Partners. Chris also has been an investor, advisor and director of strategy for FinTech and blockchain companies such as Latium, RadJav, FogChain, and ClickIPO. Chris will be joining Fernhill as its Chairman of the Board of Directors.

"Today is a very exciting day for Fernhill as we carve our path in the digital asset economy and complete the incredible acquisition of MainBloq, said Fernhill's newly appointed Chairman of the Board Chris Kern. "I'm also very thankful for having leaders and forward thinkers like Ryan and Peter join Fernhill's Board of Directors, both of whom have had great success with building companies, leading teams and driving a long-term strategic vision. As a combined force, I'm extremely confident in our abilities to become one of the leading ecosystems for digital asset mining and trading, and achieving many great things together, including uplisting to Nasdaq."

Ryan Kuiken, MainBloq's founder and CEO, has over 10 years of high-level sales and business development experience with companies such as T-Mobile and PayChex where he was awarded the #1 national sales rank for both firms. Ryan is also a partner in Bull Run Capital, a private digital asset trading fund focused on DeFi trading. Ryan will oversee and manage the overall execution of the growth plan and vision for MainBloq in coordination with Fernhill, and will be an observer of the Company's Board of Directors.

"To be honest, we were not even looking to be acquired, as we have been diligently working towards perfecting our technology," said MainBloq CEO/Founder Ryan Kuiken, "however, once Fernhill approached us, we immediately saw the synergies and long-term benefits to a partnership. They have a great team and we love their vision, so it's really the perfect opportunity to accomplish our goals in digital asset trading and DeFi."

Peter Bordes, MainBloq's Chairman and Founder, is a 30+ year technology entrepreneur, investor, advisor, board member and trusted growth hacker for a wide range of public and private companies which include being the CEO of Kubient (Nasdaq: KBNT) and member of the Board of Directors, Managing Partner of Trajectory Capital, a venture banking and venture investing platform, Board member and interim CEO for Alfi Technologies (Nasdaq: ALFI), as well as serving on the board of directors of Beasley Broadcast Group (Nasdaq: BBGI) and Chairs the digital transformation committee. Peter will be joining Fernhill as a member of the Board of Directors.

"I couldn't be more excited to join forces with Fernhill to accelerate our shared vision and journey, building the modern cloud infrastructure for the global cryptocurrency economy," said newly appointed Board member Peter Bordes. "Our combined teams' experience, resources and technology give us the core foundational building blocks to build our end to end ecosystem of crypto and blockchain applications, and infrastructure to power traditional and digital asset finance."

About Fernhill:

Fernhill Corp is a diversified technology holding company that has interests in and seeks to acquire, build and develop businesses in mobile applications, digital assets, SaaS, and FinTech space with a principal focus in the cryptocurrency and blockchain industries, as well as other technologies that address the world's leading environmental and social concerns. Fernhill supports and pursues ESG initiatives and is Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Fernhill Website:FernhillCorp.com

Company Contact Information: info@fernhillcorp.com

MainBloq Website: mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or it's subsidiaries.

#$FERN #FernhillCorp #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading

Forward-Looking Statements: This release includes 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute 'forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words 'estimate', 'project', 'intend', 'forecast', 'anticipate', 'plan', 'planning', 'expect', 'believe', 'will likely', 'should', 'could', 'would', 'may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

Coinbase sees high user growth ahead of IPO this week

In a report released on April 6, the Coinbase cryptocurrency exchange claimed to have an estimated 56 million verified customers in Q1 2021—that’s an additional 13 million since Q4 2020.

In Q1 2021, Coinbase saw a 117% increase in transacting users compared to Q4 2020, from 2.8 million to 6.1 million. That’s the highest jump in users in the last three years:

- Coinbase added 3.3 million transacting users in Q1 2021 – a 117% increase

- The platform is no the largest cryptocurrency exchange in the United States

- Over $133 billion in assets were added to the digital asset platform, totaling $223 billion in Q1 2021