Populous Post business intelligence - ICO Update

Source: Crush Crypto

- Project name: Populous

- Ticker symbol: PPT

- Market cap*: $129 million

- Circulating supply*: 37,004,027 PPT

- Total supply: 53,252,246 PPT

Populous is a peer-to-peer invoice discounting platform. Their platform uses smart contracts powered by a blockchain ledger to pair invoice sellers and lenders without the need to transact through third parties.

Their vision is to increase funding for small and medium size enterprises (SMEs) while reducing invoice fraud by transacting on a peer-to-peer blockchain platform. Populous uses two tokens to facilitate the lending and exchange of funds on their platform; Pokens and Populous Platform Tokens (PPT).

Pokens are used internally to purchases invoices on the platform, and they are pegged at a rate of 1:1 to whatever local fiat currency for which they are being exchanged. Pokens and PPT are both ERC-20 standard tokens powered by the Ethereum blockchain.

PPT are used as collateral to invest in invoices on the platform. When one lends their PPT, they will receive the profit in Pokens for their lending of capital and their principal PPT investment in return.

Below is a diagram showing how the Populous platform works in a nutshell:

Founded in 2017 and based in London, Populous World Ltd. was founded by Stephen Williams. The project raised over $10.2 million USD in their ICO.

The 2018 year has been volatile for Populous so far. A £1...

NEO Cypto trade recommendation $NEO #NEO

Author: Kiril Nikolaev / Source: Hacked: Hacking Finance

On our August 29, 2018 trade recommendation, we anticipated NEO/Bitcoin (NEO/BTC) to breakout from the large falling wedge on the daily chart. We emphasized the importance of buying only after the pair generates volume of 1 million NEO units. Without heavy volume, the breakout would not look convincing to breakout traders and trend followers. Hence, there wouldn’t be enough momentum to ignite a massive rally.

Though NEO/BTC broke out from the falling wedge as expected on August 31, the volume it printed was way below our requirements. As a result, the breakout rally was short-lived since bottom fishers saw the low volume breakout as an opportunity to take profits. The selling drove the market down. Nevertheless, this gives us a chance to buy the bottom before NEO/BTC takes off.

Technical analysis shows that NEO/BTC is respecting the historical support of 0.00245. This view comes after the pair successfully completed the retest when it dropped to as low as 0.00239 on October 15 but bulls came to the rescue and lifted the market above the support. We watched NEO/BTC from that point to see if the support will hold. The confirmation came on October 18 when volume suddenly surged. This was a signal that participants are comfortable accumulating at this level.

More importantly, the daily RSI appears to have printed a new higher low at 32.6. This is an encouraging sign as it shows that participants are no longer waiting for extreme oversold readings before entering long positions.

The strategy is to buy as close to 0.00245 support as possible. As long as the market remains above this level, it has a very good chance to rally to our initial target of 0.0034 and then 0.0046.

The process may...

The Faircoin price of $0.22 can be worth millions

Author: Ian Karamanov / Source: CoinStaker | Bitcoin News

Faircoin, this asset is worth only $0.22. Something so small can’t even register on the global financial radar. Even in crypto exchanges, if we look at daily trading volume it’s nothing more than a slight glitch.

Ranked at 1134 on CoinMarketCap, this little asset presents a very reliable lifeline for its users. According to Sporos, a crypto enthusiast based in Athens, faircoin can be found everywhere in the world. He says he hasn’t relied on banking services for no less than 8 years thanks to this asset. If we look at the events from the last decade or so, Sporos’ definitely did well to stay away from banks.

Located in an anarchist stronghold in Athens, Sporos runs a faircoin information center. There are over a few hundred similar centers located all around the world. The centers are stocked with many homemade products like honey, soap, perfume, olive oil, tea and even jewelry. Of course all the products vary depending on the location on the center, but they all have one thing in common. They can all be purchased with faircoin.

If the provided information is accurate, we’re looking at over 620 centers all around the world. Sporos refers to them as the ecosystem of faircoin. This ecosystem includes a transportation sharing app combined with an AirBnB alternative and faircoin-based financial institution. The institution is called the Bank of Commons and is completely tax-free.

Faircoin redefines being human

In this global network, nodes aren’t exactly nodes. Usually, nodes are the computers, but...

Zambia cracks down on crypto companies

Source: Bitcoin News

The Bank of Zambia has started to clamp down on cryptocurrency-related businesses, mere days after declaring that it does not view digital coins such as BTC as legal tender. The crackdown began on Oct. 14, when the central bank announced an investigation into Heritagecoin Resources Ltd. for allegedly laundering money, according to local media reports.

Also read: Zambian Central Bank Declares Bitcoin is Not Legal Tender

Bank of Zambia Probes

Heritagecoin’s Deposits Business

In addition to the ongoing probe, the Lusaka-based fintech startup faces allegations that it has taken on traditional banking activities, such as accepting deposits — something it is not certified to do.

“The company … has since been offering financial services and collecting deposits from members of the public,” Kamufinsa Manchishi, a spokesperson for the Zambian Drug Enforcement Commission, told the Lusaka Times. The organization, which is assisting with the investigation into Heritagecoin, did not reveal the amount of money involved.

Manchishi added that: “As such, the commission together with the Bank of Zambia (BoZ) are currently investigating the company for activities contrary to the Prohibition and Prevention of Money Laundering, as well as the Banking and Financial Services Acts.”

On Friday, the BoZ declared that cryptocurrencies such as BTC are not legal tender, warning that those conducting transactions in the cryptocurrency would have nobody to turn to or blame in the event of market failure. However, it appears that the bank issued the decree solely because it wants to promote its depreciating fiat currency, the kwacha.

That said, the central bank has neither the power nor the legal backing to shut down the nascent Zambian cryptocurrency market. The BoZ would need parliament to amend the law that enabled its own establishment for it to be able to claim any authority over cryptocurrency investments or trading.

Nonetheless, the BoZ does have full control of the banking sector within which Heritagecoin...

Switzerland's cryptocurrency regulations and standards

Source: Crush Crypto

Switzerland, according to its Federal Council report, classifies cryptocurrency as a "digital representation of a value which can be traded on the Internet but not accepted as legal tender anywhere”. Therefore, Switzerland regards cryptocurrency as assets (property), and cryptocurrency and related exchanges are legal in Switzerland, subject to regulations.

There are currently no cryptocurrency-specific regulations in relation to trading and offering in Switzerland, but cryptocurrency remains subjected to relevant existing regulations such as tax, money laundering and securities regulation.

Recognizing the barriers of the existing regulatory framework to new financial technology such as cryptocurrency, regulatory amendments were made by the Switzerland government to create “regulatory sandbox” in support of the development of such technology.

Overall, Switzerland is one of the countries that adopts a progressive approach towards cryptocurrency and its blockchain technology, and has relaxed its regulatory framework to balance the technological development and protection of the public from the associated risks.

Securities in Switzerland is governed by the Swiss Financial Market Supervisory Authority (“FINMA”) under the Financial Market Infrastructure Act (“FMIA”).

FMIA defines securities as “standardised certificated or uncertificated securities, derivatives and intermediated securities which are suitable for mass standardised trading, meaning they are publicly offered for sale to more than 20 investors".

Essentially, assets that represent debt or equity claim on the issuer with investment purposes are securities. Accordingly, whether a cryptocurrency is deemed as securities depends on its categorization as a Payment Token, Utility Token, or Asset Token as per guidelines published by FINMA:

- Payment Tokens are tokens which are intended to be used, now or in the future, as a means of payment for acquiring goods or services or as a means of money or value transfer. Payment Tokens give rise to no claims on their issuer. Examples include Bitcoin and Ether which FINMA does not perceive as securities.

- Utility Tokens are tokens which sole purpose is intended to provide access digitally to an application or service by means of a blockchain-based...

DZ Bank Germany Ripple blockchain integration underway

Author: Ali Qamar / Source: Global Coin Report

READ LATER - DOWNLOAD THIS POST AS PDF

The online world of business is undeniably changing. But, have we seen its full extent yet? Perhaps the answer lies with the blockchain technology. Some studies point out that with blockchain (like Ripple, and of course, other similar ones like Stellar or the ones that might come to the party) integration by the banks, they will be able to realize significant savings.

The banks will enjoy cost reductions not only in their payment processing as well as reconciliation alongside compliance and treasury operations.

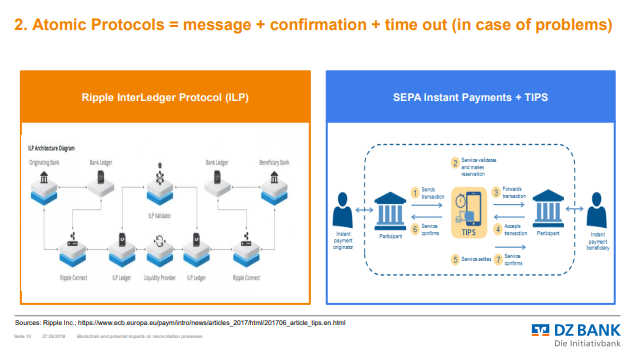

DZ Bank AG Considering Ripple Interledger Protocol

DZ Bank is one of the most talked after bank in Germany. It is the second largest bank in the country by asset size as well as the central institution. The bank functions as both a central institution as well as corporate and investment bank.

Concerning potential Ripple Interledger protocol integration, the bank has listed a couple of slides in their recent report “blockchain(s) and potential impacts on reconciliation.” It is not rocket science to what that may mean just because the protocol is all about cross-border transactions.

"…..we are very confident that Germany will move as well ahead with #ripple"

see full clip from @BankXRP https://t.co/SWJ5NnouwT#xrp #ripplenet #ripplenews #xrpcommmunity #xRapid #xrpthestandard #xrparmy pic.twitter.com/sWJQd4MNvs

— ????????????????????????????????????????⚡???????? (@stuart_xrp) October 12, 2018

If at all it means DZ is considering to welcome Ripple Interledger protocol to their platform, it won’t do anything different but probably a smile to the bank users and...

Adobe Flash Malicious Malware Includes Crypto Mining Software

Author: Author

Coin Idol / Source: coinidol.com

Agreed, Adobe Flash still works, regrettably, and that means it's still employed as a method to target ignorant users with malicious malware. As you would think, the latest malware to attract big attention masks itself as an update to Flash to trick users into installing malevolent software.

Now, the malware is a digital currency mining bot which exploits system resources to smoothly mine for Monero. The most interesting part is that the software updates the Flash software.

The Fake Updater

Revealed by experienced researchers at Palo Alto Networks, a security company, the fraudulent Flash updater has been circulating from one place to another...

Zinc CEO on merging ad tech and blockchain technology

Author: Alex Moskov / Source: CoinCentral

Over 30% of the $335 billion projected ad spend in 2020 is estimated to be lost to inefficiencies in the current digital advertising landscape.

With nearly a third of all money that goes into digital advertising getting thrown into the abyss of click farms, click spam, malware, ad stacking, bots, and other wasteful activity, it’s no surprise dozens of entrepreneurs in the space are turning to build businesses around solutions.

Zinc is a blockchain-based advertising protocol looking to crack the code to salvage some of the estimated $100.5 billion that goes to waste.

Zinc incentivizes users to be more engaged with the platform by compensating them with rewards for the ads they watch in the apps they already use. These rewards can be spent to reduce the number of ads they see, as well as accessing premium features and content inside Zinc Protocol partner apps.

Daniel Trachtemberg, the CEO and Founder of Zinc, was previously the Head of Mobile Fraud Prevention and Director of the Mobile Data Management Platform at app monetization company ironSource with over 1.5 billion monthly active users.

How does Zinc differentiate from other similar projects targeting blockchain in advertising, such as Basic Attention Token?

One of the main challenges for all new startups, especially in decentralized ecosystems like blockchain based dApps is distribution: user acquisition & adoption.

BAT is aiming to drive adoption through their web browser – the “Brave” browser. A great product, but getting the users to adopt a new browser and change their habits on that level is quite a challenge. So one key difference is that users who will participate in the Zinc protocol ecosystem will gain more rewards within the apps they already use. Basically, apart from having to install the Zinc wallet app, where users choose what information to share with advertisers, they continue doing everything as they do now, and so does the rest of the industry. Another key difference between Zinc and other projects is that the Zinc Protocol does not aim to cut out the middleman. A lot of projects are claiming that the problem is the middlemen and if advertisers and publishers had a way to work together those problems would be solved, which in concept is a great idea, but in practice we think it’s a bit naive.

It seems that Zinc is focusing efforts into app-based advertising rather than website advertising. Is site-based advertising something Zinc will explore in the future or do you see the future of digital advertising as being app-based?

Web-based advertising is something Zinc will definitely explore in the future. However, it seems the general trend is towards mobile: more and more people spend more time on their mobile phones. Mobile is a segment that’s showing rapid growth and advertisers see the potential, which is evident when you look at the growth of marketing budget spend on mobile each year.

But this growth also fuels inefficiencies and fraud, keeping big brand advertisers away from running mobile campaigns, which, in my opinion, is quite a paradox: as fraud grows in relation to mobile spend growth. So if we eliminate fraud & data inefficiencies, mobile can become even a greater untapped channel – especially for brand advertisers with big budgets.

In addition to fraud, access to quality data is one of the issues faced by advertisers. Can you explain why this is an issue, and how Zinc will provide better data quality to advertisers?

First party, real human-verifiable user data is the most precious asset traded in the advertising ecosystem, I would dare to say even more than actual ad real estate.

Most advertising budgets are dedicated to targeting specific audiences. So if a publisher succeeds in attaching high quality, verifiable user data when selling an ad space, the amount of money he’ll be able to charge is exponentially higher than without this user data – this is key to understanding how Zinc will generate value for all the players in the ecosystem, including the user/consumer.

Today only Facebook and Google and some PMPs (private marketplaces) have this kind of data. Imagine that you could target users outside the duopoly with the same accuracy – it will improve the way app developers and publishers do business (focusing of ad quality and not quantity): increase the advertiser’s capability to generate reach, and significantly improve the user experience.

That’s exactly what the Zinc protocol is meant for: ensuring users are real humans, allowing users to self-disclose basic information in exchange or getting more rewards and fewer ads via the Zinc token ecosystem. This first party data information will be used to target the specific audiences with a higher accuracy and efficiency resulting in higher revenue, less waste and better user experience.

Many app-based games such as Angry Birds already offer users the ability to earn and spend in-game rewards. How will the user experience with Zinc differ from this?

Most of the game publishers rely on advertising to achieve two main goals: the first, monetize and build their businesses; the second, keep players engaged...

How to choose your blockchain advisors

Author: Fieldcoin / Source: Hacker Noon

Or a guide for management teams on how to choose your advisors

Six months before Mr X. was barely known, he might not even know about the Blockchain. And now he is proudly broadcasted in major rating websites as one of the top ten best advisor of the sector. He is one of the ghost advisors of the Blockchain… They work for private multinational companies as employees or middle managers, more than 10 hours per day, they are often family men with many kids, and end up as advisors of more than 30 projects in less than 3 months (one might ask where they find the time). With credential related to their new positions, they are asking high upfront and percentages on ICOs. But, once you have dealt with them and send them your tokens… You will hardly heard of them (or just when it is time to cash in).

This is the new obscur face of the Blockchain. A new kind of financial vampires who is only here to suck the workforce of ICO team members and benefits of token holders. They have no genuine passion or vocation for the Blockchain technology and this amazing paradigm shift. With no real experience as CEO or real operational job in the Blockchain, they nonetheless, position themselves as the utmost experts.

For the last 3 years, Initial Coin Offerings has set up a new kind of company financing for companies using the Blockchain Technology. The technology application is still at an early stage, and changes occur at fast pace. The need for advisors to guide in each development section of the project has become vital for a project to succeed.

Surfing on this wave, a new kind of opportunists people have emerged far from the legitimate and genuine advisors. Entrepreneurs entering the sector must really be aware of the new practices settled by some unscrupulous advisors asking for shockingly huge compensation schemes.

In this context, it is sometimes difficult for CEOs and Blockchain project founders to find the right experts to assist and consult to develop the project. But there are solutions. And bear in mind that it is not the “best” advisor meaning the one with the most hyped reputation that will push your ICO to the next level, but the hard working and committed person that loves your project. I have being talking with many CEOs and experts as have been confronted with those Ghost Advisors over the last year. Here are few hints that will avoid traps and save you time.

If you are a CEO like I do and you get propositions from those people (and trust me if you have a legitimate project with growing reputation, they will come to you to propose their services). Hiring those persons is the worse things an Entrepreneur may do. They will suck the ressources needed to develop your project without tangible worked done in exchange. At Fieldcoin, in collaboration with our CLO and the management team we have seen this from the early beginnings. In order to avoid the traps, we have put a series of safeguards to protect the project and get the most of our Advisory team.

Signs that you are in front of a ghost advisor

High percentages of the ICO allocated to Advisors Some CEO’s are tempted to allocate high percentages of the ICO to Advisors. If you see an ICO with more than 3% allocated...

MeliorAl (MEL) Machine Learning, Neural Network Token Sale

Source: ICO Ranker

MeliorAl (MEL) Token Sale

Melior has developed its own Machine Learning, Neural Network and Deep Learning models and aims to open up the opportunities presented by AI in the marketplace to all businesses, not just those powerful enough to take control of the space. Melior’s extensive research has focused on (reusable and multi-purpose) Natural Language and Image Understanding.

Opens Up AI Learning Opportunities to All Businesses

Melior develops exceptional chatbot and conversational interface...