Vitalik Buterin Cashed Out of ETH During the 2017 Cryptocurrency Bubble

Author: Nick Tsakanikas / Source: CCN

Ethereum mastermind Vitalik Buterin, who holds 350,000 ETH in his main wallet address, allegedly cashed out $40 million worth of ETH between June 2017 and February 2018. The findings came to light by Alex Sunnarborg, a founding partner of the crypto hedge fund Tetra Capital, who dug into Vitalik’s historical account data.

The Breakdown of Vitalik’s ETH Movements

According to Etherscan, Buterin has converted 544,998 ETH to fiat currencies since 2015. This amount equals to almost $49 million, $40 million of which he moved during the period mentioned above.

5/ Vitalik likely cashed out ~ $40,000,000 worth of ETH between June 2017 – February 2018: pic.twitter.com/8RoMKU63ha

— Alex Sunnarborg (@alexsunnarborg) March 19, 2019

While today the balance of Vitalik’s main address is worth $50 million, its net worth reached $500 million when Ethereum exceeded $1,300 in December 2017.

4/ His net worth from this ETH balance alone exceeded $500,000,000 at the...

How Blockchain Can Democratize Artificial Intelligence Development

Author: Mina Down / Source: Hacker Noon

Data Access for AI: An Under-Explored Use for Blockchain

There is a vast amount of computing power around the world that is not used efficiently. There are an estimated 4 billion personal computers in the world and 90% of them have free capacities at any given moment. This is to say nothing of the idle capacities of other personal devices, like smartphones and tablets. In effect, this excess computing power is wasted.

Lots of startups are trying to use blockchain technology to take advantage of this inefficiency to meet different economic needs. The blockchain is exciting in this context because it provides an infrastructure for distributed computing power, while at the same time providing an incentive for individuals to link their idle devices to the network.

Many of the startups I’ve come across are focused on providing web hosting and/or data storage solutions via blockchain. However, the use case I think is the most exciting involves artificial intelligence or “AI”.

Democratizing AI

The idea of applying the blockchain to artificial intelligence is attracting a lot of attention. Similar to the goal of distributed data storage and web hosting, some experts argue the blockchain could encourage a broader distribution of the data and algorithms that will determine the future development of artificial intelligence.

However, many artificial intelligence experts are concerned that IBM, Facebook, Google and a few other big companies are monopolizing all the talent in the field. These giant corporations also control the massive silos of digital data necessary to create and refine the best machine learning programs. Many argue there is a need to democratize data if A.I. is to develop in a direction to benefit all of humanity.

This is where blockchain technology comes in.

At the most basic level, just as the blockchain allows...

Rakuten to Launch Their Crypto Wallet March 30th

Author: Matthew Proffitt / Source: CCN

Rakuten Inc. just announced their intention to terminate “All Bitcoins Inc.” and launch their own “Rakuten Wallet” on March 30. Businesses launching crypto wallets is nothing new, following companies like Line, KIK and KakaoTalk. The news comes after Rakuten completed their filings as a virtual currency exchange company (VCEX.)

The company stated:

Rakuten Wallet will contribute to the sound growth of the market as a virtual currency exchange company and will further enhance security and provide enhanced services so that more customers can use it safely and with confidence.

Rakuten will be filing another VCEX application for Rakuten Wallet in September 2019.

Rakuten Inc. (4755: JP) holds a market capitalization about one-tenth the size of GM’s profits, number ten on the Fortune 100 list.

What Does Rakuten Do?

Earning cashback on purchases can make large purchases a little more enticing if you pair it with decent discounts. Rakuten aggregates discounts and helps customers receive cash back on their online purchases.

Their offerings have struck a not-so-nice chord...

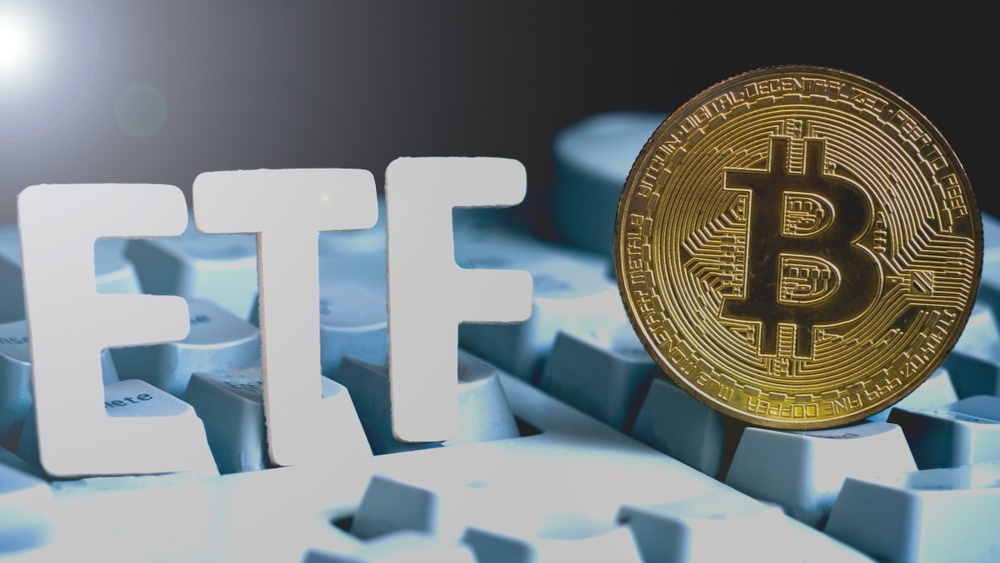

The Cryptocurrency Volume Plague Could Actually Raise Odds of Bitcoin ETF Approval

Author: Joseph Young / Source: CCN

In March 2017, the U.S. Securities and Exchange Commission (SEC) denied the first ever bitcoin exchange-traded fund (ETF) proposal.

Since then, many bitcoin ETF applications have been filed by nearly ten companies, and many of them have been rejected by the SEC for similar reasons.

This week, in a presentation to the SEC, Bitwise revealed that the overwhelming majority of the trading volume in the bitcoin exchange market is fake and that a substantially large portion of the global bitcoin volume comes from the United States.

Ironically, the fake volume plague in the cryptocurrency exchange market may increase the probability of a bitcoin ETF approval.

The Fake Crypto Volume Paradox

Two years ago, when the SEC rejected the first bitcoin ETF proposal filed in the U.S., the commission emphasized three factors:

- Vulnerability to manipulation

- Lack of regulations in overseas markets

- Lack of surveillance

“The Commission believes that, in order to meet this standard, an exchange that lists and trades shares of commodity-trust exchange-traded products (“ETPs”) must, in addition to other applicable requirements, satisfy two requirements that are dispositive in this matter. First, the exchange must have surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity. And second, those markets must be regulated,” the SEC said at the time.

In the past two years, major overseas cryptocurrency markets in the likes of...

CoinMarketCap to Revamp Listing Metrics After Fake Volume Research

Author: William Suberg / Source: Cointelegraph

Cryptocurrency market data resource CoinMarketCap (CMC) has promised to rearrange how it ranks member exchanges after research found overwhelming evidence of fake volume. The company confirmed the upcoming changes on social media on March 25.

CMC is arguably the industry’s best-known tracking service for the market cap of Bitcoin (BTC) and altcoins, as well as for the activity on exchanges trading them.

However, last week, research from cryptocurrency index fund provider Bitwise claimed that CMC hosts almost entirely fake volume statistics. This in turn deceives investors and inflates the profile of affected coins, Bitwise explained in the report.

Now, CMC has appeared to heed the warnings represented in the research, which Bitwise sent to United States regulators for consideration...

Huobi Prime offers digital currency investors a new way to Trade

Author: Nick Marinoff / Source: CCN

Tuesday, March 26 will see customers of the cryptocurrency exchange Huobi experience a whole new way of getting their fingers around cryptocurrencies. Known as Huobi Prime, the system is a coin-launch platform that ensures all currencies purchased by Huobi users are immediately deposited into their accounts and tradable against the Huobi Token (HT) with minimal delays, according to a company press release.

Customers will also have access to coins at below-market prices, as well as new projects and currencies not yet listed on major exchanges. Huobi’s executive team works with the project leaders of every coin or token listed, forming close partnerships and determining fair market values for users. Executives have also implemented tiered price limits to relieve customers of extreme volatility.

Speaking with CCN, Ross Zhang – head of marketing for Huobi Group – explains what inspired the new platform’s creation:

Low-quality coins and lack of access to ones with real potential are a perennial problem in the crypto space. While that is nothing new, I do think it’s taken on new importance in the ongoing bear market we find...

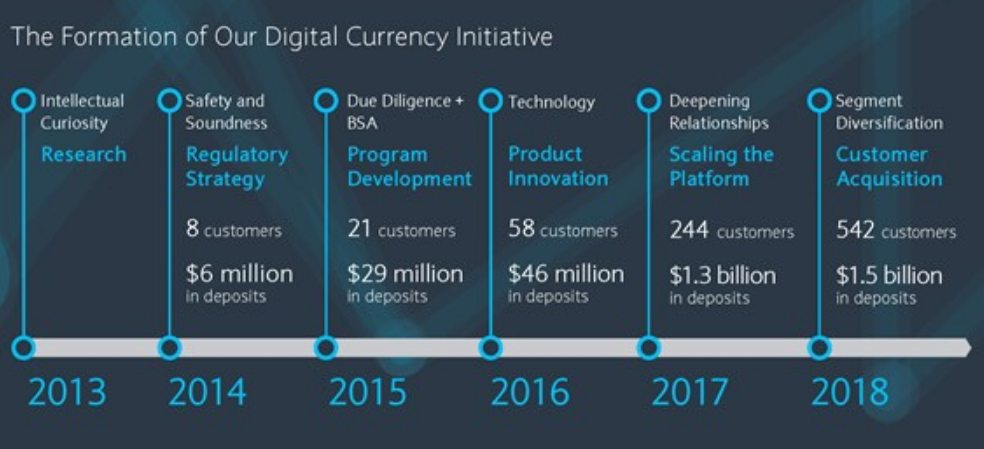

Silvergate ‘Bitcoin Bank’ crypto client base climbed 122% in 2018

Author: Mark Emem / Source: CCN

Silvergate Bank, which bills itself as the “leading provider of innovative financial infrastructure solutions and services to participants in the digital currency industry,” has disclosed in a preliminary prospectus filed with the U.S. Securities and Exchange Commission that despite the bearish conditions in the bitcoin market, its number of crypto industry clients surged in 2018.

Silvergate Crypto Client Deposits Rise to $1.58 Billion

By the end of last year, Silvergate revealed that it had 542 cryptocurrency-related customers. This was an increase of 122.1 percent from 2017 when the total number of customers was 244, per the prospectus. Total deposits also increased approximately by 8 percent from $1.46 billion to $1.58 billion.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Additionally, Silvergate disclosed that it was also in the process of onboarding some 232 customers.

Key Clients? Bitcoin Exchanges and Institutional Investors

Among its most notable customers, digital currency...

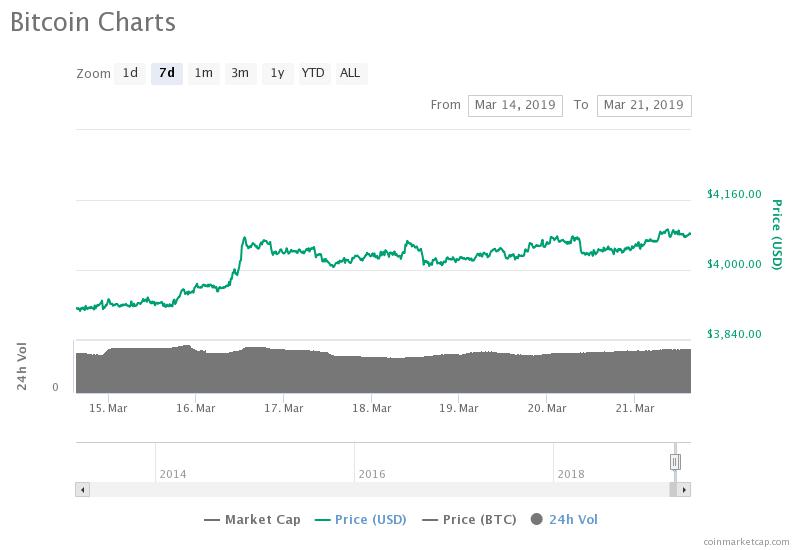

Industry sees crypto bottom as Bitcoin nears $4,100 and tokens gain 20%

Author: Joseph Young / Source: CCN

The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner...

Research: 75% of Bitcoin Exchanges Report ‘Suspicious’ Digital Currency Trading Volumes

Author: P. H. Madore / Source: CCN

A site called TheTie released a report today that estimates over 86% of all reported Bitcoin exchange volume is suspicious, while 75% of exchanges report extremely dubious volumes. The research uses a different formula than other reports have: it values each website’s visitors and compares that value to the reported figures.

Potential Fake Crypto Volumes High Across The Board

For example, Bithumb, which has been the subject of previous investigations, was expected to have a monthly volume of roughly $1.2 billion based on an average visit value of $13,418. Instead, Bithumb reports over $28 billion. This means their reported volume is nearly 2,000% higher than what would be expected.

TheTie introduces the data saying:

“The weighted average trading volume per web visit for Binance, Coinbase Pro, Gemini, Poloniex, and Kraken was selected as a baseline volume per user to calculate expected volume. This amounted to $591 per web visit. BitMEX was not included because it is a futures exchange. This does not account for mobile app or API usage to trade – web traffic is an assumption for simplicity. Relative outlier detection is quite notable, so the outright number isn’t the main objective.”

TheTie hedges its statements by saying these are “potential” indications of fake volume.

Altcoin Exchange Bittrex Among the Most Reliable Reporters

Ethereum Governance is Currently Underrated says Vitalik Buterin

Author: P. H. Madore / Source: CCN

In the most recent episode of Into the Ether, Vitalik Buterin appears to discuss all things Ethereum. One of the subjects that came up was the Ethereum governance model. Eric Conner asked Buterin about on-chain governance models, and his thoughts on how Ethereum’s governance stacks up against them.

Current Governance Model Underrated: Vitalik Buterin

Buterin says that the current Ethereum governance model works pretty well, considering the problems it has guided the protocol through.

I actually think that Ethereum governance is under-rated at this point. Because it’s not something that we can attach a cool name to and advertise. And honestly, moderation is a less exciting pitch for people than either on-chain votes, maximum coin holder engagement, or on the other hand immutability. We as a community have never tended to go for extremes. But in reality, on the one hand people complain about governance as a process. But on the other hand, in terms of concrete outcomes that Ethereum governance has achieved, it’s done really well.

It’s implemented the issuance reductions. The issuance reductions seem to be something that most people tend to agree with. […] When there was a crisis back in the year 2016 DOS attacks, it managed to implement, roll, stack out, test and roll out a hard fork all within a time span of 6 days. That’s not something we want to repeat but it’s clearly something we can do if we really wanted to.

When there was a Constantinople bug, it managed to delay the fork within a few hours. It is achieving the things that you might reasonably want a governance of a protocol to achieve, which is to make changes people want and not make changes people want. The one thing that it’s not achieving is dispute resolution or...