Silvergate ‘Bitcoin Bank’ crypto client base climbed 122% in 2018

Author: Mark Emem / Source: CCN

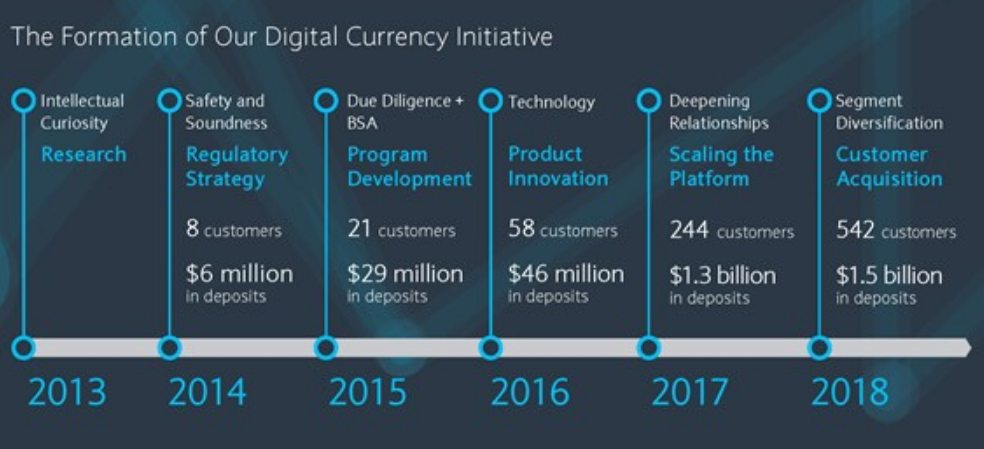

Silvergate Bank, which bills itself as the “leading provider of innovative financial infrastructure solutions and services to participants in the digital currency industry,” has disclosed in a preliminary prospectus filed with the U.S. Securities and Exchange Commission that despite the bearish conditions in the bitcoin market, its number of crypto industry clients surged in 2018.

Silvergate Crypto Client Deposits Rise to $1.58 Billion

By the end of last year, Silvergate revealed that it had 542 cryptocurrency-related customers. This was an increase of 122.1 percent from 2017 when the total number of customers was 244, per the prospectus. Total deposits also increased approximately by 8 percent from $1.46 billion to $1.58 billion.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Additionally, Silvergate disclosed that it was also in the process of onboarding some 232 customers.

Key Clients? Bitcoin Exchanges and Institutional Investors

Among its most notable customers, digital currency...

Overstock’s Blockchain Subsidiary Acquires Stake in Blockchain Banking Platform

Author: Ana Alexandre / Source: Cointelegraph

Retail giant Overstock.com, Inc.’s blockchain subsidiary, Medici Ventures, has acquired a stake in blockchain banking platform Bankorus, according to a press release published on March 11.

Medici Ventures has purchased a 5.1 percent stake in Bankorus, a blockchain banking platform that enables both individuals and institutions to buy, sell, lend and store digital assets. Jonathan Johnson, president of Medici Ventures, said that “the addition of Bankorus to Medici Ventures’ portfolio of companies will further our work in building the foundation of a blockchain-based technology stack for society.” The financial details of the acquisition were not forthcoming.

Medici Ventures has been largely investing in blockchain projects. Last December, the firm

JPMorgan to Launch JPM Coin Digital Currency

JP Morgan is rolling out the first US bank-backed cryptocurrency to speed up payments.

In a move commentators may see as unlikely, the multinational lender will use its newly developed asset, dubbed “JPM Coin,” to increase settlement efficiency, initially within three of its operations.

Speaking to CNBC, Umar Farooq, who leads JPM’s blockchain focus, appeared buoyant on blockchain technology’s perspectives at the bank.

“So anything that currently exists in the world, as that moves onto the blockchain, this would be the payment leg for that transaction,” he told the network:

“The applications are frankly quite endless; anything where you have a distributed ledger which involves corporations or institutions can use this.”

JPM Coin will initially focus on international settlements by major corporations, helping speed up transactions that currently take a day or longer using extant options such as SWIFT.

Author: Nathan Reiff / Source: Investopedia

JPMorgan Chase & Co. has officially become the first U.S. bank to launch its own digital token representing a fiat currency. Per a press release and interview issued on Valentine's Day, the bank has announced the creation of JPM Coin, a blockchain-based technology which will facilitate the transfer of payments between institutional clients. The coin has important differences from preexisting cryptocurrencies like bitcoin, primarily because it is redeemable at a 1:1 ratio for fiat currency held by JPMorgan.

JPM Coin is essentially a tool to help with the instantaneous transferring of payments between some of JPMorgan's clients. In order for an exchange of money between client parties to take place over a blockchain ledger, a digital currency must be used to facilitate the transaction. JPM Coin is the tool which helps to complete that process in a more efficient manner than traditional settlements.

JPM Coin itself is not money in the traditional sense. Rather, it is a digital token which represents U.S. dollars which are held by JPMorgan Chase. It maintains a value equal to one USD. Assuming that JPMorgan Chase deems the initial launch of JPM Coin to be successful, the bank has indicated its plans to use JPM Coin for additional currencies as well in the future.

The process by which clients will utilize JPM Coin is relatively straightforward. First, a client deposits a sum in a particular account and receives corresponding JPM Coins. Next, these coins can be used to facilitate transactions across a blockchain network and...

Central Bank of Japan says issued digital currencies are not effective economic tools

Author: Helen Partz / Source: Cointelegraph

The Bank of Japan’s (BOJ) deputy governor Masayoshi Amamiya has recently reiterated his negative stance towards central bank-issued digital currencies (CBDC), the New York Times reports Oct. 20.

Speaking on Saturday at a meeting in Nagoya, central Japan, Amamiya expressed doubts about the use of CBDCs, claiming that such digital currencies are unlikely to improve the existing monetary systems. Amamiya also stated that the BOJ does not plan to issue digital currencies.

The article reports that some financial experts consider a CBDC as a tool for central banks to control the economy once interest rates fall to zero. According to this theory, a CBDC would enable central banks to stimulate the economy by charging more interest on deposits from individuals and firms, which would in turn induce them to spend more money.

Amamiya has questioned that theory, claiming that charging interest on central banks-issued currencies...

DZ Bank Germany Ripple blockchain integration underway

Author: Ali Qamar / Source: Global Coin Report

READ LATER - DOWNLOAD THIS POST AS PDF

The online world of business is undeniably changing. But, have we seen its full extent yet? Perhaps the answer lies with the blockchain technology. Some studies point out that with blockchain (like Ripple, and of course, other similar ones like Stellar or the ones that might come to the party) integration by the banks, they will be able to realize significant savings.

The banks will enjoy cost reductions not only in their payment processing as well as reconciliation alongside compliance and treasury operations.

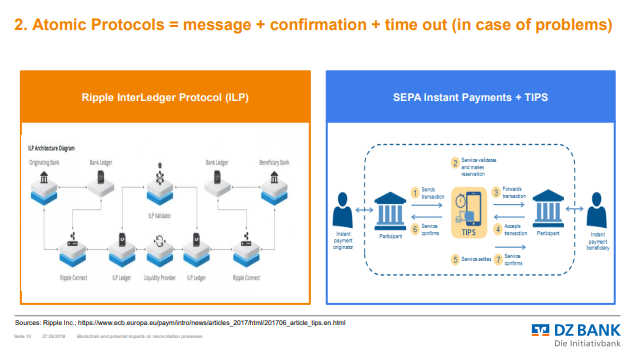

DZ Bank AG Considering Ripple Interledger Protocol

DZ Bank is one of the most talked after bank in Germany. It is the second largest bank in the country by asset size as well as the central institution. The bank functions as both a central institution as well as corporate and investment bank.

Concerning potential Ripple Interledger protocol integration, the bank has listed a couple of slides in their recent report “blockchain(s) and potential impacts on reconciliation.” It is not rocket science to what that may mean just because the protocol is all about cross-border transactions.

"…..we are very confident that Germany will move as well ahead with #ripple"

see full clip from @BankXRP https://t.co/SWJ5NnouwT#xrp #ripplenet #ripplenews #xrpcommmunity #xRapid #xrpthestandard #xrparmy pic.twitter.com/sWJQd4MNvs

— ????????????????????????????????????????⚡???????? (@stuart_xrp) October 12, 2018

If at all it means DZ is considering to welcome Ripple Interledger protocol to their platform, it won’t do anything different but probably a smile to the bank users and...

Norway's Central Bank Mulls Digital Currency as Cash Use Declines

Author: Wolfie Zhao / Source: CoinDesk

Norway's central bank is preparing for a future in which it might issue a digital currency amid a slump in cash usage in the country.

Looking into the possibility, a working group at Norges Bank has released a report titled "Central Bank Digital Currencies," which explains that, as citizens turn away from physical forms of money, the bank must consider "a number of new attributes that are important for ensuring an efficient and robust payment system."

Already, the country's DNB bank has stopped handling cash, with Trond Bentestuen, group executive vice president of wealth management and insurance at the bank, telling local media as far back as 2016, that only 6 percent of Norwegians use cash on a daily basis.

Further, Jon Nicolaisen, deputy governor of Norges Bank, stated in a speech last April that the role of cash "continues to diminish" as consumers move towards electronic payments, adding that "For many consumers, electronic central bank money could provide an...