Clay Cowdery Named As COO at MainBloq

MainBloq, the high-performance trade execution infrastructure for digital assets, is pleased to announce that Clay Cowdery has joined the executive team as Chief Operating Officer.

Clay brings 25+ years experience in tech, engineering, analytics, and financial services operations. He has worked with a variety of early stage FinTechs and established financial infrastructure solution providers. Clients include global banks, clearing houses, and financial regulators.

“I am very excited to join the MainBloq team as we scale the company and provide even more value to our clients. The demand for flexible, advanced financial infrastructure for institutional clients trading in the digital asset space is growing at an incredibly fast pace.”

Clay’s over two decades of experience as an enterprise architect, business strategist, and operations lead will be key to expanding Mainbloq’s footprint in the institutional digital asset space.

“I have been working in cross border fiat currency and trade settlement back-office operations for many years with global financial institutions and central banks. Digital currency has been on everyone’s radar for a number of years. We are now seeing institutional investors investing in these asset classes and taking them seriously,” said Clay.

As part of the company’s continued investment in product and client development Clay will spearhead productizing Mainbloq’s offering for institutional clients and building the company’s strategic roadmap in order to deliver outstanding client experience across Mainbloq’s portfolio of current and future clients.

“I am very excited about the Mainbloq solution and focus on connectivity, messaging and algos. We provide institutional investors with a single virtual view across multiple trading venues and provide them with trading algos to accelerate their trading strategy.

“Clay’s superpower is his ability to filter and focus on delivering features that make an impact advancing the cryptocurrency trading markets” said Chairman and Founder Peter Bordes, “In a complex, rapidly growing global space like digital assets the ability to see the forest for the trees is indispensable.”

Clay is joining Mainbloq during an expansionary period as the company embarks on broadening its client base both in terms of the types of clients and scope of relationships with those clients.

“Clay is that rare person who has vision and the ability to execute,” said CEO and Founder Ryan Kuiken “We’re excited to bring Clay in to help us execute our expansion as the marketplace matures.”

“I think that my knowledge, experience, and wisdom overlaps and complements the rest of the Mainbloq team,” said Clay. I am really excited to contribute to our corporate culture which fosters humility and diversity of ideas, supporting everyone to execute to their greatest strengths. This is rare in the deep technology and Fintech space.”

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a suite of trading tools, including smart order routing and trading algorithms for hedge funds, traders, and some of the world’s largest banks.

Contact Mainbloq

Ryan Kuiken, CEO

Mainbloq is Powered by IBM

Technology is at the center of everything we do at Mainbloq—our execution engine, algorithms, and smart order router are all technical solutions to real world cryptocurrency trading problems. Our clients use our technology every day to execute their trades according to their strategies. As we deal with institutions, banks, and hedge-funds one of their top priorities is security.

We're thrilled to announce that we have partnered with IBM to offer our clients best-in-class security through their IBM Cloud and LinuxOne products. You can read more about our partnership at the link below.

Find out more about our IBM collaboration >>> HERE

4 Cryptocurrency trading charts to trade smart on the Mainbloq

We have a lot of data here at Mainbloq and we believe that the more data we can supply to our customers the better decisions they can make when they trade. Today we’re thrilled the release some of that data to EVERYONE with Mainbloq Charts.

Our charts showcase some of the data we have as actionable information. Mainbloq is an all-in-one platform for digital assets providing a suite of tools to consolidate real-time data across multiple venues, and to translate data into information and algorithms for best execution of user-defined trading strategies.

Read below to see descriptions of the charts we have available for your use. To see our charts go to https://mainbloq.io/charts/

Order Book Live View

With this chart you can see where market depth is currently quoted. The venues are color coded and displayed in pie charts for bids and asks, as well as a depth chart. All prices are normalized to the “stable price”, which accounts for the exchange rate of the stable coins.

How to use it:

- Enter Currency Pair and press go

- Use mouse to zoom in Combined Depth (you can reset zoom)

Historic Volatility Explorer

With this chart you can explore the historic volatility of an asset. Volatility is an important measure to inform trading decisions indicating the potential price variability over time.

See the trends in historic volatility alongside price movements. Recalculate the Historic Volatility with differently sized dolling windows to smooth or enhance details.

How to use it:

- Adjust Slider to re-scale rolling window of calculating volatility

- Switch between Log and Linear Scales

- Pan with Date Range selector at bottom to Zoom to area of interest

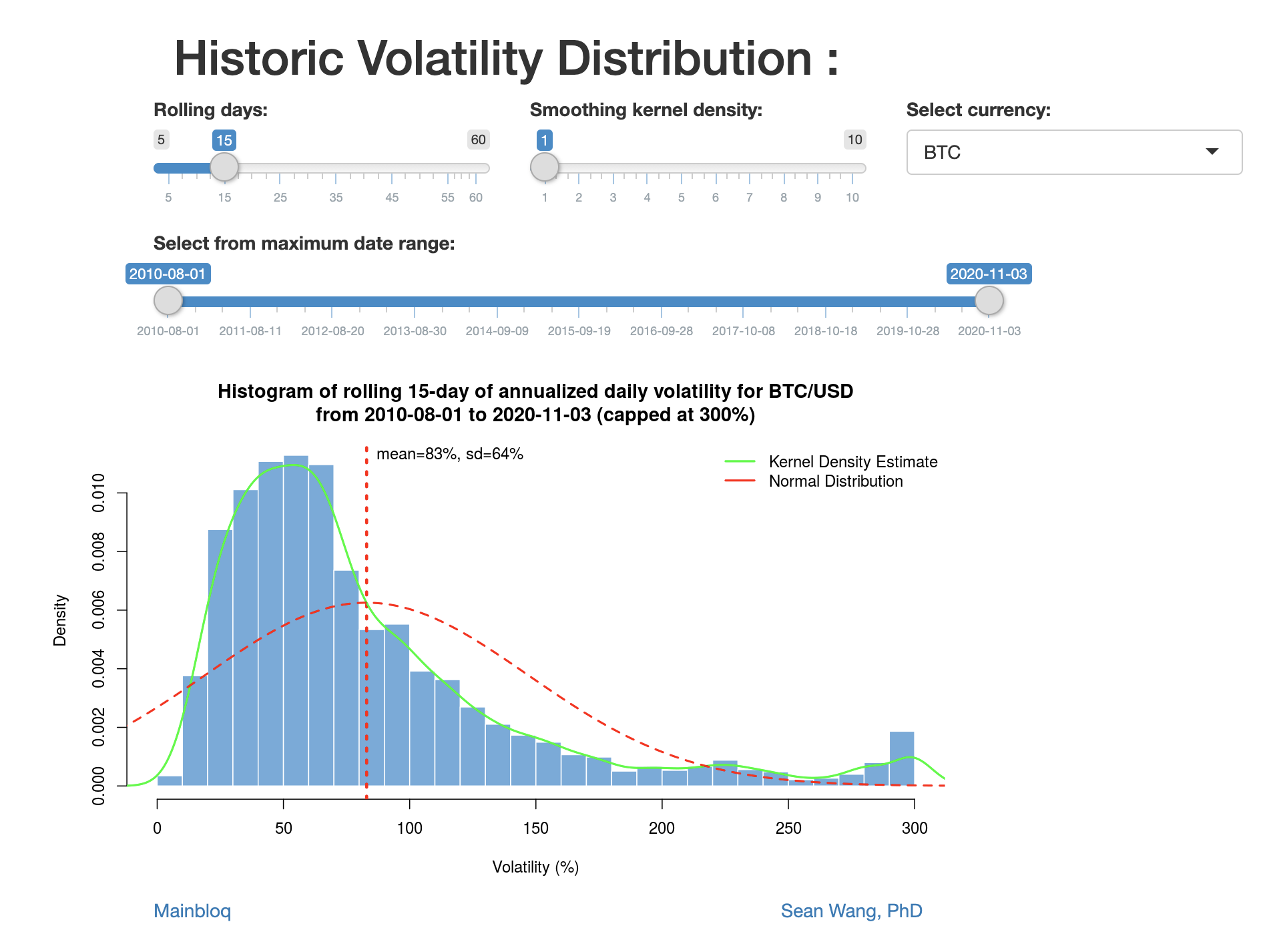

Volatility Distribution

With this chart you can explore how volatility is distributed. We take the daily historical volatility distribution, compared with Kernel density and the normal distribution.

How to use it:

Slide the time window to see how volatility has been decreasing over the years, in crypto.

Volatility by hour

With this chart you can explore the volatility of an asset by hour in the day.

Time is based on UTC (London) and it looks at last 10 weeks of data (more data is available with subscription)

How to use it:

Red line = mean

Box top/bottom = 1 standard deviation

Tails = 2 standard deviations

Dots = outliers (capped at 300%)

MAINBLOQ Integrates with BEQUANT

BEQUANT and MAINBLOQ have announced a partnership and have both made a serious commitment to building out the technology layer for the emerging digital asset space. As institutions have taken a closer look at the space both companies have been busy building the technology. This includes MAINBLOQ’s Smart Order Router and suite of algorithms and BEQUANT’s Prime Brokerage and Bequant Solutions units.

“We’ve said this before and we’ll say this again, we believe that institutions will be the foundation of Cryptocurrency trading. That is why we’re pleased to announce our partnership with BEQUANT,” says Ryan Kuiken, CEO of MAINBLOQ, “BEQUANT has a similar outlook on the future of the market and this strategic partnership is important to us.”

BEQUANT’s services will provide an unprecedented level of digital asset integration for the financial services industry, from trading terminals, cross-border compliance, matching engines to deep liquidity and tokenization. Combined with MAINBLOQ’s solutions, the market will see a robust and global suite of digital asset opportunities.

“We are incredibly happy to be partnering with MAINBLOQ and are fully committed to delivering industry focused products together,” adds George Zarya, BEQUANT CEO.

MAINBLOQ is currently integrated to 31 of the top cryptocurrency venues and with the addition of BeQuant offers its clients another source of liquidity. Clients can connect to MAINBLOQ via WebSockets, REST and FIX 4.4 & 5.0 where available.

About MAINBLOQ

MAINBLOQ is a research and fintech company focusing on digital assets. MAINBLOQ offers a modular platform including a smart order router, suite of execution algorithms, FIX gateway and consulting services to help clients execute on their trading strategies. MAINBLOQ is building the best-in-class platform for trading digital assets, For more information visit https://MAINBLOQ.io/

About BEQUANT

BEQUANT is a one stop solution for professional digital-assets investors and institutions. Our breadth of products include prime brokerage, custody, fund administration enhanced by an institutional trading platform providing low-latency, liquidity and direct market access.

BEQUANT is dedicated to providing solutions that create market efficiencies by reducing friction while delivering exceptional client services.

The BEQUANT team is comprised of experts from institutional, retail and digital financial services with experience in banking, derivatives, electronic trading and prime brokerage.

Announcing our 30th Exchange Integration: Bithumb Korea

We’ve been busy over the last few months connecting dozens of venues to Mainbloq. We’re thrilled to announce that with the addition of Bithumb Korea we are now connected with 30 exchanges. While we are thrilled with this accomplishment, we don’t see this as an endpoint. We have more exchanges currently in development to continue our goal of connecting the world’s pools of digital asset liquidity.

At Mainbloq our vision has always been to bring the technology available on the street side to the cryptocurrency market. This means seamless liquidity through our smart order router and sophisticated algorithms that can be executed across all of the thirty exchanges—and growing—that Mainbloq is connected to.

“We’re thrilled at the response we’ve seen from our partners—institutions, hedge funds, EMS and PMS providers, etc—” said Ryan Kuiken, CEO of Mainbloq, “and we know we’re still in early days. We have a long roadmap on our horizon to bring the best in class technology to the industry”.

Want to learn more? We love to talk. Go to our contact page and share your information. We’ll be in touch soon. https://mainbloq.io/contact/

Announcement: We've Integrated with LGO

When we built Mainbloq we did it with one thing in mind—bringing all of the technology that was available on Wall Street to cryptocurrency traders. Over the years, what it means to be a crypto trader has changed and we've seen more institutions adding crypto to their portfolios, which is why we're happy to announce that we're the first trading platform to integrate with LGO Group.

As the leading institutional bitcoin exchange in Europe, LGO is uniquely positioned to address this nascent, growing market. The fully electronic LGO platform allows over 40 institutions from all around the world to trade bitcoin with a level of transparency, security and client service which is uncompared in the space.

"We believe institutions will play an outsized role in the future of Cryptocurrency trading, and our partnership with LGO is an important step forward in that future," says Ryan Kuiken, CEO of Mainbloq.

Mainbloq is currently connected to 27 of the top cryptocurrency venues and with the addition of LGO now offers its clients one more place to source liquidity. Mainbloq offers WebSockets, REST and FIX 4.4 connectivity to all supported venues.

"We were impressed by Mainbloq's technology. Our visions for the future of cryptocurrency are aligned and we believe that this partnership will be mutually beneficial," said Hugo Renaudin, CEO of LGO.

Bakkt acquired Digital Asset Custody Company and partners with BNY Mellon on key storage

Source: CoinDesk

Pending bitcoin futures exchange Bakkt has acquired the Digital Asset Custody Company (DACC), secured insurance for assets it will hold in cold storage and revealed a partnership with BNY Mellon.

Adam White, the former Coinbase executive turned Bakkt COO, wrote in a blog post Monday that it acquired DACC to continue developing a secure digital asset storage solution. DACC’s team “share [Bakkt’s] security-first mindset,” he wrote, while also bringing experience in building its own secure and scalable custody solutions.

White hinted that the acquisition may also help Bakkt add cryptocurrencies beyond bitcoin sometime after launch, writing:

“As we look to scale and support custody of additional digital assets, DACC’s native support of 13 blockchains and 100+ assets will serve as an important accelerator, and we’re pleased to welcome Matthew Johnson, Adam Healy, and the entire...

The SEC Temporarily Suspended Trading in Bitcoin Generation Miner’s Shares

Author: Nikhilesh De / Source: CoinDesk

The U.S. Securities and Exchange Commission (SEC) is temporarily suspending trading of shares in a little-known, self-described crypto exchange and mining firm called Bitcoin Generation (BTGN).

The regulator announced Monday that it was suspending trading until 11:59 P.M. Eastern Daylight Time on May 10, 2019 (or 03:59 UTC May 11) due to concerns that some information BTGN has made public may be inaccurate.

Specifically, the SEC is concerned about a bond that BTGN “purportedly acquired from an entity based in the United Kingdom”; how much BTGN stock is outstanding; promotional activity related to BTGN; and the “accuracy and adequacy...

Huobi Cloud Aims for 80 More Exchange Partners

Author: Leigh Cuen / Source: CoinDesk

Singapore-based exchange conglomerate Huobi Group has a unique growth strategy for emerging markets: partner with local entities and then split the profits 50/50.

Revealed exclusively to CoinDesk, the South African exchange HIZA will launch in May and join a cohort of 150 platforms under the Huobi Cloud umbrella, according to Huobi Group’s senior business director David Chen.

“We will help them get their trading volume up and we’ll expand our business when the market is more mature,” Chen said, adding that up to 80 like-minded partnerships are currently in the pipeline.

Recent expansion isn’t unique to Huobi, however. Global exchange giants like Binance are opening independent subsidiaries in emerging markets like Uganda, or investing in local exchanges the way Bittrex did with the South African exchange VALR. Similar to Bittrex, Huobi Group offers partners like HIZA access to its global order books for prime liquidity.

Interestingly, the partnership approach allows Huobi to minimize the regulatory risks of working in under-developed markets – where banking relationships require local knowledge and repercussions for unintentional missteps remain uncertain.

“They [HIZA] own their customer data, it’s not Huobi that owns it, otherwise it would be Huobi’s responsibility,” Chen said.

He added that Huobi Group has earned $1.5 million in net profit since October 2018 from Cloud partnerships that have already gone live. One such...

Are Stiffer Bitcoin Regulations Brexit’s Surprising Side-Effect

Author: Mark Emem / Source: CCN

By CCN: The prolonged process for withdrawing from the European Union may have resulted in great uncertainty, but the UK’s financial watchdog is sure about what it wants post-Brexit – more muscle to oversee bitcoin and the crypto industry at large.

According to the Financial Conduct Authority’s business plan for 2019/2020, the regulator will urge Her Majesty’s Treasury to boost its enforcement powers in the crypto sector ahead of Brexit. Per FCA’s chief executive, Andrew Bailey, UK’s EU withdrawal is the body’s most pressing and urgent challenge.

Andrew Bailey on our Business Plan 2019/20 https://t.co/4Juptx0QcY pic.twitter.com/d5guGsyJtV

— FCA (@TheFCA) April 17, 2019

The financial watchdog intends to first hold public consultation first, though, before its enforcement powers can be increased:

“Following our consultation on cryptoassets we will publish a Feedback Statement and finalised Perimeter Guidance. We will also provide technical advice to the Treasury on extending the perimeter for utility and exchange tokens and on extending our financial crime provisions to certain activities related to cryptoassets.”