Walmart Looks to Blockchain for Package Tracking Patent

Walmart continues to develop blockchain applications to optimize the retail industry.

Author: Madeline Meng Shi / Source: CoinDesk

Walmart has yet another delivery-focused blockchain patent in the works.

The application published on July 5 is entitled "Delivery Reservation Apparatus and Method," and as suggested, it outlines a way for managing package reservations in the context of the purchaser not being available to actually receive it.

It's the latest blockchain retail supply chain "smart delivery" intellectual property play from the retail giant, which in the past year has submitted a number of U.S. patent applications in this area. Indeed, the company seems to be looking at the technology as a way to automate elements of the delivery process, but to date, much of the company's public-facing work with blockchain has been focused on food supply chain tracking.

In the newly released filing, Walmart detail system of delivery lockers – located at a person's home, transportation hub or other location – that can safeguard the delivered items until their recipients can come and actually sign for them. Blockchain fits into...

Google Co-Founder Billionaire Sergey Brin is an Ethereum Miner

How cool is THAT! hmmmm whats he really up too?

Author: Ethereum News / Source: CCN

Sergey Brin, President of Google’s parent company Alphabet Inc., appeared on the panel on emerging technologies at the ongoing Blockchain Summit in Morroco.

At his last-minute surprise appearance at the summit, Brin revealed that he is mining Ethereum with his 10-year old son. He also stated that the concept of zero-knowledge proofs is “really mind-boggling”.

Zero-knowledge proof is a cryptography principle which enables to prove something without actually revealing the knowledge. This technology is utilized by cryptocurrencies such as ZCash to enable privacy features where users can conceal the transaction information while still securing the network on a public ledger.

The panel also consisted of Elizabeth Stark, co-founder and CEO of Lightning Labs, and Neha Narula, director of the Digital Currency Initiative at MIT Media Lab. Elizabeth Stark spoke about the lightning network and security of centralized exchanges.

“Lightning enables people to transact at a high volume using the...

Facebook Ads Relaxes Ban on Cryptocurrency Advertising

Big news on the social media marketing front for cryptocurrency advertising

Author: Muyao Shen / Source: CoinDesk

Facebook is easing its ban – sort of – on ads related to cryptocurrency.

The social media giant has launched a "cryptocurrency products and services onboarding request" form that will allow some companies to get their ads on the platform, according to a blog post published Tuesday.

Facebook, however, won't allow advertisements for initial coin offerings or binary options. The prohibition on these remains in effect months after Facebook first took action against crypto-ads in a move that was followed by similar actions by Twitter, Google and other major sites.

The request sheet shows that the social media company wants specifics on the kinds of services companies wishing to advertise offer. For example, Facebook asks whether companies have the relevant licenses in order to operate, or if they are a publicly-listed company. Facebook has also...

A Modest Blockchain Proposal: Reshape Advertising with Varanida's Token Sale

Building a better Internet through a decentralized advertising and content solution.

Blockchain innovator Varanida plans to do nothing less than change the nature of internet advertising. Advertising has long supported the internet, keeping much of it free to users. But with privacy and phishing concerns on the rise, and with the broader and even more dangerous perception that the internet has been hijacked by profit-obsessed click baiters, link farmers, etc., to the detriment of the old dream that ‘information wants to be free,’ it has become clear that internet advertising will have to change.

The goal of Varanida is to get out in front of and mold that change.

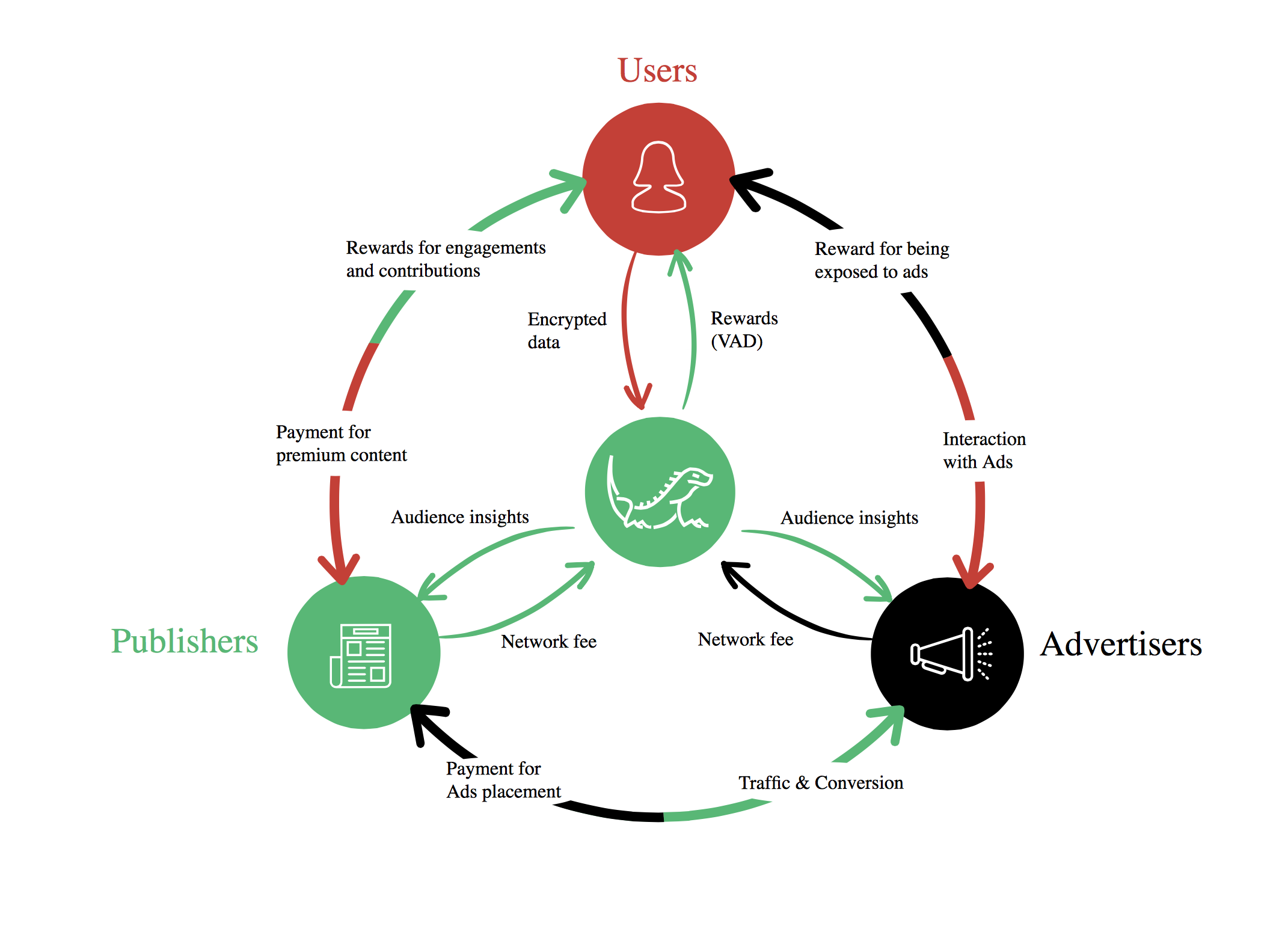

In broadest terms, the idea is to produce a world in which internet users see the advertising they want to see, given their ability to earn VAD tokens by watching it. So the users win. Also, publishers win by paying a fair value price for their advertising and preserving their engagement with their audience. And the advertisers win, getting a fair and transparent advertising network.

The key to achieving this: blockchain technology. As the white paper says, the Varanida Blockchain will deploy “a crowdsourced advertising validation through the validation by users of the quality of the advertising.” This will be a fraud-proof system, allowing for trust within the triangle of advertisers, publishers, and users.

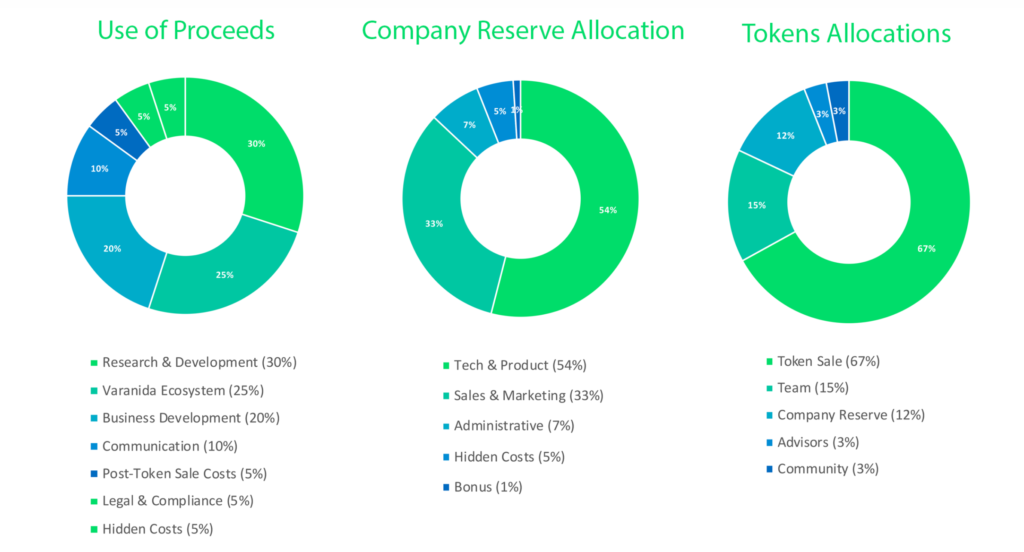

Varanida issued its token sales announcement on June 27.

On that day, Round 1, an invite-only round, began. The minimum contribution for this round is 3 BTC, or 30 ETH, and 30.15% of the new tokens, VAD, will be sold during this round.

Round 2 is slated to begin on August 15 (unless the maximum amount for Round 1 is hit before then). This will be open to the public, subject to know-your-customer restrictions.

The project’s mother company, Varanida SAS, is headquartered in Lyon, France. One of its early investors and strategic advisors is Joel Comm, the bestselling author of The AdSense Code (2006) and Twitter Power (2009).

CoolBitX's CoolWallet S Hardware Wallet (Review)

CoolBitX's next generation CoolWallet S is a credit-card-like hardware wallet for storing Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH), and select ERC20 tokens — but just how “cool” is it? Let’s find out!

Author: Adam James / Source: Bitcoinist.com

Wallet Design

First and foremost, let’s get one thing straight — you’re not going to find a ‘cooler’ looking hardware wallet anywhere on the market today.

Coming packaged in a black and gold box that looks fit to hold a luxury watch — with a personal message from CEO Michael Ou printed in gold lettering on the inside cover — the CoolWallet S offers a distinctively premium feel from the moment one unpacks it.

The package itself contains a charging dock and accompanying USB connector, a user manual, a nice-looking recovery card for handwriting your unique seed phrase, a black-on-transparent logo sticker, and — of course — the CoolWallet S, itself. And what a wallet it is!

The CoolWallet S resembles a credit card from the exterior and boasts a slick and classy-looking black and gold design which holds itself back from appearing flashy — opting instead for an understated, business-like vibe.

The back of the card has little more than a discrete serial number printed on the top, just above an appealing E-Paper display. Halfway down the right side of the card is a single button for powering on the device, changing the displayed cryptocurrency, and confirming commands. The bottom of the device features more discrete text beneath two charging pins. The button on the unit I reviewed had a response click requiring a concerted press.

The card itself is waterproof, tamper-proof, impact resistant, and heat/cold resistant — though, to be fair, I wouldn’t recommend testing these claims. The card features an acceptable amount of flex, though I would also caution against seeing how far it can fold. Still, it can easily slip into a normal pocket wallet with your IDs and credit cards,...

Working for a “Big Company” Can Be Fun, If . . .

Big companies don’t innovate fast enough.

Big companies tend to build a “kill-zone” around themselves. They destroy everything and everyone that gets too close.

There is no joy in working for a big company. More personal fulfilment can be found in a startup or other younger and smaller organization.

Author: Erik P.M. Vermeulen / Source: Hacker Noon

I come across these statements a lot in the media (old and new) recently. Many of my co-workers and students appear to agree.

Of course, there is something to these ideas. The pace and range of digital innovations as well as shorter innovation cycles make it much more difficult for bigger companies to survive. This sort of pressure is not going to deliver a stable and fulfilling work environment. And this trend seems set to continue in the future, making working for (and with) big companies even less attractive.

But there is a flip side and we shouldn’t dismiss corporate giants too quickly. Working for (as an employee) or with big companies (as a startup or research institution) can be exciting, rewarding, and inspiring. It may even be the best and only way to build a career or have an impact with your startup.

However, this will all depend on whether that big company is operating as an “intelligent platform.”

What is an “Intelligent Platform”?

When I use the term “Intelligent Platform”, people immediately assume that I am talking about companies that operate a “social” platform (Facebook, Instagram), an “exchange” platform (Amazon, Airbnb), a “content” platform (YouTube, Medium), a “software” platform (GE’s Predix, Microsoft’s GitHub), or even a “blockchain” platform (Ethereum, EOS).

This is not surprising. After all, the emergence of these new platforms and services has been one of the major economic developments of the last two decades.

But we should recognize that there is so much more to “platform companies” than facilitating transactions, exchanging information, or connecting people. There is a much more important lesson to be learned from the success of such companies.

What platform companies all have in common is that they empower and facilitate experimentation, collaboration, and co-creation amongst multiple groups of stakeholders.

These stakeholders include employees and investors, but also consumers, developers, content creators, other companies (both large and small), non-profits, educational institutions, governments, etc.

What makes an “intelligent platform” special is that it uses stakeholders’ input and feedback to improve the user experience and engagement with the “platform” and its products, services, and other solutions. This is the real lesson to be taken from the success of Amazon, Facebook, Netflix,etc.

Crucially, digital technologies are central to this approach. In this sense, all companies that wish to operate as intelligent platforms need to think and act “as if” they are a tech company.

As such, intelligent platforms are built around the idea of delivering constant innovation via an open and inclusive process of co-creation. By “organizing-for-innovation” in this way, such platforms are radically different from the clearly defined, static roles and fixed hierarchies of traditional organizations.

These are the distinctive features of “intelligent platforms”, and this is why, in an age of hyper-competitive global markets, every company needs to re-invent itself as an “intelligent platform.”

But more than that, everyone needs to ask themselves:

Is my (current or prospective) employer organized as an intelligent platform?

And why does this matter so much? Because only “intelligent platforms” can deliver the kind of environment conducive to a meaningful, fulfilling, and fun experience. Working for a big company can be fun, but only if it is organized as an intelligent platform.

So, how can we tell whether a company is organized in this way?

The 4 “Ingredients” of Intelligent Platforms

It should be noted that there is no “one-size-fits-all” model for such platforms.

Intelligent platforms can take multiple forms ranging from slightly “tweaked” versions of traditional (hierarchical and closed) companies through to the (flat and open) blockchain-based “decentralized autonomous organizations.” The “best” approach depends on the individualized circumstances of a particular business or organization.

The structure and organization of an intelligent platform does depend on four crucial “ingredients.” Every company has to analyze and use these ingredients to find the unique recipe for its “platform” to maximize creativity and opportunities for innovation.

And every employee needs to understand these ingredients in order to find an organization that works for them.

1 — Technology

It could be argued that intelligent platforms aren’t new. Some form of platforms has always been around. The exponential growth of technology, however, has significantly accelerated the emergence, possibilities, and opportunities of platforms.

For instance, Airbnb or Amazon rely...

ICO & Token Generation Audience Development Marketing

Source oneQube by Peter Bordes

360-degree audience development and marketing strategies are mission critical to get your brand above the noise as blockchain proliferation accelerates, and the number of companies looking to launch ICO's and Tokens grows exponentially.

Blockchain companies need customized, multifaceted programs, and the ability to execute simultaneously across all organic and paid channels in order to compete effectively for market share. We have developed a proprietary data-driven audience automation software stack for ICO and token generation event (TGE) marketing, and a team of audience architect specialists who are obsessed with developing powerful highly engaged audiences for our partners. Not just for their launch, but for the full life cycle from ICO/TGE launch to post-event to build brand awareness, platform adoption and visibility in their cryptocurrency and token markets.

The cryptocurrency space is becoming exponentially more competitive. In order to have a successful token launch, projects have to communicate their value proposition and connect to relevant audiences at scale. Having a technology partner that has the necessary tools and ability to identify, communicate and engage with token buyers significantly impacts our partner's ability to deliver their message at the right time, right place and right method to their target market.

Launch a Successful ICO / TGE by leveraging our Audience Development and Engagement Platform

The blockchain space is in its nascent days and many of the marketing tactics deployed in other industries are not effective. The use of antiquated siloed mass marketing tactics are ineffective compared to the hub and spoke ecosystem approach developed by oneQube. For instance, when looking at any given ICO / TGE, a company cannot expect to effectively rank their keywords in a timely enough fashion to achieve the desired result. If they are not leveraging and syncing all channels simultaneously to accelerate their keyword ranking trajectory.

OneQube focuses on driving direct and measurable results for our partners. We use a combination of Organic Audience Development, Paid Social Media, Organic Community Management, Email Nurturing, Community Activation, Content and Social Amplification to drive interested parties to their website to learn more about their project and drive conversions.

Establishing trust and credibility within your community and potential users of the platform is key to a successful token generation event. Together with our clients, we put great effort into building trust with the audience. Creating a highly engaged passionate audience, and enabling our partners to harness the powerful collective network effect of that audience.

We leverage our network of thought leaders and add additional exposure through networking our partners with advisors and business development relationships to help our customers build their business, increase their visibility, reach their target token buyers and successfully convey their message.

oneQube ensures our clients build the reputation and awareness for their token to have the most successful project launch. As well as developing and executing a post-event marketing strategy to build their business and cryptocurrency markets.

The Regulatory System(S) And Cryptocurrencies

Source oneQube by Christopher Faille

Edmund Mokhtarian and Alexander Lindgren have written a fascinating discussion of “operational issues and best practices” for cryptocurrency traders. As part of this broader discussion, they have provocative things to say about the regulatory system in the U.S. and about where, if anywhere, bitcoins and other cryptocurrencies fit into it.

The regulatory system in the United States is both fragmented and functional. There is no single administrative body whose job it is to oversee the capital markets as a whole, working toward efficiency on the one hand and working against fraud on the other. Instead, there are several agencies involved in this task or these tasks, the most important of which (the Commodity Futures Trading Commission and the Securities and Exchange Commission) are distinguished from each other by the sort of investment vehicle they oversee. As the names suggest, the CFTC oversees commodities trading, the SEC securities trading.

The fragmentation is “functional” in character in that the distinction is defined by the function the two types of instrument perform. Commodities and securities have much in common. They are both traded on markets, they are both quite liquid, and they both serve both profit seekers and risk hedgers. But what distinguishes them? Seventy years ago the Supreme Court gave the following ffunction definition if a security: it is an instrument by which “a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.”

The Function of a Security

By design, that definition is very broad, in order to make it difficult for security fraudsters to escape responsibility by saying that they aren’t really securities fraudsters. The function of a security, whether called a stock or bond or something else, is to allow an investor to gain exposure to the gains of an enterprise (commonly a listed corporation) without making any further ‘effort’ other than the infusion of the money itself.

Indian State to Use Blockchain to Streamline Food Supply

Blockchain technology is starting to gain ground by being used to address critical global issues such as food supply, fraud, and finance.

Author: Stefan Filipović / Source: thetokener.com

The world is slowly starting to realize the immense potential of the blockchain technology. The latest implementations are taking place in the field of finance, but this is just a tip of an iceberg. The huge power of blockchain lies in the fact that it could bring much more effective administrative outlook. By cutting out the middleman, time and resources could be much better used in order to create a better administrative environment for the people.

Kerala to implement blockchain to streamline supply

One of the most recent decisions regarding blockchain comes from the Indian state of Kerala. As Business Standard reports Kerala’s government has decided to apply the strategy to leverage blockchain tech in order to streamline distribution network and purchase of food supplies.

Supervision and implementation of the project will go through Kerala Development and Innovation Strategic Council (K-DISC). Every product will be registered on the newly created network. This will ensure that the information about manufacturer, origin, quality, and movement of the product are easy to find. Also, blockchain will do one of its main purposes in cutting out the middleman. This will be done in the field crop loss where...

The Rise of Cryptocurrencies Securities Lawsuits

Source: Bitcoin Magazine

OPINION

As the cryptocurrency market develops and grows, cryptocurrencies have become the subject of an increasing number of securities lawsuits. This year alone, more than 10 cryptocurrency securities lawsuits have been filed in federal district courts throughout the country.

While regulations and laws governing the cryptocurrency market continue to develop, recent activity involving cryptocurrency has raised a host of questions concerning investor protections. As federal and state regulators and policymakers grapple with how to regulate digital currencies, some investors have sought protection through securities lawsuits.

Based on the number of lawsuits filed to date and the recent decline in the price of cryptocurrencies, such litigation will likely increase in volume in the coming year. Investors should be aware of recent cryptocurrency case law to safeguard their rights and preserve their legal remedies. A selection of recent securities lawsuits against five cryptocurrency companies is highlighted below to illustrate some of the typical cases in which investors have found reason to pursue legal action against cryptocurrency companies.

Longfin Corp., a global cryptocurrency company, was a “pure stock scheme.” On April 9 and April 19, 2018, two classes of investors sued Longfin and its top officers for allegedly violating Sections 10(b) and 20(a) of the Securities Exchange Act. The investors allege that Longfin misrepresented the location of its primary offices and the identity of key employees in its public statements; had numerous material weaknesses in its operations and internal financial reporting controls; and was ineligible for inclusion in certain stock indices.

The investors allege that when this information was made public, Longfin’s stock value declined more than 86 percent in two weeks. The investors are attempting to recover damages associated with the decline in stock value.

Takeaway: This case is an example of a cryptocurrency company’s shares plummeting after company executives disclosed financial information to the public. Prospective investors should be wary of giving too much credibility to unsubstantiated statements made by cryptocurrency companies and should be selective when determining the trustworthiness of sources.

Nano: Danger of Foreign Exchanges and Hacks

Nano, a U.S.-based blockchain developer and cryptocurrency issuer, was involved in a hack scandal. On April 6, 2018, a class action was filed against Nano and its key officials for allegedly violating federal securities laws.

The complaint alleges that Nano engaged in an unregistered offering and sale of securities by issuing cryptocurrencies on BitGrail, an Italian cryptocurrency exchange, in violation of Sections 12(a) and 15(a) of the Securities Act. The complaint also alleges that Nano wrongly encouraged investors to invest assets with BitGrail, which lost $170 million worth of the cryptocurrency “XRB” due to a hack on the exchange platform. The investors are asking for, among other relief, rescission of their investments.

Takeaway: This case is noteworthy because it illustrates the vulnerabilities of cryptocurrency exchanges and their susceptibility to theft. To protect cryptocurrency investments from possible hacks and cyber theft, investors should take a number of precautionary measures, including closely examining where funds are being held and inquiring about the security controls in place to prevent potential hacks.

Giga Watt: Mismanagement Allegations

Giga Watt, a U.S.-based cryptocurrency startup, was a promising venture that was arguably mismanaged by its founder. On , an investor sued Giga...