Zambia cracks down on crypto companies

Source: Bitcoin News

The Bank of Zambia has started to clamp down on cryptocurrency-related businesses, mere days after declaring that it does not view digital coins such as BTC as legal tender. The crackdown began on Oct. 14, when the central bank announced an investigation into Heritagecoin Resources Ltd. for allegedly laundering money, according to local media reports.

Also read: Zambian Central Bank Declares Bitcoin is Not Legal Tender

Bank of Zambia Probes

Heritagecoin’s Deposits Business

In addition to the ongoing probe, the Lusaka-based fintech startup faces allegations that it has taken on traditional banking activities, such as accepting deposits — something it is not certified to do.

“The company … has since been offering financial services and collecting deposits from members of the public,” Kamufinsa Manchishi, a spokesperson for the Zambian Drug Enforcement Commission, told the Lusaka Times. The organization, which is assisting with the investigation into Heritagecoin, did not reveal the amount of money involved.

Manchishi added that: “As such, the commission together with the Bank of Zambia (BoZ) are currently investigating the company for activities contrary to the Prohibition and Prevention of Money Laundering, as well as the Banking and Financial Services Acts.”

On Friday, the BoZ declared that cryptocurrencies such as BTC are not legal tender, warning that those conducting transactions in the cryptocurrency would have nobody to turn to or blame in the event of market failure. However, it appears that the bank issued the decree solely because it wants to promote its depreciating fiat currency, the kwacha.

That said, the central bank has neither the power nor the legal backing to shut down the nascent Zambian cryptocurrency market. The BoZ would need parliament to amend the law that enabled its own establishment for it to be able to claim any authority over cryptocurrency investments or trading.

Nonetheless, the BoZ does have full control of the banking sector within which Heritagecoin...

Switzerland's cryptocurrency regulations and standards

Source: Crush Crypto

Switzerland, according to its Federal Council report, classifies cryptocurrency as a "digital representation of a value which can be traded on the Internet but not accepted as legal tender anywhere”. Therefore, Switzerland regards cryptocurrency as assets (property), and cryptocurrency and related exchanges are legal in Switzerland, subject to regulations.

There are currently no cryptocurrency-specific regulations in relation to trading and offering in Switzerland, but cryptocurrency remains subjected to relevant existing regulations such as tax, money laundering and securities regulation.

Recognizing the barriers of the existing regulatory framework to new financial technology such as cryptocurrency, regulatory amendments were made by the Switzerland government to create “regulatory sandbox” in support of the development of such technology.

Overall, Switzerland is one of the countries that adopts a progressive approach towards cryptocurrency and its blockchain technology, and has relaxed its regulatory framework to balance the technological development and protection of the public from the associated risks.

Securities in Switzerland is governed by the Swiss Financial Market Supervisory Authority (“FINMA”) under the Financial Market Infrastructure Act (“FMIA”).

FMIA defines securities as “standardised certificated or uncertificated securities, derivatives and intermediated securities which are suitable for mass standardised trading, meaning they are publicly offered for sale to more than 20 investors".

Essentially, assets that represent debt or equity claim on the issuer with investment purposes are securities. Accordingly, whether a cryptocurrency is deemed as securities depends on its categorization as a Payment Token, Utility Token, or Asset Token as per guidelines published by FINMA:

- Payment Tokens are tokens which are intended to be used, now or in the future, as a means of payment for acquiring goods or services or as a means of money or value transfer. Payment Tokens give rise to no claims on their issuer. Examples include Bitcoin and Ether which FINMA does not perceive as securities.

- Utility Tokens are tokens which sole purpose is intended to provide access digitally to an application or service by means of a blockchain-based...

DZ Bank Germany Ripple blockchain integration underway

Author: Ali Qamar / Source: Global Coin Report

READ LATER - DOWNLOAD THIS POST AS PDF

The online world of business is undeniably changing. But, have we seen its full extent yet? Perhaps the answer lies with the blockchain technology. Some studies point out that with blockchain (like Ripple, and of course, other similar ones like Stellar or the ones that might come to the party) integration by the banks, they will be able to realize significant savings.

The banks will enjoy cost reductions not only in their payment processing as well as reconciliation alongside compliance and treasury operations.

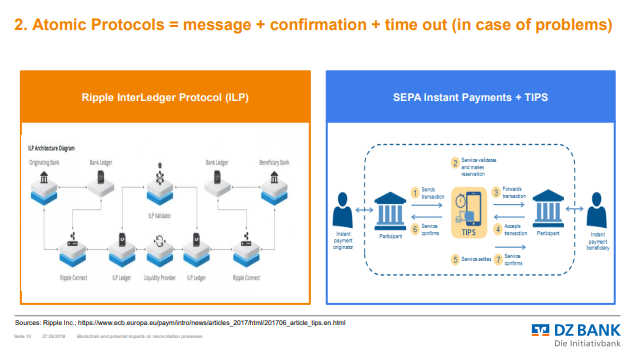

DZ Bank AG Considering Ripple Interledger Protocol

DZ Bank is one of the most talked after bank in Germany. It is the second largest bank in the country by asset size as well as the central institution. The bank functions as both a central institution as well as corporate and investment bank.

Concerning potential Ripple Interledger protocol integration, the bank has listed a couple of slides in their recent report “blockchain(s) and potential impacts on reconciliation.” It is not rocket science to what that may mean just because the protocol is all about cross-border transactions.

"…..we are very confident that Germany will move as well ahead with #ripple"

see full clip from @BankXRP https://t.co/SWJ5NnouwT#xrp #ripplenet #ripplenews #xrpcommmunity #xRapid #xrpthestandard #xrparmy pic.twitter.com/sWJQd4MNvs

— ????????????????????????????????????????⚡???????? (@stuart_xrp) October 12, 2018

If at all it means DZ is considering to welcome Ripple Interledger protocol to their platform, it won’t do anything different but probably a smile to the bank users and...

Cryptocurrency Exchange OKEx Simultaneously Lists 4 Stablecoins

Author: Helen Partz / Source: Cointelegraph

The third top crypto exchange by market cap, OKEx, has recently announced the listings of four stablecoins at once, according to an official blog post published on Monday, Oct. 15.

OKEx has added support for four stablecoins, including TrueUSD (TUSD), USD Coin (USDC), Gemini Dollar (GUSD), and Paxos Standard Token (PAX). According to the schedule mentioned in the statement, the stablecoins have become available for deposits today, at 05:00 PM on Hong Kong Time (HKG), with a number of crypto trading pairs. Withdrawal will be available starting tomorrow, Oct.16.

TrueUSD is the second stablecoin that has been introduced following the launch of controversial stablecoin Tether (USDT), which is backed by the U.S. dollar on a 1:1 proportion. Both listed on major cryptocurrency exchanges like Binance, Bitfinex, OKEx, Huobi and HitBTC, the stablecoins are deployed on the Omni and Ethereum blockchain networks.

Based on tokenization platform TrustToken, TrueUSD has been touted as “world’s first legally backed stablecoin,” and went...

Bitcoin Price Analysis: #BTC/USD Goes Haywire with USDT Decline

Source: CCN

Bitcoin on Monday pursued a fake upside action across several exchanges, mainly BitFinex, after stablecoin Tether (USDT) started falling.

The BTC/USD responded to the upside action witnessed in the BTC/USDT market. USDT traders started exiting their positions amidst growing concerns about BitFinex’s insolvency and its impact on the coin’s liquidity. The more traders swapped USDT for other coins, the larger it dropped, eventually founding support near 85 cents. By that time, Bitcoin had established its upside just shy of $8,000 on BitFinex only – so as other top coins which recorded massive gains.

So far, Bitcoin has corrected towards $6,346. But indeed, the latest price action has messed up the technical outlook.

BTC/USD Technical Analysis

The Coinbase chart indicates that BTC/USD is struggling to find support near its 50H moving average for a potential reversal. If it drops below the pink curve, the pair will enter into a near-term bearish bias, which is further supported by the RSI indicator, which is on the verge of inflection, and the Stochastic oscillator which could continue its drop into...

Bitcoin's block size can be increased without a hard fork

Author: Helen Partz / Source: Cointelegraph

Bitcoin (BTC) protocol developer Mark Friedenbach introduced a method for Bitcoin scaling he claims will not require a hard fork at a workshop in Tokyo October 5.

The new concept presented at the Scaling Bitcoin workshop, entitled “Forward Blocks,” suggests a major on-chain capacity boost by means of a Proof-of-Work (PoW) alternation that is done as a soft fork, combined with use of alternative private ledgers.

The proposal describes a method for scaling that claims to be able to increase “settlement transaction volume to 3584x current levels” and improve censorship resistance via sharding.

During the presentation, Friedenbach suggested major improvements for on-chain Bitcoin transactions, or those that appear on the Bitcoin blockchain. The so-called “soft-fork” alternation implies a strengthening of consensus rules where old nodes “still see the chain advance.” The research also represents a definition of “forwards compatible soft-fork,” for which non-upgraded nodes still receive and process all transactions.

In his presentation, Friedenbach emphasized the role of sharding...

Crowdholding Connects to Blockchain – Releases Automatic Cryptocurrency Transfers

Source: CCN

This is a paid-for submitted press release. CCN does not endorse, nor is responsible for any material included below and isn’t responsible for any damages or losses connected with any products or services mentioned in the press release. CCN urges readers to conduct their own research with due diligence into the company, product or service mentioned in the press release.

Bitcoin Press Release: Crowdholding announces major updates, including Blockchain synergies to facilitate automatic cryptocurrency transfers.

May 22nd 2018, Prague, Czech Republic – Crowdholding’s platform upgrades and now YUP token payments are on the Ethereum Blockchain. Users can now instantly withdraw tokens earned as a reward for co-creating with businesses. More than 25 blockchain startups, including established ones such as Deep Onion, Intelligent Trading Foundation, and Peculium, award tokens for bounties on Crowdholding.

Ethan Clime, CEO of Crowdholding commented;

“We are on the verge of connecting users and businesses through smart contracts in a trusted and transparent environment, allowing tokens to seamlessly move from our clients to users through the Ethereum blockchain network.”

What is the YUP token?

The YUP token is built on the Ethereum platform and is used to access the Crowdholding ecosystem. Soon users will be able to use YUP to invest, purchase products and services. Businesses invest YUP and other ERC20 tokens to manage ideas and bounty campaigns as well as co-create with the community. As the interests of everyone are aligned, the larger the ecosystem, the more liquid and valuable YUP becomes. In the next few months we aim to grow...