Amazon AWS and ConsenSys-Built Kaleido launches full-stack marketplace

Author: Landon Manning / Source: Bitcoin Magazine

Blockchain software-as-a-service (SAS) project Kaleido has launched a marketplace to provide its users with a “full-stack enterprise platform.”

Their “Blockchain Business Cloud” now features a “new marketplace [of] trusted tools and services from Kaleido, AWS, and members of the new partnership program, all offered as plug-and-play.” The suite of services will feature oracles, wallet and ID services, supply chain tools and even legal contract software.

According to a company statement, “Clients now have access to native AWS integrations, popular services such as HD wallets for privacy and ID registries for organizational identity, as well as industry products such as Chainlink for smart contract oracles, Viant for supply chain management, OpenLaw and Clause.io for real-time legal contracts, and many others—all...

Security tokens from Zurich’s Cryptosummit

Author: Andrea Bianconi / Source: Hacker Noon

One of the key events of the year took place last week in Zurich´s “Crypto Valley”. The Cryptosummit was — for me — both engaging and stimulating because the broad focus and main topic of it was the tokenization of securities, which is where — with Untitled-INC — I am more involved.

Among the high level speakers were ConsenSys Joseph Lubin in video streaming, Charles Hoskinson, CoinDesk´s Michael Casey, VC investor Jalak Jobanputra, Outlier Venture´s Jamie Burke and many other top businesspeople.

Of course, with such a packed agenda and thought-provoking panels running simultaneously on 3 stages, I had to make a choice and follow only those which were — for me at least — the most compelling. Most certainly I have missed interesting stuff, but the following were for me the key “take-aways” from the event.

Charles Hoskinson, formerly Ethereum CEO and currently at Input Output HK, gave me comfort that the global adoption path of crypto is nowadays irreversible. He captivated the audience mentioning his experiences while travelling for crypto projects in lands such as Mongolia where — perhaps not surprisingly — cryptocurrency adoption is progressing at a faster rate than in many western countries. He emphasized that Securities Token Offerings (STOs) will be the key instrument for driving the growth and capital allocation to developing countries. This is the first time in history that developing countries are not constrained in accessing capital for development. And of course this will be a radical shift for those countries which will have the unique opportunity to free themselves from the chokehold of western powers and financial institutions such as the IMF. For the first time in history those countries can now sell tokenized bonds backed up by their commodities and rare earth resources, without the need to sell them out to multinationals in exchange of “peanuts”. The first time in history that they can access a global, decentralized market of investors to fuel their growth. I find this is pretty exciting.

Juwan Lee, founder and CEO of Nexchange, presented interesting datasets to show where crypto investments stand today when compared with the hedge funds in the 90s. Crypto investments stand today where the hedge funds sector stood back in 1997, at the very beginning of its growth phase. Since then the hedge fund sector has grown in volume more than 15 times, going from the early phases, through institutionalization, consolidation and finally to the current maturity phase.

Crypto funds are also still quite minuscule in terms of managed funds. The large majority (approx. 208) have less than US$10m under management. Only the largest funds — approx. 28...

Education ministry of Malaysia builds "University Degree Verification" blockchain

Author: Helen Partz / Source: Cointelegraph

The Ministry of Education (MoE) of Malaysia is establishing a University Consortium to combat degree fraud using blockchain, the ministry announced in a tweet Nov. 8.

According to the ministry’s tweet, the system is designed to issue and verify the authenticity of university-issued degrees. The new government-backed consortium will initially be comprised of six public universities and their diploma-verifying system is set to operate using the NEM (XEM) blockchain. According to the ministry, the new system was developed by a team led by a professor from...

Israel Securities Authority (ISA) turns to blockchain for messaging system cybersecurity

Author: Marie Huillet / Source: Cointelegraph

The Israel Securities Authority (ISA) has started to use blockchain to improve the cybersecurity of its messaging system, online newspaper Times of Israel reports today, October 3.

The government regulator has reportedly embedded the technology into a system dubbed “Yael,” used to deliver messages and other information to entities that fall under ISA oversight.

The ISA has further plans to implement blockchain in two other systems, including an online voting system that enables investors to participate in ISA meetings remotely, and a system called ‘Magna” that stores all the reports filed by ISA-regulated entities. The blockchain solution used by ISA was reportedly developed by IT firm Taldor, according to the Times of Israel.

...

FCC Chairman Aijt Pai addresses blockchain regulations

Author: Ellis / Source: CoinStaker | Bitcoin News

, Aijt Pai, U.S. FCC Chair stated.

Blockchain regulation is one of the major developments going on in the tech industry now. The distributed ledger technology has been touted by many to be the savior to tracking of records, supply chains, voting, retailing, travel and a whole lot more. But for the tech to go fully functional in some places, there have to be ground rules to regulate how the tech can be used or not used.

The government agency that is responsible for the regulation of radio, television, wire, satellite, and cable – the chair of the Federal Communications Commission (FCC) – voiced to the Indian Express that it might be essential to grow the realm of the telecom regulator (FCC) to include the evolving tech.

“So one of the challenges is to figure out how we find a level-playing field that promotes investment and innovations for all these firms without disadvantaging any one of them. The second issue is that these are very dynamic industries and one can foresee in coming decades – things like artificial intelligence, machine learning, blockchain, quantum computing will have significant impact on how communications networks...

Why BCIO Is Not Just Another Utility Token

Source: thetokener.com

2019 will be a decisive year for the Blockchain industry as the world moves towards a friendlier Crypto environment with governments such as Korea, Singapore, and Switzerland paving the way for appropriate regulatory measures. Likewise, France is aiming to become a blockchain hub for entrepreneurs and investors alike, with a 30% flat tax regime possibly in the works. Blockchain.io aims to become the new European cryptocurrency exchange of trust for individual and institutional investors alike. At the center of the Internet of Value, we provide users with an augmented trading experience in a thriving ecosystem.

A new wave and generation of tokens is upon us, and Blockchain.io intends to be a leading player in this field. As such, we have conceived the BCIO token to do just that, and more importantly, we envisioned and conceptualized it as a pipeline to the Internet of Value. For the first time, transactions can be performed without any counterparty risk, which is a crucial advancement as well as a guarantee of safety. This brings us to the essence of CEO Pierre Noizat’s vision of digital assets as a platform for applications, as well as a marketing mechanism.

Proprietary exchange tokens are still fairly uncommon in the cryptosphere, even though a handful of major platforms...

Vitalik Buterin “Ethereum will eventually be able to process $1m transactions per second”

Author: George Nicholson / Source: tokenmarket.net

In a recent OmiseGO AMA session, Ethereum founder Vitalik Buterin announced that soon the Ethereum network would be able to process one million transactions per second, with Sharding and Plasma technology playing a vital role.

This advancement in the scalability issues of blockchain based technologies has been something which Buterin has long discussed. Whilst these decentralized networks have the potential to become a part of the everyday world, they are limited by the capacity of transactions per second.

The Ethereum blockchain at the moment can “processes around 15 transactions per second” Buterin stated in the conversation. Whilst this is far more advanced than the capability of Bitcoin, for example, the capability of Ethereum is far smaller than “PayPal, VISA and the major stock exchanges which go up to about 80,000 transactions per second” according to Buterin.

Whilst Buterin knows too well that the current level of transactions processed by the Ethereum blockchain is high for the platform and industry, he also knows that the scalability of Ethereum has some major issues.

The layer one property improvements that Sharding can address in these scalability issues allows the blockchain to process these transactions a lot...

Populous Post business intelligence - ICO Update

Source: Crush Crypto

- Project name: Populous

- Ticker symbol: PPT

- Market cap*: $129 million

- Circulating supply*: 37,004,027 PPT

- Total supply: 53,252,246 PPT

Populous is a peer-to-peer invoice discounting platform. Their platform uses smart contracts powered by a blockchain ledger to pair invoice sellers and lenders without the need to transact through third parties.

Their vision is to increase funding for small and medium size enterprises (SMEs) while reducing invoice fraud by transacting on a peer-to-peer blockchain platform. Populous uses two tokens to facilitate the lending and exchange of funds on their platform; Pokens and Populous Platform Tokens (PPT).

Pokens are used internally to purchases invoices on the platform, and they are pegged at a rate of 1:1 to whatever local fiat currency for which they are being exchanged. Pokens and PPT are both ERC-20 standard tokens powered by the Ethereum blockchain.

PPT are used as collateral to invest in invoices on the platform. When one lends their PPT, they will receive the profit in Pokens for their lending of capital and their principal PPT investment in return.

Below is a diagram showing how the Populous platform works in a nutshell:

Founded in 2017 and based in London, Populous World Ltd. was founded by Stephen Williams. The project raised over $10.2 million USD in their ICO.

The 2018 year has been volatile for Populous so far. A £1...

DZ Bank Germany Ripple blockchain integration underway

Author: Ali Qamar / Source: Global Coin Report

READ LATER - DOWNLOAD THIS POST AS PDF

The online world of business is undeniably changing. But, have we seen its full extent yet? Perhaps the answer lies with the blockchain technology. Some studies point out that with blockchain (like Ripple, and of course, other similar ones like Stellar or the ones that might come to the party) integration by the banks, they will be able to realize significant savings.

The banks will enjoy cost reductions not only in their payment processing as well as reconciliation alongside compliance and treasury operations.

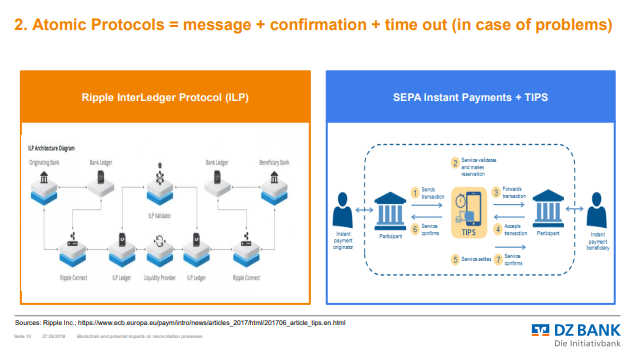

DZ Bank AG Considering Ripple Interledger Protocol

DZ Bank is one of the most talked after bank in Germany. It is the second largest bank in the country by asset size as well as the central institution. The bank functions as both a central institution as well as corporate and investment bank.

Concerning potential Ripple Interledger protocol integration, the bank has listed a couple of slides in their recent report “blockchain(s) and potential impacts on reconciliation.” It is not rocket science to what that may mean just because the protocol is all about cross-border transactions.

"…..we are very confident that Germany will move as well ahead with #ripple"

see full clip from @BankXRP https://t.co/SWJ5NnouwT#xrp #ripplenet #ripplenews #xrpcommmunity #xRapid #xrpthestandard #xrparmy pic.twitter.com/sWJQd4MNvs

— ????????????????????????????????????????⚡???????? (@stuart_xrp) October 12, 2018

If at all it means DZ is considering to welcome Ripple Interledger protocol to their platform, it won’t do anything different but probably a smile to the bank users and...

Zinc CEO on merging ad tech and blockchain technology

Author: Alex Moskov / Source: CoinCentral

Over 30% of the $335 billion projected ad spend in 2020 is estimated to be lost to inefficiencies in the current digital advertising landscape.

With nearly a third of all money that goes into digital advertising getting thrown into the abyss of click farms, click spam, malware, ad stacking, bots, and other wasteful activity, it’s no surprise dozens of entrepreneurs in the space are turning to build businesses around solutions.

Zinc is a blockchain-based advertising protocol looking to crack the code to salvage some of the estimated $100.5 billion that goes to waste.

Zinc incentivizes users to be more engaged with the platform by compensating them with rewards for the ads they watch in the apps they already use. These rewards can be spent to reduce the number of ads they see, as well as accessing premium features and content inside Zinc Protocol partner apps.

Daniel Trachtemberg, the CEO and Founder of Zinc, was previously the Head of Mobile Fraud Prevention and Director of the Mobile Data Management Platform at app monetization company ironSource with over 1.5 billion monthly active users.

How does Zinc differentiate from other similar projects targeting blockchain in advertising, such as Basic Attention Token?

One of the main challenges for all new startups, especially in decentralized ecosystems like blockchain based dApps is distribution: user acquisition & adoption.

BAT is aiming to drive adoption through their web browser – the “Brave” browser. A great product, but getting the users to adopt a new browser and change their habits on that level is quite a challenge. So one key difference is that users who will participate in the Zinc protocol ecosystem will gain more rewards within the apps they already use. Basically, apart from having to install the Zinc wallet app, where users choose what information to share with advertisers, they continue doing everything as they do now, and so does the rest of the industry. Another key difference between Zinc and other projects is that the Zinc Protocol does not aim to cut out the middleman. A lot of projects are claiming that the problem is the middlemen and if advertisers and publishers had a way to work together those problems would be solved, which in concept is a great idea, but in practice we think it’s a bit naive.

It seems that Zinc is focusing efforts into app-based advertising rather than website advertising. Is site-based advertising something Zinc will explore in the future or do you see the future of digital advertising as being app-based?

Web-based advertising is something Zinc will definitely explore in the future. However, it seems the general trend is towards mobile: more and more people spend more time on their mobile phones. Mobile is a segment that’s showing rapid growth and advertisers see the potential, which is evident when you look at the growth of marketing budget spend on mobile each year.

But this growth also fuels inefficiencies and fraud, keeping big brand advertisers away from running mobile campaigns, which, in my opinion, is quite a paradox: as fraud grows in relation to mobile spend growth. So if we eliminate fraud & data inefficiencies, mobile can become even a greater untapped channel – especially for brand advertisers with big budgets.

In addition to fraud, access to quality data is one of the issues faced by advertisers. Can you explain why this is an issue, and how Zinc will provide better data quality to advertisers?

First party, real human-verifiable user data is the most precious asset traded in the advertising ecosystem, I would dare to say even more than actual ad real estate.

Most advertising budgets are dedicated to targeting specific audiences. So if a publisher succeeds in attaching high quality, verifiable user data when selling an ad space, the amount of money he’ll be able to charge is exponentially higher than without this user data – this is key to understanding how Zinc will generate value for all the players in the ecosystem, including the user/consumer.

Today only Facebook and Google and some PMPs (private marketplaces) have this kind of data. Imagine that you could target users outside the duopoly with the same accuracy – it will improve the way app developers and publishers do business (focusing of ad quality and not quantity): increase the advertiser’s capability to generate reach, and significantly improve the user experience.

That’s exactly what the Zinc protocol is meant for: ensuring users are real humans, allowing users to self-disclose basic information in exchange or getting more rewards and fewer ads via the Zinc token ecosystem. This first party data information will be used to target the specific audiences with a higher accuracy and efficiency resulting in higher revenue, less waste and better user experience.

Many app-based games such as Angry Birds already offer users the ability to earn and spend in-game rewards. How will the user experience with Zinc differ from this?

Most of the game publishers rely on advertising to achieve two main goals: the first, monetize and build their businesses; the second, keep players engaged...