Announcing our 30th Exchange Integration: Bithumb Korea

We’ve been busy over the last few months connecting dozens of venues to Mainbloq. We’re thrilled to announce that with the addition of Bithumb Korea we are now connected with 30 exchanges. While we are thrilled with this accomplishment, we don’t see this as an endpoint. We have more exchanges currently in development to continue our goal of connecting the world’s pools of digital asset liquidity.

At Mainbloq our vision has always been to bring the technology available on the street side to the cryptocurrency market. This means seamless liquidity through our smart order router and sophisticated algorithms that can be executed across all of the thirty exchanges—and growing—that Mainbloq is connected to.

“We’re thrilled at the response we’ve seen from our partners—institutions, hedge funds, EMS and PMS providers, etc—” said Ryan Kuiken, CEO of Mainbloq, “and we know we’re still in early days. We have a long roadmap on our horizon to bring the best in class technology to the industry”.

Want to learn more? We love to talk. Go to our contact page and share your information. We’ll be in touch soon. https://mainbloq.io/contact/

Taxing Crypto: Currency or Commodity?

The world saw its first bona fide cryptocurrency in 2009 with the advent of Bitcoin. Since then, cryptos have taken the realm of fintech by storm. Its rise in popularity billowed so rapidly, in fact, that nations are unsure how to regulate it. The truth is, cryptocurrency is such a novel technology that we still don’t quite know how to handle it.

Should we consider cryptocurrencies commodities or actual currencies? The answer to this question is not so simple. In fact, tax regulations around the world differ on the interpretation.

Our current understanding of cryptocurrencies is that they can basically be either, depending on how they’re used.

Crypto as Currency

As the name itself implies, cryptocurrency can function much like fiat money. By that token, one may use them for the purchase of goods and services (in some countries, anyway). They may also be exchanged into other currencies, making them functionally the same.

So that settles it, right? After all, cryptos do everything money does, for the most part. Well, not quite. While they may operate like currency, and intuitively it makes sense, some traits make cryptos difficult to classify as currency.

For one, it is a decentralized currency. In other words, it is not tied to any third party authority (country, bank, etc.); there’s the sender and the receiver, nothing more. This stands in stark contrast to how traditional money has worked up until now.

Secondly, cryptos cannot be produced arbitrarily according to a country’s current economic state. It instead requires “mining,” and only a fixed amount of them exists. This makes cryptos more of an asset, like gold.

Crypto as Commodity

From a certain perspective, cryptos can also be considered a commodity. Granted, the line between currency and commodity is quite fine. The key difference between the two is that the former acts as a clear-cut facilitator for exchange which quantifies the value of an item or service.

That being said, a cryptocurrency does possess fungibility, i.e. the ability to be interchangeable with other commodities on the market. Beyond that, commodities can afford to be volatile, whereas currencies don’t have that luxury. Having in mind Bitcoin’s value history, it certainly fits the profile of a commodity.

This view certainly isn’t without legal precedent. In early 2019, Indonesia greenlit legislation that treats Bitcoin as a commodity for trade. Meanwhile, the Australian Tax Office (ATO) suggested the same ruling on the matter for other cryptos as well, rendering them subject to the Goods & Services Tax. Australia ultimately dubbed Bitcoin as money.

The main idea that stops cryptocurrencies from being pure commodities, however, is the idea of value. Commodities have intrinsic value, like crops, for example. Cryptos, on the other hand, hold only the value that current market expectations give them. It’s only worth what it can buy, and nothing else.

In the Eye of the Beholder…

As things currently stand, crypto seems to dip its toes in both ponds, performing as both commodity and currency. And until we reach a deeper understanding of crypto, regulation cannot consistently come to the same decision on the matter. Thus, for now, it’s up to each individual country to make up its mind about this conundrum. Until then, take a look at this insightful infographic below:

Bakkt acquired Digital Asset Custody Company and partners with BNY Mellon on key storage

Source: CoinDesk

Pending bitcoin futures exchange Bakkt has acquired the Digital Asset Custody Company (DACC), secured insurance for assets it will hold in cold storage and revealed a partnership with BNY Mellon.

Adam White, the former Coinbase executive turned Bakkt COO, wrote in a blog post Monday that it acquired DACC to continue developing a secure digital asset storage solution. DACC’s team “share [Bakkt’s] security-first mindset,” he wrote, while also bringing experience in building its own secure and scalable custody solutions.

White hinted that the acquisition may also help Bakkt add cryptocurrencies beyond bitcoin sometime after launch, writing:

“As we look to scale and support custody of additional digital assets, DACC’s native support of 13 blockchains and 100+ assets will serve as an important accelerator, and we’re pleased to welcome Matthew Johnson, Adam Healy, and the entire...

Crypto Analysis - Litecoin Price Running Out of Gas After Rally

Author: Josiah Wilmoth / Source: CCN

Get Exclusive Analysis and Investing Ideas of Future Assets on Hacked.com. Join the community today and get up to $400 in discount by using the code: "CCN+Hacked". Sign up here.

By CCN: The litecoin price has been one of the cryptocurrency market’s top performers in 2019, climbing a ridiculous 162 percent since the new year.

Among large-cap cryptoassets, only binance coin has performed better, and litecoin’s year-to-date rally leaves the bitcoin price’s 40 percent advance in the dust. However, one team of crypto analysts says the sixth-largest cryptocurrency looks poised for a sell-off.

Litecoin Price Likely to Crash Through Support – And That’s OK!

Writing in a note to clients on Wednesday, crypto brokerage BitOoda said that a downward wedge has begun to form on the litecoin chart, suggesting that the cryptocurrency could be on the verge of a short-term breakdown. That sell-off would likely cause the litecoin price – which currently holds near...

Ripple Confirms Crypto-Powered xRapid ‘Global Expansion’ Plans

Author: Harsh Chauhan / Source: CCN

By CCN.com: Asheesh Birla, the senior vice-president of product at San Francisco-based Ripple, recently revealed that the company has aggressive expansion plans for xRapid, its XRP-powered crypto remittance platform.

Ripple’s vision of changing the payments landscape

During an ask-me-anything session hosted by Ripple’s Ginger Baker, Birla said that the company is in the process of expanding its cross-border payments platform to more countries across the globe. He said:

On demand liquidity is available today in Mexico and the Philippines. So far, the positive responses from our customers in those two countries has (sic) been overwhelming. But we are working on the next set of destinations, which we will be announcing in hopefully short order here.

I know our product teams and marketing and engineering teams are working hard to light up those next set of destinations so that we can provide our customers with increased choice in terms of global expansion.

Ripple can partner with cryptocurrency exchanges across the globe that are capable of accepting fiat currency from banks. It then converts fiat money into XRP and transmits it to the destination, where it is instantly converted back into fiat.

Quick and Easy Way to Multiply Your Portfolio (and Protect it) with Crypto Lending

Author: Press Release / Source: CCN

The moment the crypto community has been waiting for has finally arrived, (for now). Out of nowhere, Bitcoin has demolished resistance levels and the crypto market is showing bullish signals. In times like these, your portfolio will multiply by itself, but if you really want the most out of this bull run, let’s see how crypto lending can help. Alternatively, we’ll show you a few tips to hedge your portfolio in case this “pump” becomes a “dump.”

HOW TO BUY MORE CRYPTO FAST IN A BULL MARKET: YOUHODLER

In both bullish and bearish markets, time is an important factor. Depositing fiat money from a bank to crypto exchange can take too long. To really capitalize on market movements, you need cash and you need it quick. YouHodler’s FinTech platform offers a lightning-fast solution for crypto lending users. After signing up and passing a quick KYC procedure, users can put up their crypto as collateral (BTC, BCH, BSV, ETH, LTC, XRP, and XLM) and receive a cash loan in minutes.

HOW TO MULTIPLY YOUR CRYPTO IN A BULL MARKET

Let’s use an example. You have 100 LTC and you want to use that as collateral for a cash loan. In exchange, you get around $5,000 without having to sell your LTC assets. If the market is bullish like it is now, you can use this loan to buy more LTC, effectively multiplying your holdings. If the market keeps growing, the gains...

Coinbase Confirms Extent of $255 Million Crypto Insurance Coverage

Author: Ian Allison / Source: CoinDesk

Coinbase has revealed the details of its insurance arrangements for cryptocurrency held on customers’ behalf, a rare move in an opaque market.

In a blog post published Tuesday, Philip Martin the exchange’s vice president of security, confirmed that it is covered for up to $255 million for coins held in so-called hot wallets – in other words, assets which are essentially online and open to potential hacks. CoinDesk first reported in November that Coinbase’s coverage was in this ballpark.

San Francisco-based Coinbase holds less than 2 percent of customers’ assets in hot wallets, with the remaining 98 percent at arm’s length from third-party attacks in cold storage, where the private keys are offline, the company told CoinDesk. (At its height during the crypto bull market, the company stored $25 billion worth of assets on customers’ behalf, but the company would not provide a recent figure.)

This policy was placed by Lloyd’s registered broker Aon and sourced from a global group of US and UK insurance companies, including certain Lloyd’s of London syndicates, Martin’s blog post said. He did not name the individual underwriters.

Lloyd’s, which gathers under one roof a range of specialist insurance markets dealing with everything from crime and cyber attacks to natural disasters, is viewed as a seal of approval when it comes to underwriting potential losses of crypto assets.

Previously secretive about publicizing anything about insurance of digital assets, Lloyd’s is steadily becoming more visible, for a certain class of crypto customer at least.

For instance, last month security specialists BitGo trumpeted $100 million of cover for crypto held in cold storage and went as far as naming the lead Lloyd’s underwriter of the policy.

In fact, much of Martin’s post could be read as a veiled dig at BitGo, since he talks about “recent news and announcements” around crypto insurance, suggesting a lot of “confusion” still exists. He then advises firms to focus on hot wallet cover as opposed to cold storage, where value is “at rest” and therefore not so much at risk.

Regarding Coinbase’s blog post, Clarissa Horowitz, VP marketing, BitGo, told CoinDesk via email:

“We’re glad to see that Coinbase is following our lead in bringing more transparency to the discussion of insurance for digital assets. Insurance is complex and transparency is essential for building...

A16z Placing Bigger Bets on High-Risk Assets – Including Digital Currencies

Author: Nikhilesh De / Source: CoinDesk

Andreessen Horowitz can now back crypto startups with potentially up to $1 billion, after reportedly making some recent internal changes.

The company’s founders – Marc Andreessen and Ben Horowitz – told Forbes that they had registered all of its 150 employees as financial advisors, so as to allow them to place larger bets and invest more heavily into high-risk asset classes, such as cryptocurrencies.

As such, A16z is shifting away from being a traditional venture capital firm, with its 150 employees each becoming a financial advisor.

According to Forbes, the company can now put as much as $1 billion in these riskier bets, such as cryptocurrency or other digital assets. The firm can also “buy unlimited shares in public companies or from...

Brian Kelly Reveals Just How High This Bitcoin Rally Will Go

Author: Gerelyn Terzo / Source: CCN

The crypto bulls are out in full force, and price predictions are back. Crypto trader Brian Kelly has consistently stuck up for bitcoin, even during the market downturn. Now BTC is returning the favor with today’s double-digit percentage rally. Kelly has taken his cue, telling CNBC that the $6,000 to $6,500 range is the new resistance and that’s exactly where the bitcoin price is headed:

“Probably a reasonable target is close to $6,000 for this move.”

Based on fundamentals, bitcoin could rise as high as the $6,500 to $6,800 range before there’s even a hint of it being overvalued in the current cycle. Kelly believes that at the very least, the market has begun to put in a bottom based on historical patterns. He points to a shift in sentiment, one that includes institutions and one that is being fueled by a trifecta across fundamentals, technical signals, and quantitative analysis that his firm BKCM performs.

Bitcoin is blossoming this spring! @BKBrianKelly weighs in on what’s behind today’s 15% move pic.twitter.com/t7sWLycc7r

— CNBC Futures Now (@CNBCFuturesNow) April 2, 2019

Bitcoin ETF Rumors Percolate

It’s important to note that much of the gains in the bitcoin price appear to be being fueled by the technical signals, both...

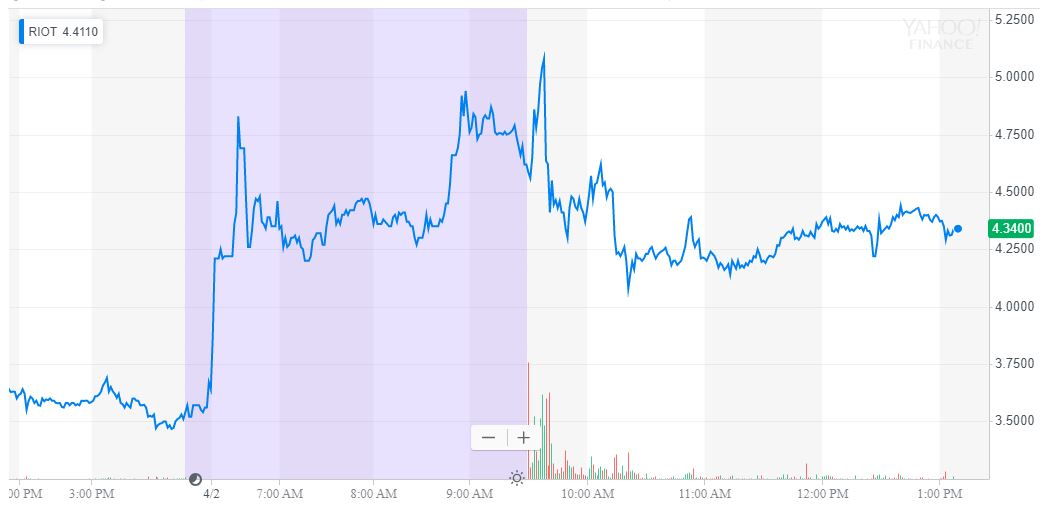

Bitcoin’s Rally Caused This Nasdaq Stock to Surge 20%

Author: Francois Aure / Source: CCN

As Bitcoin’s sudden rally higher captures the world’s attention, it is not only the cryptocurrency investment that is racing back into the light. Any company associated with BTC is experiencing a green day, and naturally, Riot Blockchain (RIOT) is no exception. Despite fading a lot of its daily gains, the crypto mining outfit is still up more than 20%, outperforming most cryptocurrencies.

Riot Blockchain Lives and Dies With the Bitcoin Price

Most articles in the mainstream financial media are pushing the “no-one knows” line about the rally in the Bitcoin Price. Anyone who read this article on CCN yesterday knows that BTC/USD was on the verge of breaking a significant technical level. In an illiquid market where everyone is watching momentum and price action way more than they look at fundamentals, a mass of trend following orders would naturally spike the market aggressively.

Understanding what would cause appetite for Riot Blockchain to surge higher is even more straightforward. They...