Crypto News Headlines — June 7th 2021

Here are the top digital assets news from the weekend.

After being an outspoken advocate for Bitcoin Musk has cooled on Bitcoin calling it destructive to the environment and discontinuing Tesla's short-lived acceptance of Bitcoin as payment for cars. Anonymous has called out musk and has demanded he stops meddling in cryptocurrency.

COINBASE TO GIVE AWAY $1.2MM IN $DOGE

After listing on Coinbase this week Coinbase is giving away over $1MM in Dogecoin to any user who opts-in to sweepstakes and trades (buys or sells) at least $100 worth of the coin.

FIDELITY SELLS OVER $100MM TO WEALTHY INVESTORS

Fidelity investments has raised $102MM from investors in the first nine months since launching the fund according to SEC filings. This makes the fund one of the largest after Pantera, Galaxy and NYDIG.

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a suite of trading tools, including smart order routing and trading algorithms for hedge funds, traders, and some of the world’s largest banks. For more information visit https://mainbloq.io

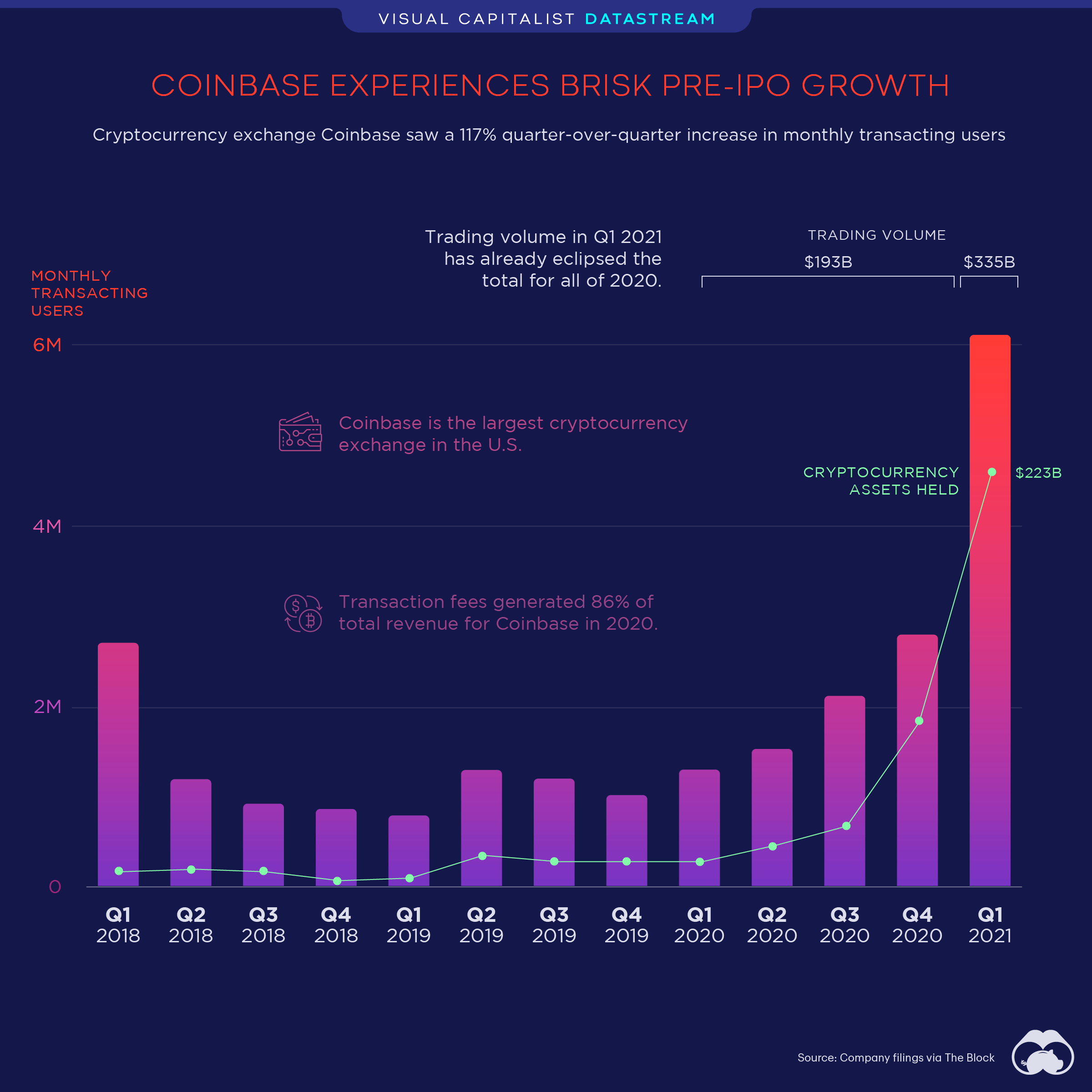

Coinbase sees high user growth ahead of IPO this week

In a report released on April 6, the Coinbase cryptocurrency exchange claimed to have an estimated 56 million verified customers in Q1 2021—that’s an additional 13 million since Q4 2020.

In Q1 2021, Coinbase saw a 117% increase in transacting users compared to Q4 2020, from 2.8 million to 6.1 million. That’s the highest jump in users in the last three years:

- Coinbase added 3.3 million transacting users in Q1 2021 – a 117% increase

- The platform is no the largest cryptocurrency exchange in the United States

- Over $133 billion in assets were added to the digital asset platform, totaling $223 billion in Q1 2021

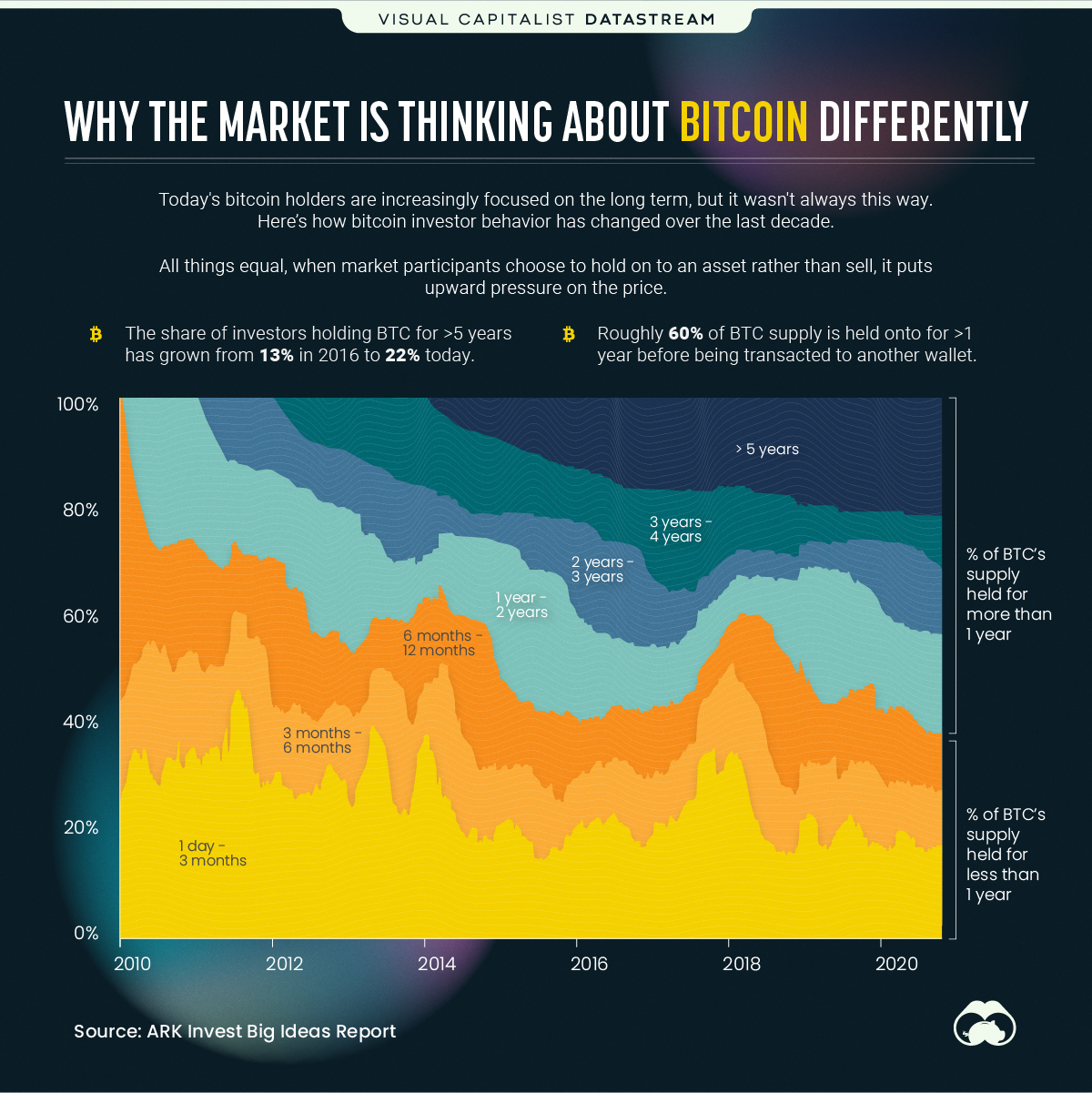

Why Bitcoin investors are increasingly focused on the long term.

The market is thinking about Bitcoin differently

This chart shows the duration of how long investors have been holding onto the cryptocurrency, by the percentage of supply.

- Bitcoin investors are increasingly long-term focused. In 2020, 57% of bitcoin’s (BTC) supply was held onto for more than a year

- Today, nearly 22% of BTC supply is held for more than five years

- Bitcoin hit a $1 trillion market cap milestone in the first quarter of 2021

According to research from Ark Invest, investors are holding onto bitcoin for longer and longer durations. By holding the asset rather than selling, it decreases the supply of coins available on the market at any given moment, which can drive up price. This suggests that market participants see the long-term value and potential future payoff the asset possesses.

In the past, durations of days and months were the most common holding periods for bitcoin investors, while holding for more than a year was practically non-existent up until recently.

| BTC Duration Held | % of BTC Supply |

|---|---|

| >5 years | 21.80% |

| 3 to 5 years | 13.38% |

| 2 to 3 years | 10.99% |

| 1 to 2 years | 10.70% |

| 6 months to 1 year | 8.30% |

| 3 months to 6 months | 7.07% |

| 1 day to 3 months | 27.76% |

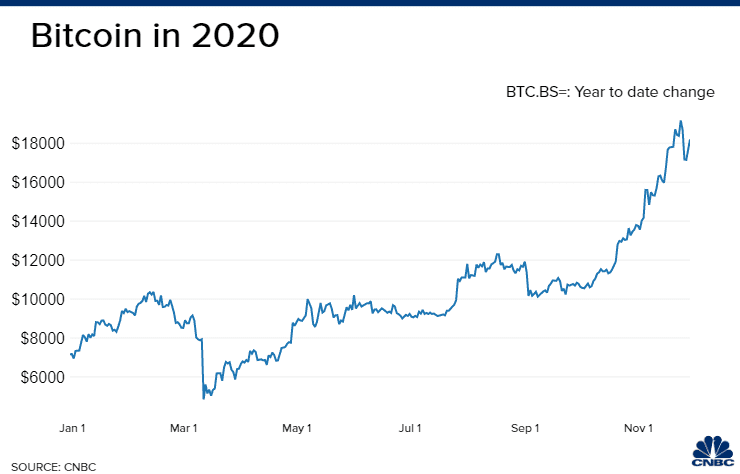

Bitcoin should be worth about $400,000 says Guggenheim Partners CIO Scott Minerd

- Bitcoin should be worth $400,000 based on its finite supply and value compared with gold, Guggenheim's Scott Minerd told Bloomberg on Wednesday.

- "Our fundamental work shows that bitcoin should be worth about $400,000," he said. "It's based on the scarcity and relative valuation such as things like gold as a percentage of GDP."

- His comments came on the day bitcoin crossed $20,000 for the first time.

Guggenheim Partners CIO Scott Minerd asserted on BloombergWednesday that bitcoin's current price is well below fair value and that given its scarcity and the “rampant money printing” by the Fed, the digital token should eventually climb to about $400,000 per coin.

By the numbers: Bitcoin rose above $23,000 overnight (our data viz team made this chart at 3:40pm yesterday) bringing its 2020 gain to more than 200%.

- Last month, Guggenheim filed to reserve the right to invest as much as 10% of its $5.3 billion Macro Opportunities Fund in the Grayscale Bitcoin Trust, which invests solely in the cryptocurrency.

What he's saying: “Our fundamental work shows that bitcoin should be worth about $400,000,” Minerd said. “It’s based on the scarcity and relative valuation such as things like gold as a percentage of GDP. So you know, bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.”

- Similarly, hedge fund manager Paul Tudor Jones said earlier this year he’s been buying bitcoin as a hedge against inflation after years of muted price increases.

Bulls on parade: “We have a new line in the sand and the focus shifts to the next round number of $30,000,” Antoni Trenchev, co-founder and managing partner of Nexo, a crypto lender, told Bloomberg.

- This “is the start of a new chapter for bitcoin. It’s a narrative the media and retail crowd can properly latch onto because they’ve been noticeably absent from this rally.”

Many of bitcoin's attributes are similar to gold, and it also has an unusual value in terms of transactions carried out, he said. Minerd's comments echo those of an incoming Senator Cynthia Lummis who thinks bitcoin is a better store of value than paper money because of its finite supply. The Senator-elect plans to teach Congress how to use bitcoin to reduce US national debt when she assumes office in January.

Guggenheim is among the institutional players that are validating bitcoin's legitimacy as a reserve asset. The firm last month filed to reserve the right for 10% of its $5.3 billion Macro Opportunities Fund to invest in the Grayscale Bitcoin Trust, a bitcoin-focused investment vehicle.

Three major players are holding up the massive interest around bitcoin this year. That can be pinned down to enthusiasm from institutional investors, Wall Street professionals, and retail investor participation, according to Garrick Hileman, head of research at Blockchain.com.

According to Hileman, as many as 100 million people own crypto assets.

Congress unveiled a new legislation focused on the regulation of stablecoin issuers and service providers

Three House Democrats have unveiled a new piece of legislation focused on the regulation of stablecoins issuers and companies that provide stablecoin-related services. The new Congressional bill says it would be 'unlawful' to issue stablecoins, 'provide any stablecoin-related service' without federal approval.

-

Stablecoins ‘Pose Serious Risks’ to Financial Security, ECB’s Lagarde Says - Coindesk

-

Russian central bank opposes ruble-pegged stablecoins - CoinTelegraph

According to the text of the bill, the draftees appear to be casting a wide regulatory net to cover those that issue stablecoins or provide business services related to them.

As the text states:

"It shall be unlawful for any person to issue a stablecoin or stablecoin-related product, to provide any stablecoin-related service, or otherwise engage in any stablecoin-related commercial activity, including activity involving stablecoins issued by other persons, without obtaining written approval in advance, and on an ongoing basis, from the appropriate Federal banking agency, the Corporation, and the Board of Governors of the Federal Reserve System."

The draft bill, if approved, "would protect consumers from the risks posed by emerging digital payment instruments, such as Facebook’s Libra and other Stablecoins currently offered in the market, by regulating their issuance and related commercial activities," according to a statement published by the office of Rep. Rashida Tlaib.

The bill would notably mandate that "any prospective issuer of a stablecoin to obtain a banking charter" and "that any company offering stablecoin services must follow the appropriate banking regulations under the existing regulatory jurisdictions." The legislation was put forward by Tlaib along with Reps. Stephen Lynch and Jesús García — all of whom signed a letter that took aim at U.S. Comptroller Brian Brooks for his focus on cryptocurrency-related issues earlier this month.

Stablecoins are cryptocurrencies designed to minimize the volatility of the price of the stablecoin, relative to some "stable" asset or basket of assets. A stablecoin can be pegged to a cryptocurrency, fiat money, or to exchange-traded commodities (such as precious metals or industrial metals).

Tyler Winklevoss thinks the Realization ‘cash is trash’ could have Bitcoin hitting $500,000

Also Read:

- Bitcoin Could Hit $500,000, the Founder and CEO of ARK Invest Says Catherine Woods - MarketWatch

-

Winklevoss twins say bitcoin will be the decade’s best-performing asset, see ’25x’ gains from here - CNBC

‘Cash is trash…and [high-profile investors] realize it…At some point, it is hard to look at those data points and say that bitcoin isn’t an incredible store of value.’

— Tyler Winklevoss

The Winklevoss twins see bitcoin’s market value one day hitting $9 trillion

“Our thesis is that Bitcoin is gold 2.0 and it will disrupt gold. If it does that it has to have a market cap of $9 trillion. So we think bitcoin could price one day at $500,000 a bitcoin. So at $18,000 bitcoin it’s a hold or if you don’t have any its a buy opportunity because we think there’s a 25x from here,” Tyler expounded.

“We think bitcoin’s here to stay,” said Tyler, who explained that his prediction for much higher prices for bitcoin are based on a number of factors but not least of all the recognition by high-profile investors, including Paul Tudor Jones and Stanley Druckenmiller, who have recently “extolled the virtues” of the nascent asset, which was created in 2009.

Ark Investment CEO Cathie Wood appeared at the virtual investing in tech seminar put on by Barron's where she discussed the rise of Bitcoin.

What Happened: Wood told viewers the 160% year-to-date increase for the price of Bitcoin could be just the beginning.

Wood said the decision by the Fed to keep interest rates low, Bitcoin being a digital alternative to gold and an insurance policy against inflation as reasons why Bitcoin has increased in price.

The increase in institutional investors getting involved in Bitcoin is where Wood sees the price increasing further.

Wood said it reminds her of the early days of institutions beginning to make small allocations to real estate and emerging markets. She said the allocations started at 0.5% and then rose to 5%.

If institutions allocated mid-single-digit amounts to Bitcoin, it would take the price to a range of $400,000 to $500,000.

There will only be a supply of 21 million Bitcoin, with 18.5 million currently in existence.

PayPal Unveiled Plans to Enable the Purchase and Sale of Cryptocurrencies

RELATED ARTICLES

- Novogratz calls PayPal’s Bitcoin news 'the shot heard around the world on Wall Street’ - Cointelegraph

![]()

By Yassine Elmandjra | @yassineARK

Analyst

PayPal and its subsidiary Venmo have announced plans to enable cryptocurrency purchases. Within the next few weeks, users of Paypal’s Cash or Cash Plus will be able to buy, sell, and hold bitcoin, ether, litecoin, and bitcoin cash.

In June, CoinDesk surfaced rumors of PayPal’s crypto plans, suggesting that its 346 million users around the world would be able to buy and sell cryptocurrencies.

Next year, PayPal plans to enable crypto purchases through its network of more than 26 million merchants and through Venmo, its P2P payments app. According to its FAQ, “Once launched in 2021, when a consumer selects cryptocurrency as the funding source, the cryptocurrency will be instantly converted to fiat currency and the transaction will be settled with the PayPal merchants in fiat currency.” PayPal has not disclosed when or if it will enable cryptocurrency withdrawals, a cause for concern for the crypto community.

With 346 million active users around the world, PayPal will be the first network capable of introducing crypto to a mainstream audience.

7 Technologies Disrupting Finance Industry

In recent years, people have experienced the wonders of modern technology when it comes to managing their finances and accessing financial services. This trend is only expected to improve and continue with the advancements in technology like AI, cryptocurrency, blockchain, VR, and AR, among many other things.

But getting to this point has been a bit slow for the financial industry as compared to other industries who have arguably fewer developments in the technology department.

It’s understandable for the financial sector to have a slower response in the digital disruption due to the sensitive data that they hold.

There’s also the issue of established legacy systems that they have relied on for years. Something that newer and more agile financial companies are not facing due to less dependency on the system. These FinTech companies have the luxury of constantly re-evaluating and re-organizing their business model to give modern solutions to modern financial problems of customers today.

Rules and regulations have also hampered down the advancement of traditional financial companies. Most regulating bodies still don't know the capabilities of some of these technologies and the negative impacts they might have on both the ecosystem and the customers.

Despite these obstacles and due to the fast-changing behavior of customers and increasing competition from FinTech companies, a lot of financial companies have no choice but to digitally transform to provide the best service to their customers

Since fintech companies, normally, don't fall under the jurisdiction of these regulating bodies, they have been pushing the envelope and have experienced successes in implementing them. A great example of this is cryptocurrencies like Bitcoin and Ethereum that have experienced tremendous growth in the last decade. Now, traditional companies are exploring how they can use cryptocurrencies and blockchain technologies to carry out traditional tasks that are considered rigid, slow, and insecure. Some companies have also started accepting cryptocurrencies to pay for specific services.

We could say that, somehow, traditional financial companies are trying to keep up with the changes. But if they continue at this pace, they will always find themselves lagging behind modern and more flexible service providers. Soon they'll find that traditional financial advisors may not be as effective as an AI who can predict the most ideal investment streams or that people don't want to be bothered driving to physical banks since financial transactions can now be securely done through mobile phones.

The key to the industry's survival is to spearhead the implementation or experimentation of these technological tools instead of waiting for the next move of technology companies.

In this infographic created by Prototype, a digital transformation company, you'll see a list of modern technologies disrupting the finance industry, the factors driving these changes, and trends these companies should watch out for.

Infographic by: Prototype

Fidelity Digital Assets eyes service for introducing hedge fund investors to crypto funds

RELATED DIGITAL ASSETS INSIGHTS:

Crypto Industry Entering New Era as Institutional Traders Get Invested - Cointelegraph

Institutional interest in digital assets is growing as major financial players continue to enter the cryptocurrency space.

Appeal Of Digital Assets Growing Among Global Institutional Investors, Fidelity Says - Financial Advisor Magazine

Digital assets such as Bitcoin are gaining popularity among institutional investors in the U.S. and abroad, according to a survey by Fidelity Digital Assets.

- Fidelity Digital Assets has seen its book of business for its custody and execution offerings grow since the beginning of the year

- At the same time, the firm has been talking to hedge funds about a new service that would introduce them to big capital allocators

- Meanwhile, the firm has made two key hires, including a new CTO

by Frank Chaparro for The Block

by Frank Chaparro for The Block

Fidelity Digital Assets has been building out its team and is now appears poised to expand its suite of product offerings, The Block has learned.

The crypto-focused subsidiary of $7.9 trillion asset manager Fidelity has seen an increase in interest in its existing products from investors "across the board," according to a spokeswoman. Fidelity Digital Assets offers a custody service for bitcoin as well as an execution service, which helps institutional investors trade bitcoin in large size.

Since the beginning of the year, ongoing market turbulence and fears around impending inflation drove new interest from traditional investors, the firm has said.

Fidelity Digital Assets has ambitions to expand its business outside of custody and execution, according to people familiar with the process. A spokeswoman said the firm "routinely in discussions with market participants to understand the needs in the market to help inform our product roadmap. Our current product offering includes custody and execution services." [READ MORE]

Traditional Traders Are Ready to Go Crypto and Prefer Bitcoin

In a report named Institutional Adoption of Digital Asset Trading, compiled by the Acuiti management intelligence platform, in conjunction with the CME Group and the Bitstamp crypto exchange, authors claimed that survey data “suggests the digital assets market is on the cusp of significant growth from traditional trading firms.”

The findings were based on a survey of 86 senior executives “across the sellside, proprietary trading firms and the buyside.” The authors stated that its respondents from non-bank Futures Commission Merchants, proprietary trading firms and the buyside “tended to be C-suite [the executive-level managers],” while banking and brokerage respondents were primarily “heads of function at managing director level.” The findings were announced this week. However, the authors did not specify whether the survey was conducted before or after the market crash in March.

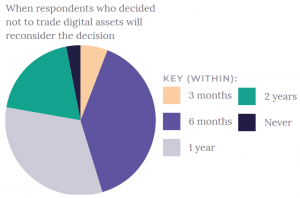

In either case, according to the survey, although most “traditional trading firms” still refuse to handle crypto, the tide could be about to turn.

The authors wrote,

“97% [of trading firms] will consider the opportunity again in the next two years or less and 45% are planning to revisit the idea in six months or less.”

What’s stopping them? Yes, you guessed it – it's regulation again.