MainBloq launches next generation micro service cloud infrastructure for trading digital assets

Fernhill Corp (OTC Markets:FERN), a Web3 Cloud Based Infrastructure platform focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to provide the following corporate update.

Fernhill Corp is pleased to make a big announcement that MainBloq Cloud has just launched as a newly rearchitected version of its platform that can connect users with over 50 digital asset exchanges and DeFi venues. This next generation platform is based upon Microservices, Cloud based, Modular Plug-in architecture which is geared to be highly scalable, incredibly stable, and have extensive interoperability with a wide range of other platforms and partners. MainBloq Cloud is also built to be delivered via API, a White Label basis, or On-Premise based upon the needs of institutional and enterprise clients and their preferred deployment requirements.

We are now stronger as a unified team with one mission and one vision," said Ryan Kuiken, CEO of MainBloq. With the recent volatility in the market and removal of our former CTO, it enabled us to take a step back and look at our platform through a different lens, which has set us up to create a more stable and scalable product leveraging the latest technology and the new microservices architecture. Were very excited about MainBloq Cloud and its future potential!

Although losing a CTO can be detrimental to growing a company, and it did set the company back a bit on its timelines and resources, in this case, moving on has already had a very positive impact. Most importantly, the technology has advanced by leaps and bounds under the new development team led by Fernhills VP of Engineering, Nathanael Coonrod.

Fernhill President Marc Lasky added At this point, the development is being done based upon the highest of standards and professionalism, which includes the proper integration of unit testing and software documentation which has created a superior product that is leading to a far better user experience. In fact, with the feedback we are receiving, users are expressing greater satisfaction. This new, more stable platform will also enable the Company to better market its services to targeted institutions and enterprise clients that seek professional digital asset trading solutions and data aggregation tools. This has already led to a much more engaged sales team at MainBloq given the dramatic improvements to the platform and the increased quality of the product.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading digital asset trading venues exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / WebSocketSOCKETS / and REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit the MainBloq Website www.mainbloq.io

MainBloq Facebook

Company Contact Information: info@fernhillcorp.com or sales@mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

$FERN #FernhillCorp #Web3 #DIGXNFT #CryptoLending #CryptoCurrencies #MainBloq #AdditionbtSubtraction #DigitalAssetTrading #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #Metaverse #NFTCommunity #BTCMaxi #DeFi #MetaverseForum #BuildingBloqs #LendBloq

Forward-Looking Statements

This release includes forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words estimate', project', intend', forecast', anticipate', plan', planning', expect', believe', will likely', should', could', would', may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

Fernhill launches DIGXNFT Marketplace and NFT infrastructure platform Beta

We have a new member of the FernHill MainBloq blockchain family. The beta launch is official of the DIGXNFT Marketplace that's powered by the NFTX cloud infrastructure. We now offer API infrastructure to enable anyone to be able to easily build and launch an NFT offing. All with a single frictionless API.

Fernhill Corp (OTCMKTS:FERN), a Web3 holding company focused on software solutions and marketplace infrastructure for digital assets, is pleased to announce the beta launch of its NFT Marketplace, DIGXNFT.

DIGXNFT caters to high-quality and exceptionally curated collections of art, music, videos, gaming, photography, domain names, real estate, and sports memorabilia, among other categories. Additionally, the company will provide white glove service with a full turn-key solution to assist creators with the minting, marketing, and selling of their non-fungible token (NFT) collection.

“Although the NFT world is a very competitive landscape, we feel confident that with our state-of-the-art infrastructure and our management team in place, we will not only succeed but thrive,” said Marc Lasky, President of Fernhill Corp. “We have a detailed roadmap that is strategically planned to continually build upon and improve our Marketplace, and with our decades of experience growing businesses, we know how to run a process and execute on our goals.”

In beta, users will be able to:

- Connect their MetaMask wallets and create an account.

- Learn more about our first showcased collection: Fraud – The Game of White-Collar Crime (artwork by world-famous artist Rick Parker).

- Join our Discord channel.

- Review our roadmap and read our white paper.

The first NFT collection, Fraud – The Game, will launch on the DIGXNFT marketplace for viewing on July 21st. The official drop date is scheduled for Wednesday, July 27th.

Fraud – The Game of White-Collar Crime, was conceived as a satirical card game by Pete Newman, a cybersecurity professional and fraud expert. Artwork was completed by world-famous comic artist Rick Parker, best known as the artist behind MTV’s Beavis and Butthead Comic Book and staff artist at Marvel Comics.

”Fraud is not only a fun, tongue in cheek game, but at its core it’s really an amazing collection of art,“ said creator Pete Newman. “Thanks to the outstanding artwork of my partner in crime, artist Rick Parker, it makes perfect sense to sell this as an NFT game and as exclusive artwork.”

This is a limited release collection with multiple NFTs to choose from. The NFTs are intended to be part of a larger community and online game that is currently in development. The sale will last one week and all NFTs will be available on a first-come, first served basis.

“Ultimately, everything will become – or be attached to – an NFT,” said Chris Kern, Chairman of Fernhill. “The NFT and metaverse industry are expected to grow in excess of $3 trillion over the next decade and experience unprecedented growth – no temporary market downturn can stop what NFTs will surely become. There are an infinite number of use cases for NFTs and we feel it’s necessary to establish ourselves in the market and seize this unique opportunity now. We’re very excited about launching DIGXNFT, and that more collections will come as we get through beta.”

About Fernhill:

Fernhill Corp is a Web3 holding company focused on developing and acquiring software companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

#$FERN #FernhillCorp #Web3 #DIGXNFT #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading #Metaverse #NFTCommunity #DeFi

Forward-Looking Statements

This release includes ‘forward-looking statements’ within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute ‘forward-looking statements.’ Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words ‘estimate’, ‘project’, ‘intend’, ‘forecast’, ‘anticipate’, ‘plan’, ‘planning’, ‘expect’, ‘believe’, ‘will likely’, ‘should’, ‘could’, ‘would’, ‘may’ or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company’s actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company’s ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company’s limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company’s control.

MainBloq launches cloud-based crypto trading platform TradeBloq PRO

It's official! We are thrilled to announce we have launched TradeBloq PRO. Our cloud-based cryptocurrency trading platform that can easily be integrated into any environment, and give our partners the most sophisticated trading capabilities and algos for their users to trade under their brand.

READ MORE ABOUT TRADEBLOQ PRO.

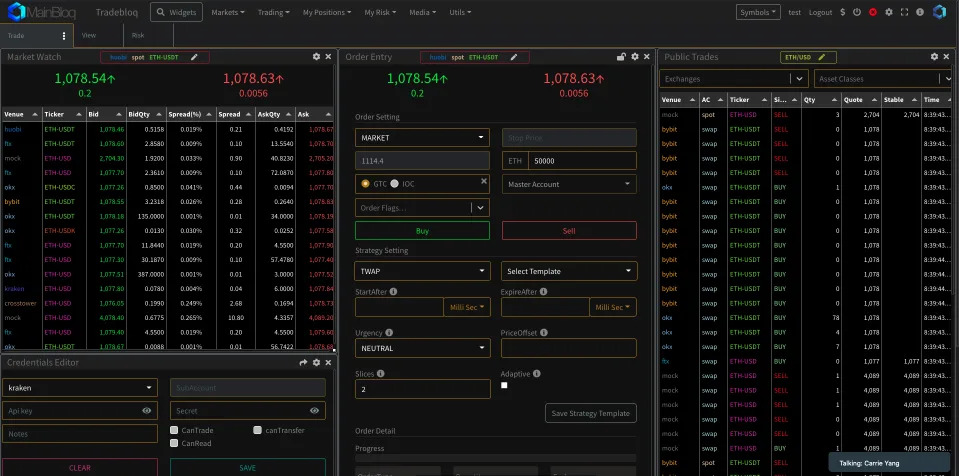

Fernhill Corp (OTCMarkets:FERN) announces that its digital asset trading division, MainBloq, has completed the build of their innovative, white-label ready, premier trading dashboard. It is designed for existing and new exchanges to offer an upgraded level of service to their customers that demand more robust trading capabilities, including new trading tools, increased configurability, and more algorithmic trading strategies.

"As we were building out a white-label platform for one of our recent clients we decided that we should be offering this level of service to every venue, not just the company that approached us" stated Ryan Kuiken, CEO of MainBloq. "Having been the CEO of MainBloq for 3+ years now, we know exactly what companies in the industry want and need, and so a white-label Digital Asset Trading Platform could not come at a better time."

MainBloq's VP of Business Development Patrick Egan added that "This is the same style of dashboard that professional traders at major hedge funds are utilizing for their traditional trading, and it's about time that they have the ability to utilize TWAP and VWAP orders or even execute an arbitrage strategy if they so desire within Crypto. This should also help exchanges attract and retain institutional clients with a robust suite of services not commonly found in the market. This now allows exchanges to offer these advanced order types to all of their clients within 30 days of signing up and create new revenue streams and enhanced trading for their professional trading clients.

MainBloq's Whitel Label Solution, "TradeBloq PRO", is now available for all new and existing exchanges and trading venues on a global basis. By providing advanced algorithmic trading capabilities, risk analytics, sub account access and a wide range of additional benefits - it solves many of the pain points in the industry and bridges the gap between Web2 and Web3 digital asset trading.

For more information please reach out to Patrick Egan at patrick@mainbloq.io

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / SOCKETS / REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io

MainBloq Website: mainbloq.io

About Fernhill:

Fernhill Corp ($FERN) is a Web3 holding company focused on developing and acquiring software companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA).

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

Fernhill Website: FernhillCorp.com

Company Contact Information:

PHONE: 775-400-1180

MainBloq expands digital asset trading infrastructure cloud team into the EU and UK

MainBloq, a digital asset connectivity platform connecting customers to exchanges and OTCs around the world, has expanded its presence within the United Kingdom and European Union, which will be headed by UK based Mr. Larry Grant.

MainBloq, a digital asset connectivity platform connecting customers to exchanges and OTCs around the world, has expanded its presence within the United Kingdom and European Union, which will be headed by UK based Mr. Larry Grant.

“We are thrilled about the MainBloq expansion into Europe and the addition of Mr. Grant to our team,” said MainBloq CEO Ryan Kuiken. “I’ve known Larry for years, and his knowledge and connections in this space are truly second to none. I am confident that Larry will become another valuable member of our team in short order.”

Mr. Grant’s experience includes being the Managing Director of Tick Trend, LTD since 2011 and being Co-Founder and COO of Argentium Digital Asset Management since 2020.

Mr. Grant’s Objectives with MB Europe will include

- ● Taking the lead on all sales, support, and marketing activities relating to UK/EU clients

- ● Using his knowledge and skillset to grow the business, brand, and awareness in UK/EU

- ● Growing the team and leading expansion efforts to help us better serve our clients around

the world. - ● Ensuring client success from testing through deployment.

“I am looking forward to this opportunity,” said newly appointed head of MB Europe, Larry Grant. “I’ve known the MainBloq folks for years and I am confident that with my skill set in business development, strategy, and trading, coupled with their superior trading technology, we can rapidly grow the sales pipeline for MB by delivering real value to funds, family offices, and others in the asset management and trading space.”

About Fernhill:

Fernhill Corp is a Web3 holding company focused on developing and acquiring companies in crypto currency mining, digital asset trading, NFTs, DeFi and the Metaverse that form the foundation of the tokenized economy. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA). For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

OTC Markets

Nevada SOS Fernhill Twitter

Fernhill Facebook

Fernhill Linkedin

Fernhill Website: FernhillCorp.com

Company Contact Information: info@fernhillcorp.com

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

About MainBloq:

MainBloq, a Fernhill Company ($FERN), is a digital asset connectivity platform connecting to leading exchanges to serve the needs of clients around the world. MainBloq offers a modular platform including a smart order router, a suite of algorithmic tools, FIX / SOCKETS / REST gateway, sub-accounts for exchanges, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit www.mainbloq.io MainBloq Website: mainbloq.io

MainBloq Twitter MainBloq Facebook MainBloq Linkedin

#$FERN #FernhillCorp #MakeCryptoGreen #CryptoCurrencies #GreenMiningPools #FinTech #SaaS #CryptoClimateAccord #LFG #PerfectMine #CryptoMining #MainBloq #DigitalAssetTrading #SmartOrderRouter #AlgorithmicTrading

Forward-Looking Statements: This release includes 'forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute 'forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words 'estimate', 'project', 'intend', 'forecast', 'anticipate', 'plan', 'planning', 'expect', 'believe', 'will likely', 'should', 'could', 'would', 'may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

This Week in Digital Asset Headlines - June 21st, 2021

We find the most important headlines in digital assets for the week and give you our take. This week's themes were institutional adoption and regulation, here are your headlines for June 21st, 2021:

GOLDMAN SACHS EXPANTS CRYPTO TRADING

Synopsis: Goldman Sachs has expanded their offerings to clients to include Ether options and futures to go along with their Bitcoin offerings.

Theme: Institutional Adoption

Our Take: It's a great signal that the institutions who have dipped their toes into digital assets have expanded their offerings to their clients.

SEC DELAYS RULING ON BITCOIN ETF AGAIN

Synopsis : The SEC, who has signaled that they may rule on regulations surrounding Crypto ETFs in the past few months, have announced they will not be releasing guidance this year.

Theme: Regulation

Our take: We believe any digital asset ETF will be a positive for the industry as it will allow a wider adoption via more traditional on-ramps for institutions and retail.

HEDGE FUNDS EXPECT ~10% OF THEIR ASSETS TO BE CRYPTO WITHIN FIVE YEARS

Synopsis: Hedge funds plan to ramp up their crypto holdings to more than 7% of assets by 2026, a survey showed.

Theme: Institutional adoption

Our take: Hedge funds love the volatility and opportunity for alpha that digital assets presents. We believe as the market continues to mature this number will be larger.

MANY MORE CALLS FOR REGULATION

Synopsis: Representatives from India, Italy, China, and even Mark Cuban have called for regulation amid a volatile few weeks in the crypto markets.

Theme: Regulation

Our take: The time for regulation is now. We must establish the rules of the road if the market is going to mature.

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a suite of trading tools, including smart order routing and trading algorithms for hedge funds, traders, and some of the world’s largest banks. For more information visit https://mainbloq.io

This Week in Digital Asset Headlines - June 14th, 2021

We find the most important headlines in digital assets for the week and give you our take. This week's themes were institutional adoption and regulation, here are your headlines for June 14th, 2021:

MORE U.S. FINANCE GIANTS DIPPING THEIR TOES INTO DIGITAL ASSETS

Synopsis: JP Morgan, State Street, and Interactive Brokers have announced separate entries into digital assets. This adds to a growing list of companies who have dipped their toes into digital assets including Morgan Stanley and BlackRock, BNY Mellon, and Goldman Sachs.

Theme: Institutional Adoption

Our Take: As cryptocurrency matures we anticipate more and more growth in institutional clients. We believe that the increase in institutional clients will call for a maturation of infrastructure throughout the industry. We're still in the early nineties of the world wide web.

INSTIUTIONAL CLIENTS UP 170% IN Q1 FOR COINBASE

Synopsis : Coinbase has over 8,000 institutional clients holding over $120B in assets.

Theme: Institutional Adoption

Our take: Bull markets are hard to ignore, nobody wants to be on the sideline during a parabolic move. The total assets held is a small fraction of the pie, but it is increasing. We talk to institutional clients every day who are looking to trade across multiple venues with one click.

BITCOIN IS LEGAL TENDER IN EL SALVADOR

Synopsis: El Salvador president Nayib Bukele announced that Bitcoin will be accepted as legal tender in El Salvador.

Theme: Institutional adoption

Our take: One of the main blockers of Bitcoin being accepted as a currency has been its lack of use as a means of exchange—could this be a first step? The asset is too volatile to be used as a currency today, but if more states and companies being accepting Bitcoin that could help quell its volatility.

A RUNDOWN OF CRYPTO REGULATIONS

Synopsis: Representatives from America, India, El Salvador, and China have made headlines over the past week when it comes to regulating cryptocurrency.

Theme: Regulation

Our take: Creating headlines is easy, enacting and enforcing regulations is tough. This isn't the first time that China has banned cryptocurrency. We look forward to good faith efforts of all governments to create rational regulations to enable everyone to understand and follow the rules.

MIKE NOVOGRATZ CALLS FOR MORE REGULATION ON CRYPTOCURRENCY

Synopsis: Cryptocurrency evangelist and former Fortress Investment Group and Goldman Sachs partner has called for more regulation on digital assets to boost investor confidence.

Theme: Regulation

Our take: A lack of clarity has kept institutions from seriously investing in the asset class. The most common thing we hear from our institutional clients is that the lack of clarity and clear guardrails is the biggest blocker from making a serious investment in the space.

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a suite of trading tools, including smart order routing and trading algorithms for hedge funds, traders, and some of the world’s largest banks. For more information visit https://mainbloq.io

Crypto News Headlines — June 7th 2021

Here are the top digital assets news from the weekend.

After being an outspoken advocate for Bitcoin Musk has cooled on Bitcoin calling it destructive to the environment and discontinuing Tesla's short-lived acceptance of Bitcoin as payment for cars. Anonymous has called out musk and has demanded he stops meddling in cryptocurrency.

COINBASE TO GIVE AWAY $1.2MM IN $DOGE

After listing on Coinbase this week Coinbase is giving away over $1MM in Dogecoin to any user who opts-in to sweepstakes and trades (buys or sells) at least $100 worth of the coin.

FIDELITY SELLS OVER $100MM TO WEALTHY INVESTORS

Fidelity investments has raised $102MM from investors in the first nine months since launching the fund according to SEC filings. This makes the fund one of the largest after Pantera, Galaxy and NYDIG.

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a suite of trading tools, including smart order routing and trading algorithms for hedge funds, traders, and some of the world’s largest banks. For more information visit https://mainbloq.io

IBM Webcast: digital asset custody client conversations with the MainBloq

As you may have read, we’ve partnered with IBM to deliver best-in-class security for our clients and partners. We’re thrilled to announce we have been invited to participate in a blockchain webcast

We’ll be discussing digital asset trading—how it has evolved over the years, where it is going, and how the players are changing

JOIN US with IBM on Wed, Nov 4, 2020 2:00 PM CET (8:00 AM EST)

REGISTER HERE

Speaking With MainBloq Co-Founder Ryan Kuiken

MainBloq is a leading institutional-grade, digital asset, performance trading technology. Integrating via API directly into our customers' front ends and communicating via FIX, we are able to provide an unparalleled trading experience. Our capabilities include customization of complex algorithmic trading strategies as well as out of the box configurable algorithms and strategies.

HOST

Andrea Corbelli, IBM Global Technical Lead

Andrea Corbelli, IBM Global Technical Lead

Andrea Corbelli is an IBM technical leader, working with large enterprises, government agencies, and Fintech companies in projects for Blockchain, Digital Asset Custody, Hybrid Cloud, Data Security & Privacy. After starting his career in IBM as UNIX and Linux IT specialist, he held several positions as technical manager in Italy, Europe, and at the global level, leading IBM professionals in technical sales, lab services, and client centers roles, to help clients in designing their Infrastructure Architecture for Digital Transformation.

Peter DeMeo, Head of IBM Hyper Protect Digital Assets Platform, IBM Systems

Peter DeMeo, Head of IBM Hyper Protect Digital Assets Platform, IBM Systems

Peter globally leads IBM Systems technology solutions for crypto assets to power institutional digital asset custody, exchange wallets, and tokenization solutions requiring advanced secure private key management. Peter is responsible for market development, technology roadmaps, and building sales and services infrastructure. As a certified design thinking facilitator, Peter also helps clients enhance their solution’s capabilities by leveraging IBM’s Hyper Protect Services on-premise and on the IBM Cloud. Peter is a regular speaker at blockchain conferences. Prior to his relocation to the Asia Pacific from Washington DC in 2013, he was practice leader for Enterprise Architecture, including the divisions large scale software development efforts and IT strategy consulting for US Federal clients including the Federal Aviation Administration, Federal Depository and Trust Corporation, Department of Defense, and Department of Homeland Security. He was also a contributing author to enterprise architecture publication: Coherency Management: Architecting the Enterprise for Alignment, Agility, and Assurance (2009).

Colin PLATT, Independent consultant for DLT and cryptocurrency

Colin PLATT, Independent consultant for DLT and cryptocurrency

Colin has worked in distributed ledger technology and cryptocurrencies since 2013, launching efforts at BNP Paribas Global Markets, where he sat on DLT focused industry steering committees, including R3, the Post-Trade Distributed Ledger working group (PTDL), and FIX cryptocurrency working group. He became a technology entrepreneur in early 2016, initially working with digital asset derivatives. He has been the co-host of the Blockchain Insider podcast since 2017 (1.2m+ downloads). Currently an independent consultant for DLT and cryptocurrency, Colin works with a wide range of companies from start-ups to UK and US blue-chip companies, as well as government and industry consortium. He recently led a 40+ digital asset working group of financial institutions in Europe and North America, in collaboration with R3. Colin is a regular cryptocurrency conference speaker and panelist, and has been featured in the Financial Times, BBC Radio, the Block Crypto, Coindesk; quoted in Reuters, the New York Times, Capital (France), Risk Magazine, and Banking Tech. Prior to his involvement in cryptocurrencies, Colin held roles in business transformation, and structured product marketing at BNP Paribas in Paris, London, and New York. He holds a Masters in Finance from EDHEC Business School in France, and Bachelor's in Business Administration from Jönköping International Business School in Sweden.

4 Cryptocurrency trading charts to trade smart on the Mainbloq

We have a lot of data here at Mainbloq and we believe that the more data we can supply to our customers the better decisions they can make when they trade. Today we’re thrilled the release some of that data to EVERYONE with Mainbloq Charts.

Our charts showcase some of the data we have as actionable information. Mainbloq is an all-in-one platform for digital assets providing a suite of tools to consolidate real-time data across multiple venues, and to translate data into information and algorithms for best execution of user-defined trading strategies.

Read below to see descriptions of the charts we have available for your use. To see our charts go to https://mainbloq.io/charts/

Order Book Live View

With this chart you can see where market depth is currently quoted. The venues are color coded and displayed in pie charts for bids and asks, as well as a depth chart. All prices are normalized to the “stable price”, which accounts for the exchange rate of the stable coins.

How to use it:

- Enter Currency Pair and press go

- Use mouse to zoom in Combined Depth (you can reset zoom)

Historic Volatility Explorer

With this chart you can explore the historic volatility of an asset. Volatility is an important measure to inform trading decisions indicating the potential price variability over time.

See the trends in historic volatility alongside price movements. Recalculate the Historic Volatility with differently sized dolling windows to smooth or enhance details.

How to use it:

- Adjust Slider to re-scale rolling window of calculating volatility

- Switch between Log and Linear Scales

- Pan with Date Range selector at bottom to Zoom to area of interest

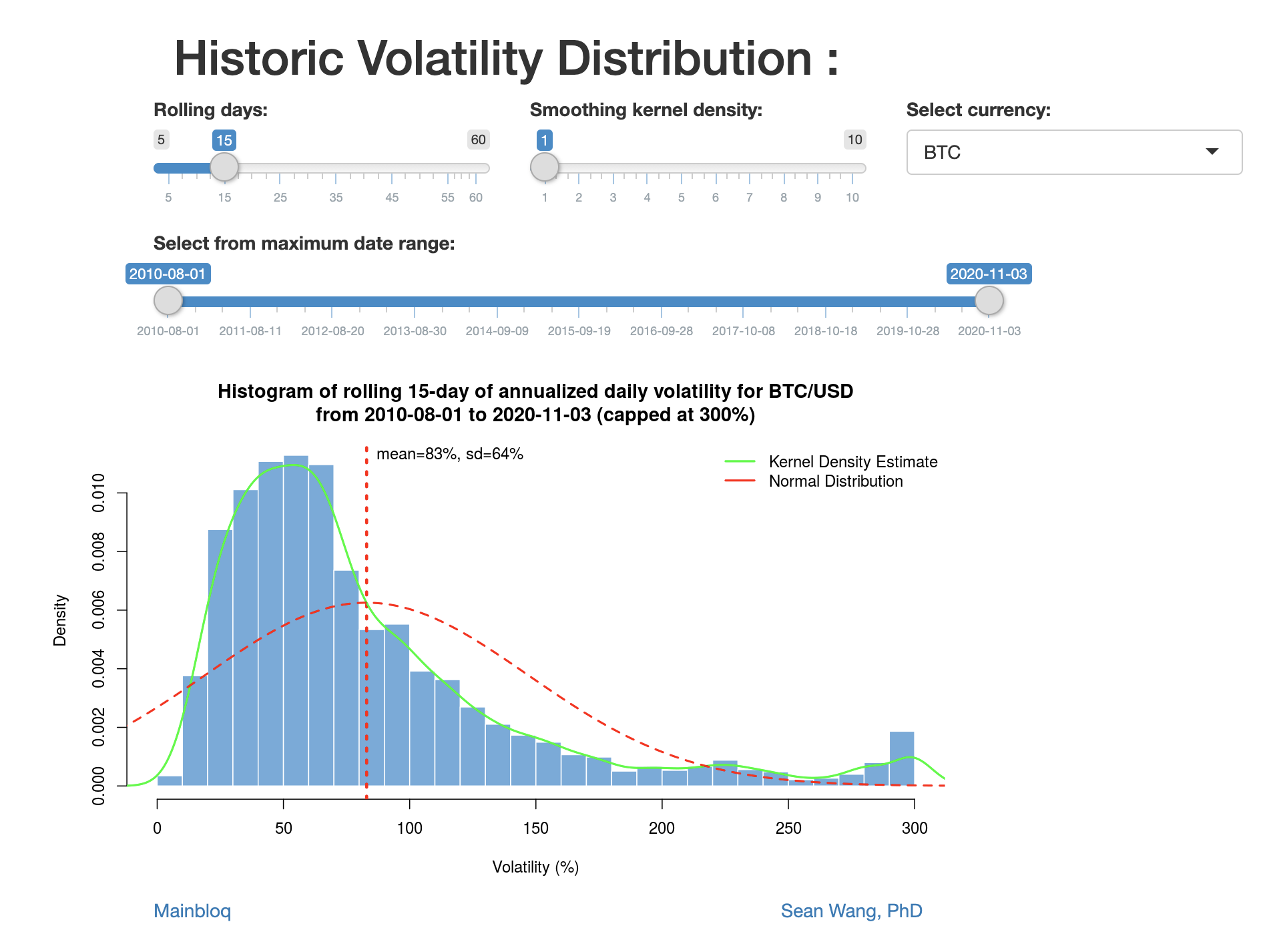

Volatility Distribution

With this chart you can explore how volatility is distributed. We take the daily historical volatility distribution, compared with Kernel density and the normal distribution.

How to use it:

Slide the time window to see how volatility has been decreasing over the years, in crypto.

Volatility by hour

With this chart you can explore the volatility of an asset by hour in the day.

Time is based on UTC (London) and it looks at last 10 weeks of data (more data is available with subscription)

How to use it:

Red line = mean

Box top/bottom = 1 standard deviation

Tails = 2 standard deviations

Dots = outliers (capped at 300%)

Here come the crypto trading algorithms

After spending a few decades on the street I got to see first-hand how the trading algorithm revolution lead to sophisticated and complex strategies that were necessary to execute trades efficiently and effectively. This revolution is coming to cryptocurrency.

First, let’s define what a trading algorithm is—simply put, algorithms are a method of executing orders using a set of rules based on a multitude of dimensions (volume, time, venue) in order to fan out orders to accomplish certain objectives (speed, secrecy, price).

The most important thing to remember is that not all algos are created equal. That’s why we’ve assembled a team of street veterans with experience crafting algorithms for some of the most successful shops.

Our algorithms include a blend of well-established algorithms along with custom algorithms created by our team. Unlike most existing cryptocurrency algorithms, all of our algorithms execute across multiple venues. Our algorithms can be blended according to each individual trader’s strategy.

- BASKET - Executes multiple trades of multiple coins simultaneously and over a period of time using TWAP or other time-based strategies.

- TWAP (Time Weighted Average Price) - Executes trades evenly over a specified time period

- VWAP (Volume Weighted Average Price) - Executes trades evenly based on trading volume.

- THOR - Executes one order across multiple venues so they arrive at each venue at the same time to minimize market impact.

- ICEBERG - Executes orders in random slice sizes over a period of time over multiple venues to minimize market impact.

- Pairs Trades - Executes two trades of individual coins while maintaining a balance between the long and the short side of the trade.

- IWAP (Information Weight Average Price) - A custom Mainbloq algorithm that trades in windows of fixed notional while varying the duration.

- ISR (Implementation Shortfall Reducer) - A custom Mainbloq algorithm that reduces slippage and balances market impact by controlling the rate of execution.

These algorithms are just the start. We’re crafting sophisticated strategies to ensure our clients can execute effectively and efficiently. We also work with our clients to create tailored algorithms so they can execute their trading strategies.

Our mission at Mainbloq is to bring the sophistication of traditional finance to digital assets. Our streaming smart order router is the most efficient way to trade cryptocurrencies across multiple exchanges. Our algorithms help traders execute their strategies smarter. You might be thinking, what comes next? You’ll just have to wait and see...