MainBloq launches next generation micro service cloud infrastructure for trading digital assets

Fernhill Corp (OTC Markets:FERN), a Web3 Cloud Based Infrastructure platform focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to provide the following corporate update.

Fernhill Corp is pleased to make a big announcement that MainBloq Cloud has just launched as a newly rearchitected version of its platform that can connect users with over 50 digital asset exchanges and DeFi venues. This next generation platform is based upon Microservices, Cloud based, Modular Plug-in architecture which is geared to be highly scalable, incredibly stable, and have extensive interoperability with a wide range of other platforms and partners. MainBloq Cloud is also built to be delivered via API, a White Label basis, or On-Premise based upon the needs of institutional and enterprise clients and their preferred deployment requirements.

We are now stronger as a unified team with one mission and one vision," said Ryan Kuiken, CEO of MainBloq. With the recent volatility in the market and removal of our former CTO, it enabled us to take a step back and look at our platform through a different lens, which has set us up to create a more stable and scalable product leveraging the latest technology and the new microservices architecture. Were very excited about MainBloq Cloud and its future potential!

Although losing a CTO can be detrimental to growing a company, and it did set the company back a bit on its timelines and resources, in this case, moving on has already had a very positive impact. Most importantly, the technology has advanced by leaps and bounds under the new development team led by Fernhills VP of Engineering, Nathanael Coonrod.

Fernhill President Marc Lasky added At this point, the development is being done based upon the highest of standards and professionalism, which includes the proper integration of unit testing and software documentation which has created a superior product that is leading to a far better user experience. In fact, with the feedback we are receiving, users are expressing greater satisfaction. This new, more stable platform will also enable the Company to better market its services to targeted institutions and enterprise clients that seek professional digital asset trading solutions and data aggregation tools. This has already led to a much more engaged sales team at MainBloq given the dramatic improvements to the platform and the increased quality of the product.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading digital asset trading venues exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, FIX / WebSocketSOCKETS / and REST gateway, and consulting services to help banks and hedge funds execute on their trading strategies. For more information please visit the MainBloq Website www.mainbloq.io

MainBloq Facebook

Company Contact Information: info@fernhillcorp.com or sales@mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

$FERN #FernhillCorp #Web3 #DIGXNFT #CryptoLending #CryptoCurrencies #MainBloq #AdditionbtSubtraction #DigitalAssetTrading #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #Metaverse #NFTCommunity #BTCMaxi #DeFi #MetaverseForum #BuildingBloqs #LendBloq

Forward-Looking Statements

This release includes forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words estimate', project', intend', forecast', anticipate', plan', planning', expect', believe', will likely', should', could', would', may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

MainBloq launches new digital asset lending service LendBloq

Fernhill Corp (OTC Markets:FERN), a Web3 Cloud Based Infrastructure platform focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions, is pleased to provide the following corporate update.

Fernhill is excited to announce the launch of another complementary service as part of our broader branding initiative for the Fernhill subsidiary, MainBloq. The new offering is called LendBloq. LendBloq is part of a larger strategy to roll out several plug and play, modular building Bloqs that will comprise the MainBloq ecosystem. LendBloq is a new Digital Asset Lending offering for hedge funds, family offices, trading firms, miners and institutional investors or for anyone that wants to monetize their Digital Asset holdings without selling them. Interested parties can get highly competitive non-recourse loans against their digital assets such as BTC, ETH, BCH, etc.

In partnership with a corresponding multi-billion dollar international financial institution that specializes in lending against digital assets, several programs are available. These loans are designed as non-recourse loans, with competitive low fixed rates, high LTVs and have flexible margin maintenance structures. Having access to well established lending partners will allow MainBloq to provide customized solutions with some of the most competitive rates and terms found in the digital asset lending industry today. Targeted loan sizes range from $1,000,000 - $25,000,000+ with quick closings in as little as 5 - 10 days.

“We believe there is a substantial gap in the marketplace to serve small to large sized trading firms, family offices, miners and hedge funds seeking liquidity with a well managed digital asset lending solution that is custom designed to meet a company’s specific needs. Partnering with one of the leading firms in the alternative lending space is a great fit with our current service offerings and we look forward to serving our clients at a higher level and providing them as much value as possible,” stated Chris Kern, Fernhill’s Chairman and CEO.

Ryan Kuiken, MainBloq’s Founder and President commented “The addition of lending capabilities has arrived at a critical time. With the market heating up, we are seeing renewed interest in and around the space. This lending offering serves as another block of the MainBloq platform and drives us closer to bringing our full vision to fruition as a leading digital asset infrastructure company delivering next-generation financial services and technology solutions.”

In other housekeeping news, Fernhill would like to address the departure of the former CTO of its wholly-owned subsidiary, MainBloq. We provide an excerpt of the disclosure made in our most recent Annual Report:

On January 6, 2023, we terminated the employment of the former CTO of Qandlestick LLC, (a wholly owned subsidiary of the company), for cause. On March 6, 2023 the Company filed a complaint in Clark County, Nevada District Court against the former employee and his wholly owned company. The Claims include Breach of Fiduciary Duty, Disparagement and Conversion. The relief sought has yet to be determined or finalized.

Given the sensitive nature of this case, the Company is unable to provide additional details at this time.

The Company also further confirms that it is still focused on up listing to a senior exchange and is in ongoing discussions with potential strategic partners and acquisitions.

About Fernhill:

Fernhill Corp is a Web3 Cloud Based Infrastructure provider focused on providing APIs for digital asset trading, NFT marketplaces and data aggregation solutions. Fernhill is a Signatory Member of the Crypto Climate Accord (CCA) and a Principal Member of the Metaverse Standards Forum.

For all official Fernhill corporate information, please refer to our filings, news and updates on the following resources:

About MainBloq:

MainBloq, a division of Fernhill Corporation ($FERN), is a digital asset connectivity platform that is integrated with leading digital asset trading venues exchanges to serve the needs of institutional clients around the world. MainBloq offers a modular platform including a smart order router, suite of execution algorithms, WebSockets & REST gateway, and consulting services to help banks and hedge funds simplify and optimize their trading strategies. For more information please visit the MainBloq Website www.mainbloq.io

MainBloq Facebook

Company Contact Information: info@fernhillcorp.com or sales@mainbloq.io

Any other links are not official & should be taken as such nor have anything to do with Fernhill Corp or its subsidiaries.

$FERN #FernhillCorp #Web3 #DIGXNFT #CryptoLending #CryptoCurrencies #MainBloq #DigitalAssetTrading #FinTech #SaaS #CryptoClimateAccord #NFTs #PerfectMine #CryptoMining #Metaverse #NFTCommunity #BTCMaxi #DeFi #MetaverseForum #BuildingBloqs #LendBloq

Forward-Looking Statements

This release includes ‘forward-looking statements' within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Certain statements set forth in this press release constitute ‘forward-looking statements.' Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate, or imply future results, performance or achievements, and may contain the words ‘estimate', ‘project', ‘intend', ‘forecast', ‘anticipate', ‘plan', ‘planning', ‘expect', ‘believe', ‘will likely', ‘should', ‘could', ‘would', ‘may' or words or expressions of similar meaning. Such statements are not guaranteeing of future performance and are subject to risks and uncertainties that could cause the company's actual results and financial position to differ materially from those included within the forward-looking statements. Forward-looking statements involve risks and uncertainties, including those relating to the Company's ability to grow its business. Actual results may differ materially from the results predicted and reported results should not be considered as an indication of future performance. The potential risks and uncertainties include, among others, the Company's limited operating history, the limited financial resources, domestic or global economic conditions, competition, changes in technology and methods of marketing, delays in completing various engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological innovations, shortages in components, production delays due to performance quality issues with outsourced vendors, services or components, and various other factors beyond the Company's control.

4 Cryptocurrency trading charts to trade smart on the Mainbloq

We have a lot of data here at Mainbloq and we believe that the more data we can supply to our customers the better decisions they can make when they trade. Today we’re thrilled the release some of that data to EVERYONE with Mainbloq Charts.

Our charts showcase some of the data we have as actionable information. Mainbloq is an all-in-one platform for digital assets providing a suite of tools to consolidate real-time data across multiple venues, and to translate data into information and algorithms for best execution of user-defined trading strategies.

Read below to see descriptions of the charts we have available for your use. To see our charts go to https://mainbloq.io/charts/

Order Book Live View

With this chart you can see where market depth is currently quoted. The venues are color coded and displayed in pie charts for bids and asks, as well as a depth chart. All prices are normalized to the “stable price”, which accounts for the exchange rate of the stable coins.

How to use it:

- Enter Currency Pair and press go

- Use mouse to zoom in Combined Depth (you can reset zoom)

Historic Volatility Explorer

With this chart you can explore the historic volatility of an asset. Volatility is an important measure to inform trading decisions indicating the potential price variability over time.

See the trends in historic volatility alongside price movements. Recalculate the Historic Volatility with differently sized dolling windows to smooth or enhance details.

How to use it:

- Adjust Slider to re-scale rolling window of calculating volatility

- Switch between Log and Linear Scales

- Pan with Date Range selector at bottom to Zoom to area of interest

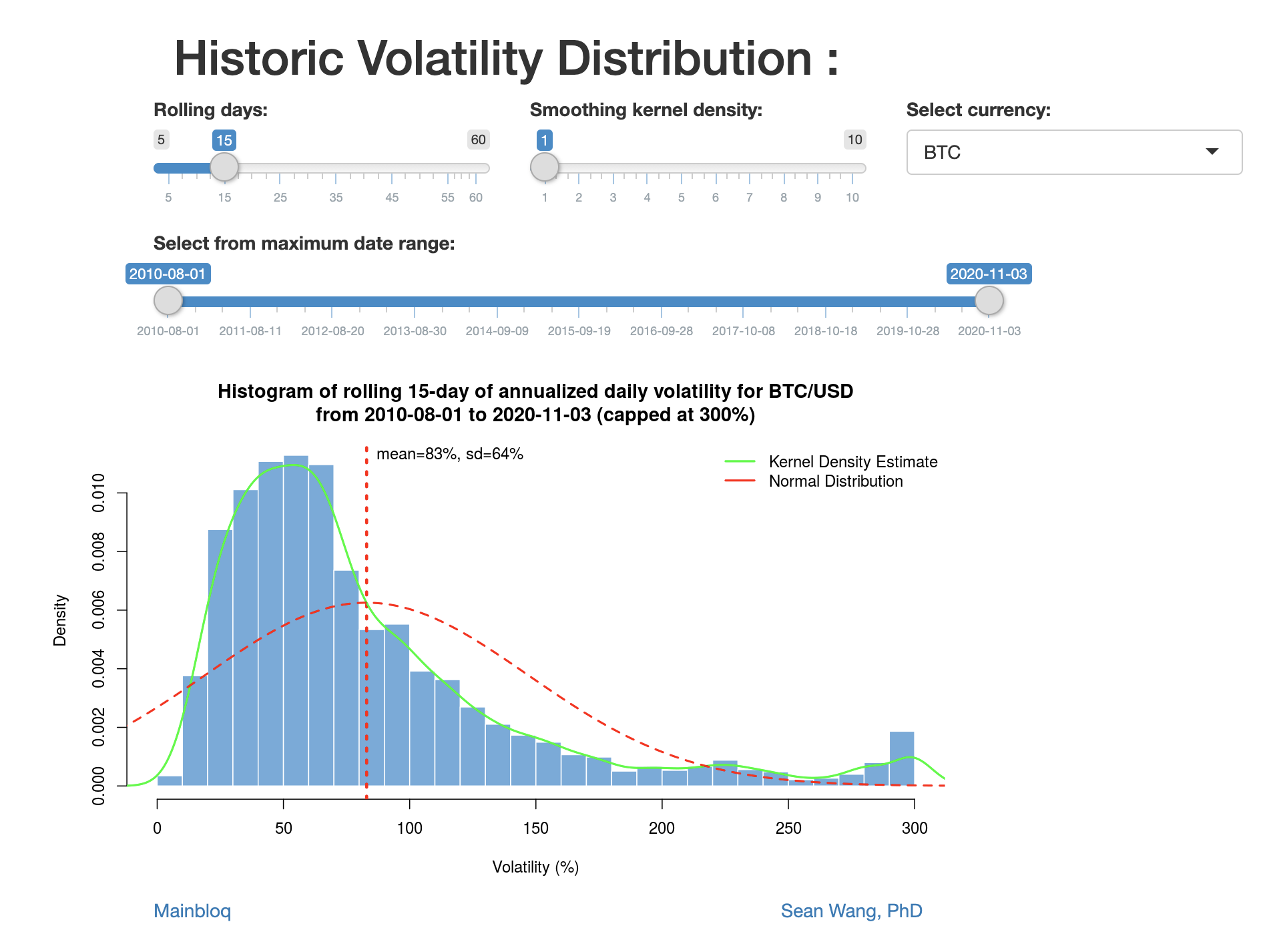

Volatility Distribution

With this chart you can explore how volatility is distributed. We take the daily historical volatility distribution, compared with Kernel density and the normal distribution.

How to use it:

Slide the time window to see how volatility has been decreasing over the years, in crypto.

Volatility by hour

With this chart you can explore the volatility of an asset by hour in the day.

Time is based on UTC (London) and it looks at last 10 weeks of data (more data is available with subscription)

How to use it:

Red line = mean

Box top/bottom = 1 standard deviation

Tails = 2 standard deviations

Dots = outliers (capped at 300%)

Announcing LiveView: Look into the top of book for any crypto currency pair across all of the major exchanges

Announcing LiveView by Mainbloq: your live view into the crypto markets. We built LiveView to demonstrate to our clients the power of our technology, now we're giving it to anyone with a web browser: www.mainbloq.io/liveview

We're always building new technology for our clients—you may have read about our Smart Order Router and Trading Algorithms in previous articles—but today we're releasing something for EVERYONE.

What's in LiveView:

- An insider's look into the top of book for any currency pair across all of the major exchanges and their liquidity pools.

- See total volume and liquidity for currency pairs across exchange in real-time.

- Identify price differences between exchanges to see where to get the best price.

- A real-time calculation of stable rates normalized to give the true best price.

So what can you do with LiveView? You can trade smarter. That's what we're all about at Mainbloq, we give you the tools to make better trading decisions.

The one thing that we see as most salient is if you are only executing on one exchange you are leaving money on the table. To make the most efficient trades you need to execute cross-exchange.

One thing you can't do from LiveView is trade. If you're looking to trade smarter in real-time contact us here: https://mainbloq.io/contact/

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Mainbloq offers a cloud-based, modular platform including a smart order router, suite of trading algorithms, the ability for clients to integrate their own algorithms, and consulting services to help clients execute on their trading strategies. Mainbloq is building the best-in-class platform for researching and trading digital assets. For more information visit https://mainbloq.io/

Here come the crypto trading algorithms

After spending a few decades on the street I got to see first-hand how the trading algorithm revolution lead to sophisticated and complex strategies that were necessary to execute trades efficiently and effectively. This revolution is coming to cryptocurrency.

First, let’s define what a trading algorithm is—simply put, algorithms are a method of executing orders using a set of rules based on a multitude of dimensions (volume, time, venue) in order to fan out orders to accomplish certain objectives (speed, secrecy, price).

The most important thing to remember is that not all algos are created equal. That’s why we’ve assembled a team of street veterans with experience crafting algorithms for some of the most successful shops.

Our algorithms include a blend of well-established algorithms along with custom algorithms created by our team. Unlike most existing cryptocurrency algorithms, all of our algorithms execute across multiple venues. Our algorithms can be blended according to each individual trader’s strategy.

- BASKET - Executes multiple trades of multiple coins simultaneously and over a period of time using TWAP or other time-based strategies.

- TWAP (Time Weighted Average Price) - Executes trades evenly over a specified time period

- VWAP (Volume Weighted Average Price) - Executes trades evenly based on trading volume.

- THOR - Executes one order across multiple venues so they arrive at each venue at the same time to minimize market impact.

- ICEBERG - Executes orders in random slice sizes over a period of time over multiple venues to minimize market impact.

- Pairs Trades - Executes two trades of individual coins while maintaining a balance between the long and the short side of the trade.

- IWAP (Information Weight Average Price) - A custom Mainbloq algorithm that trades in windows of fixed notional while varying the duration.

- ISR (Implementation Shortfall Reducer) - A custom Mainbloq algorithm that reduces slippage and balances market impact by controlling the rate of execution.

These algorithms are just the start. We’re crafting sophisticated strategies to ensure our clients can execute effectively and efficiently. We also work with our clients to create tailored algorithms so they can execute their trading strategies.

Our mission at Mainbloq is to bring the sophistication of traditional finance to digital assets. Our streaming smart order router is the most efficient way to trade cryptocurrencies across multiple exchanges. Our algorithms help traders execute their strategies smarter. You might be thinking, what comes next? You’ll just have to wait and see...

Mainbloq launches Streaming Smart Order Router for trading cryptocurrency

We are thrilled to officially release our first "TradeBloq" module which is the first of its kind, and a critical part of the infrastructure needed for the digital asset markets to scale efficiently.

- Mainbloq offers best execution to sophisticated digital asset traders through their xSOR Smart Order Router which has direct, streaming connections to exchanges for the fastest and best execution.

- Their Smart Order Router is live and currently trading cryptocurrency for their clients.

- Each client receives a dedicated Smart Order Router to execute from.

- The Smart Order Router can be used stand-alone or can be integrated into other trading platforms via API.

Mainbloq launched their Streaming Smart Order Router for trading digital assets. The Router has direct market access via streaming connections to exchanges enabling the fastest execution. It executes cross-exchange trades for the best price with the click of one button.

"We've heard a lot of the other platforms talk about their plans to build a Smart Order Router," said CEO Peter Bordes, "but we are live today and know we have the best, most sophisticated technology. Our system is built by a team of Wall Street trading veterans looking to bring the sophistication of the street to digital assets."

"Not all smart order routers are created equal," said CIO Marc Deveaux, "The purpose of a Smart Order Router is best execution, so if you're using a third party servers and APIs you're already behind. We create direct, streaming connections to exchanges to snipe as quickly as possible. Our process for normalizing data is unparalleled."

Mainbloq's Smart Order Router currently has connections to over 100 exchanges and can trade over 30,000 currency pairs.

"This is just the beginning," said Peter Bordes. "We're building a best-in-class cloud-based modular platform joining data, tools, research, and insights for digital assets. It's time that crypto got more sophisticated."

About Mainbloq

Mainbloq is a data, research, and technology company focusing on blockchain and digital assets. Their streaming Smart Order Router gives clients access to cross-exchange pools of liquidity with direct, streaming connections to exchanges for the fastest and best execution. Mainbloq offers a cloud-based modular platform, and suite of trading algorithms, the ability for clients to integrate their own algorithms, and consulting services to help client's execute on their trading strategies. Mainbloq is building the best-in-class platform for researching and trading digital assets. For more information visit www.mainbloq.io.

Contact

Ryan Kuiken

Ryan@mainbloq.io

VP, Sales and Business Development