Erisx Launches Regulated Bitcoin Futures Market BTC $BTC

Crypto trading platform Erisx has launched a bitcoin futures market regulated by the U.S. Commodity Futures Trading Commission (CFTC). Its physically-settled bitcoin futures contracts trade alongside its spot market which supports four cryptocurrencies. Erisx has obtained a license from the U.S. Financial Crimes Enforcement Network (FinCEN) and is currently approved to operate in 44 states, with a plan to expand to 53 states and U.S. territories.

Article Published on Bitcoin.com

Physically Settled, Regulated Bitcoin Futures

Erisx announced on Tuesday the launch of its regulated bitcoin futures market. The platform’s physically-settled bitcoin futures contracts are offered alongside its spot market for “price transparency and collateral efficiency,” the company detailed. Initially, only monthly and quarterly contracts are offered.

Since the contracts are physically settled, “settlement will be made by the movement of the digital currency to the buyer of the futures contract and US dollars to the seller of the contract,” Erisx’s website describes. The current requirement to become a member of the platform is a minimum balance of $10,000.

Erisx’s current futures product.

Prior to Tuesday’s launch, the company ramped up its team and developed technology for its exchange’s matching engine (TME) and clearinghouse’s clearing system (TCS). The company also developed risk-mitigating functionality to enable efficient price discovery such as self-match prevention, price banding, and maximum order sizes. Its futures clearing platform was built from scratch. Currently, Erisx’s spot trading platform supports BTC, BCH, ETH, and LTC, which can be traded against the USD or BTC >> READ MORE

The best blockchain conferences and events to attend in 2019

2019 is a big year for the blockchain and cryptocurrency markets. Here is a curated list of the events you should look at attending. The next wave of post-2018 scale is coming into the markets. The contraction created the opening for big companies to enter the markets.

Author: Asaf Fybish / Source: Hacker Noon

2019 is going to be an exciting year for the blockchain community. After a very volatile 2018, we are all looking for a brighter future for our cutting-edge blockchain technology and wide community to emerge back.

The event listed below are sorted by dates, from the beginning of 2019, all the way to the end of the year.

If you would like to add your event, please feel free to contact me directly:

Telegram: https://t.me/fybish

Email: asaf@guerrillabuzz.com

Linkedin:https://www.linkedin.com/in/asafybish/

The event will gather the most authoritative Blockchain professors around the world, the public chain projects with the most advanced technology, and technical experts, to discuss the most cutting-edge Blockchain academic research, problems, and solutions. By including keynote speeches and panels covering topics from research to application, the conference will explore the next big opportunity in the Blockchain industry.

Date: Jan. 11, 2019.

Location: San Francisco Marriott Marquis.

Keynote Speakers: Vitalik Buterin, David Chaum, Jun Li, Dawn Song, Mic Bowman and more!

Come with DAIBC series congress, at the World Digital Asset and Blockchain Congress in Dubai. We will create a social networking experience for connecting global investors and entrepreneurs together in Dubai. Meanwhile, we’ll discuss the future of global Blockchain technology, as well as the innovative application of Blockchain technology in different Industries. 30 hot topics will bring you with the most comprehensive case study of innovation project showcases and help you foresee the development trend of Blockchain in the next few years.

Date: Jan 16–18, 2019.

Location: Downtown Miami, James L. Knight Center.

Keynote Speakers: Shiv Madan, Ben Swann, Nebil Ben Aissa, Jhon Harris and more!

The Crypto Finance Conference is offering conference attendants educational keynotes by industry experts, insightful panel discussions about current and future trends as well as unique networking opportunities with other hand-picked participants in a remote and private setting. Additionally, investors get the opportunity to learn more about new crypto businesses. The Crypto Finance Conference is a place to learn, connect and invest with the best.

Date: Jan 16–18, 2019.

Location: St. Moritz, Switzerland.

Keynote Speakers: Charles Hoskinson, Eva Kaili, Helen Hai, Andy Bromberg and more!

Join the entrepreneurs, developers, industry leaders and investors at The Blockchain Event. Learn everything how Blockchain business models will take this distributed ledger technology to disrupt every market imaginable from shipping to commerce. Hear real-life case studies from companies across industries and learn from their successes and failures. Industry experts and cutting-edge global startups will discuss everything from the advertising implications to potential regulation to security concerns. Finally, we will focus on what the future holds for Blockchain and how your company can benefit now.

Date: January 30 — February 1, 2019.

Location: Greater Fort Lauderdale / Broward County Convention Center.

Keynote Speakers: Andey Zanovskiy, Pramod Achanta, Gary Davis, Chong Li and more!

Netherlands-based banking giant ING published a customer report recently where it was declared...

Cryptocurrency Performers: Ethereum, Ethereum Classic, NEO, IOTA, Binance Coin, Stratis

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

The market data is provided by the HitBTC exchange.

While 2017 was a raging bull market in cryptocurrencies, 2018 turned out to be a massive bear market that wiped out more than $720 billion in total crypto market capitalization. We believe that 2019 will bring back the focus on the fundamentals and the true potential of virtual currencies.

With the arrival of traditional investors, digital currencies will at times behave similar to the traditional markets. The Wall Street Journal recently pointed out that the correlation between Bitcoin trading and gold reached as high as 0.84 over a short period of time. Similarly, it has traded at a 0.77 correlation to the Chicago Board of Options Exchange’s Volatility Index (VIX).

As the market matures, it will carve out a niche for itself. We believe that cryptocurrencies are currently in a bottoming process and might signal a bottom within the next few weeks.

ETH/USD

After surrendering its position as the top altcoin to Ripple (XRP) a few weeks ago, Ethereum (ETH) is attempting a comeback. It has made giant strides last week and has emerged as the top performer among the major cryptocurrencies.

BitMEX CEO Arthur Hayes believes that the dead ICO market will spring back into action next year and will prove to be positive for Ethereum. He expects the cryptocurrency to rise to $200. Some are hoping that the network will get a boost from the upcoming Constantinople upgrade. However, it is always difficult to predict the market’s reaction to such a major event.

The long-term trend in Ethereum is down. It has lost a lot of money for its investors this year. However, after the fall, can the ETH/USD pair start a new uptrend in 2019?

After every rise and after every fall, the digital currency has a tendency to consolidate in a range. We have highlighted these periods with ellipses on our chart. In 2018, all the ranges have resolved to the downside.

Currently, the bulls are attempting a pullback after hitting a low of $83. The support line of the former range will now act as a stiff resistance. Because of that, we anticipate selling close to $167.32. If the bears succeed in defending this level, a range bound trading action might ensue.

On the other hand, if the bulls climb above $167.32, a rally to $249.93 is probable. The traders can wait for a close above $167.32 to establish long positions with a close stop loss.

Our neutral-to-bullish view will be invalidated if the price turns down and sinks below $83. We shall confirm the start of a long-term uptrend if the pair forms a large basing pattern and then breaks out of it. Until then, the traders should aim for small targets and book profits periodically.

ETC/USD

Ethereum Classic (ETC) turned out to be the second-best performer among the top cryptocurrencies. The market participants are bullish on the upcoming cohort slated for Jan. 14. 11 startups have been selected to get access to the shared office space, developer support and funding. Can the bull run continue? Let’s find out.

The long-term trend in the ETC/USD pair is down. Currently, the bulls are attempting to break out of the downtrend line that has capped all recovery attempts since May of this year.

A break out of the downtrend line will be the first indication that the momentum on the downside is waning. It can result in a rally to the next overhead resistance...

Wall Street institutions are entering the digital currency markets

Author: Peio Purlev / Source: CoinStaker | Bitcoin News

People know that financial institutions think of cryptocurrencies as arch enemies. But with the increase of opinions from financial advisors that the world is on the brink of another financial collapse because of inflation, maybe digital currency are the solution to some of the problems. Although not perfect, digital currency are still developing and will have a far bigger impact that most people give them. So it wouldn’t come as a surprise when financial institutions end up adopting the technology they are so actievly against. For investors, adapting to circumstances has always been the correct way. Different people use cryptocurrencies for different reasons: some want to get rich quick, others want independent control over their financial assets and some idealists desire an entirely new and efficient global economy built on blockchain technology and digital currency.

Whatever a person’s reasons for using crypto and blockchain are, there will always be a huge cultural clash when cryptocurrency holders and Wall Street ideals meet. A huge influx of institutional money would be extremely beneficial for cryptocurreny prices in the short term, but in the long term this will cause extreme volatility. Recently the sixth-biggest fund manager in the world, Fidelity started to offer digital trading services and it shook the landscape even more. The announcement of this project was aimed at the trading demands of large institutional investors. These demands will in turn provide services like “institutional-grade custody”, large scale leverage trading and more, all of which should pump cryptocurrency prices, but will basically just bring more whales to the digital currency free market.

Institutional money will spike Digital Currency prices

People who believe or want to be financially independent from banks will not like this. In fact, most supporters and users of Bitcoin stand firmly behind Bitcoin’s philosophy that you can be your own bank. Developers and investors with insight however, knew that this day would eventually come. Risk management will see those institutions passing off the risk of holding the said assets to...

What a Crypto Mining Scam Looks Like

Author: Marshall Taylor / Source: CoinCentral

Whether it’s Power Mining Pool today or Bitconnect yesterday, the crypto space is festering with parasitic scams and opportunistic swindlers. The conditions are ripe for them and there’s money to be made.

Among the dangers, Bitcoin mining scams are a tough one to identify and parting the good from the nasty can be tricky. Mining scams are wrapped up in an already technically demanding task of Bitcoin mining. They are billed as a consumer-friendly method for building exposure to Bitcoin mining, and when run like this, they really do provide value for investors looking to diversify.

Legit Bitcoin cloud mining pools are too often buried in search results and outranked by throngs of fly-by-night operations. Finding the legit pools can be a tall order and require sifting through Reddit posts and Bitcointalk forum entries.

With that said, there are legit mining operations out there. As always, do your own research and stay skeptical as we settle and develop this wild frontier. For now, let’s take a look at what a crypto mining scam looks like to hopefully better prepare us to identify the key red flags.

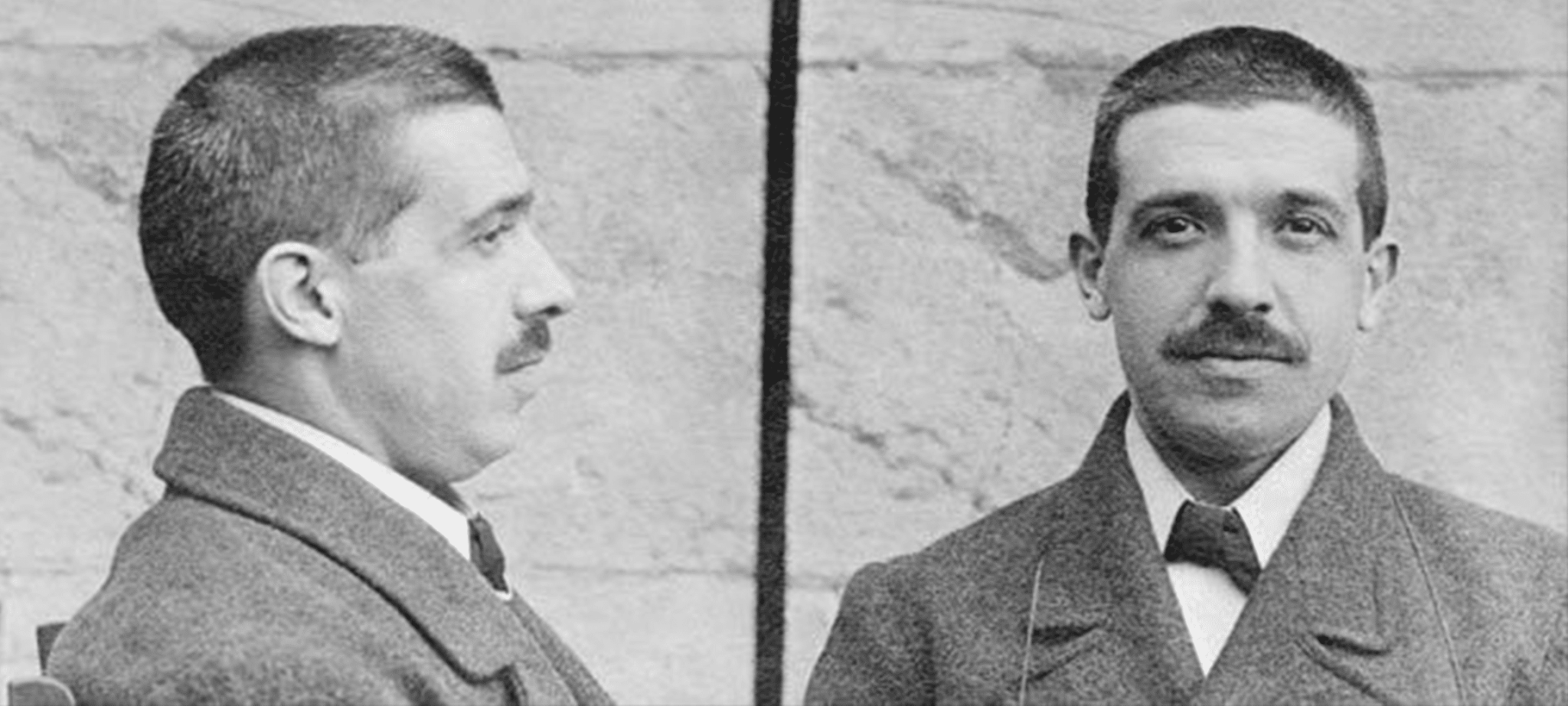

Cloud Mining Pools and Ponzi Schemes: A Match Made in He….

Let’s take a moment to clear up what a cloud mining pool is and why they attract Madoff-like Ponzi schemes faster than ants at a picnic.

What’s a Cloud Mining Pool?

A cloud mining pool is the most hands-off version of crypto mining you can get. They allow a participant to rent or lease hashing power not directly owned by themselves. The rented hashing power is then pooled and paid out proportionally to the members (after fees and operational costs).

A traditional mining pool instead requires participants to supply their own hashing power and pool it with other miners. The participant owns and operates their own hardware and contributes to the pool’s overall hashing power.

The critical difference between a cloud mining pool and a traditional mining pool is the ownership of the hardware.

Cloud mining: you don’t own the hardware (hashing power).

Traditional mining: you own hardware (hashing power).

Why pool at all? In short, block rewards become more difficult to obtain as overall hashing power of a particular blockchain increase.

Take Bitcoin as an example. There was a time in Bitcoin mining when a standard CPU could mine whole blocks itself. Gone are those days. Bitcoin mining is now big business with plenty of stakeholders leveraging their resources into the security of the blockchain.

Miners with serious hashing power make it improbable for small miners to reasonably expect block rewards. Their hashing power is just not enough to compete.

The solution: gather together all these smaller players and pool their hashing power. Miners in a pool no longer compete for blocks of their own, instead, they work together and proportionally share the booty.

What’s a Ponzi Scheme?

It’s theft, let’s just clear that up. If you’re in a Ponzi scheme you are either being robbed or doing the robbing yourself.

A typical Ponzi scheme involves enticing participants to invest their money into a fund or investment strategy that has seemingly guaranteed returns. In reality, and with variation, the returns are not gained by real-world trading or superior business acumen. Conversely, new investments to the funds are distributed around existing investors and represented as market returns.

Ponzi schemes require a constant flow of new investment to keep the machine moving. Once things fall apart or new investment slows, the scheme is often revealed for what it is. In the world of crypto Ponzi schemes, a collapsing Ponzi scheme is followed by a hasty exit scam.

Keep in mind that Ponzi schemes thrive in times of economic expansion and speculative bubbles. Capturing collective optimism is pivotal to its success. Bitconnect is a choice example of the market fervor getting the best of investors.

Identifying the Red Flags of a Cloud Mining Ponzi Scheme

Firstly, the duck test. If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

The duck test isn’t scientific by any standard but can be used to leverage your gut feeling to identify early warning...

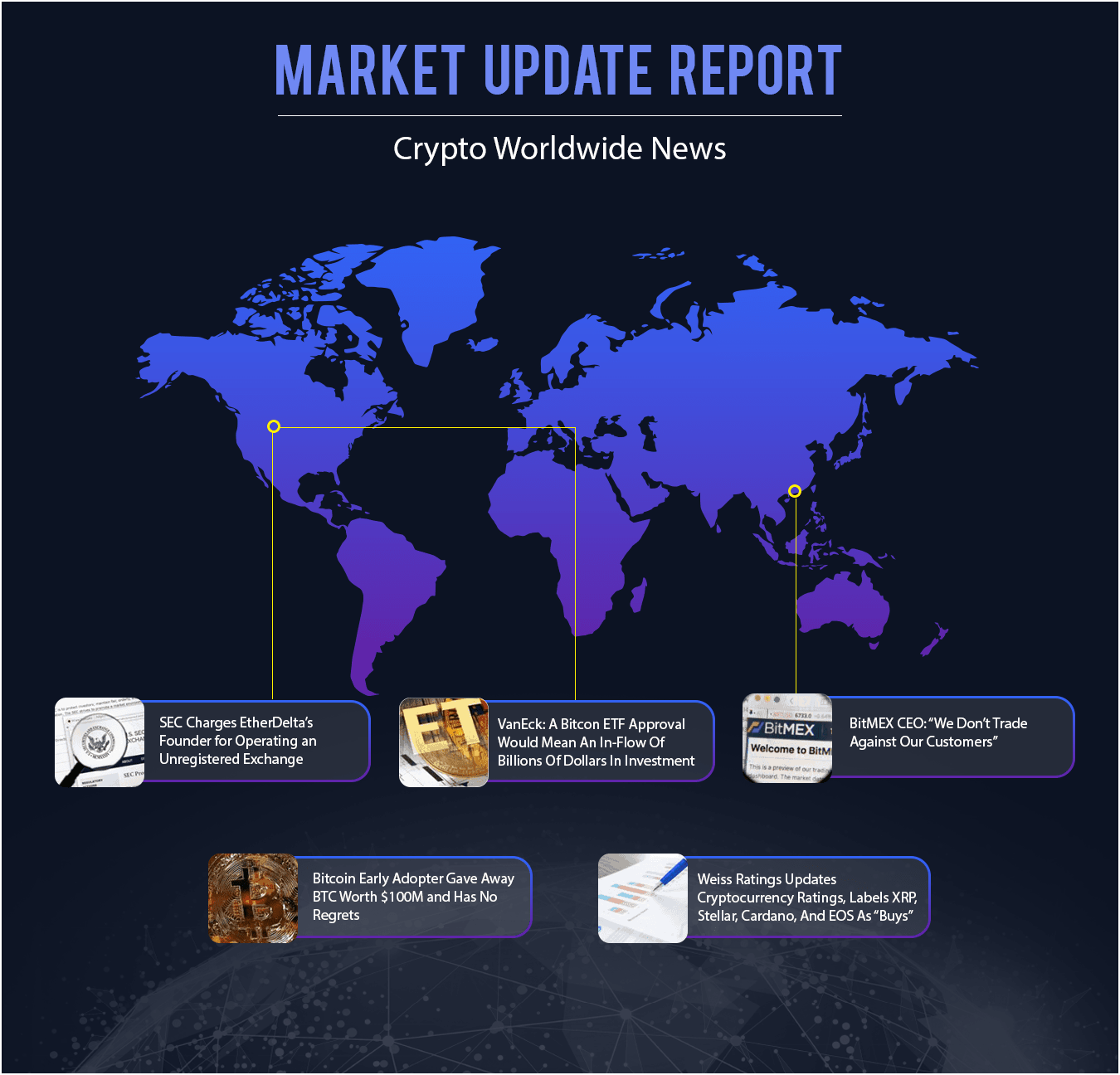

Crypto Market Update : Bears are Back, year-end rally nearby?

Author: Yoni Berger / Source: CryptoPotato

After a positive week for the alternative coins, a correction came to remind us of the risks involved with market volatility. However, the sharp declines have already been halted for the moment, getting closer to the dangerous $6000 zone.

Ahead of the expected Fork of Bitcoin Cash hard fork, the price of the currency has risen by tens of percent and has attracted considerable interest from traders and investors who are eyeing the market.

In light of the upcoming decisions regarding Bitcoin ETFs and other financial instruments related to the crypto markets, a trend has recently been initiated by regulators turning to large-volume crypto exchanges that affect the Bitcoin price and other altcoins in order to try to understand the price discovery mechanism.

The end of the year is near, and November began with a positive altcoin trend. The recent price hikes brought a positive sign to the market. But if we put the prices of the coins aside and look at the development of the infrastructure, the number of companies, employees and the partnerships that are being formed, one might expect another bullish wave in the near future.

Bitcoin continues to be the dominant and leading currency in the market and begins to show signs of stability with support around $6,200.

Bitcoin dominance 52.2% | Market Cap: $211 billion | Trading volume: $10 billion

Crypto News & Headlines

SEC Charges EtherDelta’s Founder for Operating an Unregistered Exchange. The U.S SEC has heavily fined Zachary Coburn for operating an unregistered platform that allows people to buy and sell tokens that the agency had earlier...

Transitioning from bitcoin depression to disbelief to opportunity

Author: Kiril Nikolaev / Source: Hacked: Hacking Finance

Based on market cycle psychology, depression is the state where people have lost all hope in the market. They believe that the downtrend is a bottomless pit and the market will never again reach its former glory. This discourages everyday investors from entering the market when in fact, this is the point of maximum financial opportunity. Time and time again, markets bottom out when ordinary people have abandoned them.

This is exactly what we’re seeing in Bitcoin (BTC/USD). The hype that surrounded the cryptocurrency almost a year ago is completely gone. The interest over time, when looking at google trends, is at its lowest in 12 months. More importantly, many people believe that it can go significantly lower.

Current market sentiment maybe depressive but the charts show that the end is almost near. In this article, we show how Bitcoin may be transitioning from depression to disbelief.

A Comparison of Market Cycle Psychology Chart and Bitcoin Chart

Disbelief is the state where the market shows signs of life but participants ignore them. They do so because they think that the downtrend is not yet over and the rally is just another pump and dump scheme to slaughter newbies.

We believe Bitcoin is getting ready to make you a non-believer. To understand why we have this point of view, allow us to first show you the market cycle psychology chart.

Disbelief comes after a boring and depressed market. If you’ve been following Bitcoin’s price action since September, you’d know that the past few months have been the longest. Volatility has been almost non-existent. There were times when Bitcoin traded within a $10 range. At that point, we knew that Bitcoin was in a state of depression.

If you’re skeptical, the next chart should help alleviate your concerns.

Bitcoin daily chart over market cycle psychology chart

We overlayed the Bitcoin daily chart on top of the market cycle psychology chart and we have an almost perfect representation of market sentiment over the last twelve months.

Currently, the market is so depressed that...

5 Things Needed for the Mass Adoption of Bitcoin

Source: Bitcoinist.com

It’s been ten years since Satoshi Nakamoto published the Bitcoin White Paper and introduced cryptocurrencies to the world. His radical vision of a decentralized peer-to-peer electronic cash system was groundbreaking, as it sought to rebuild the structures that upheld our global financial institutions. A decade on, the cryptocurrencies market is now worth $209 billion globally, and there are more than a thousand separate tokens in circulation.

[Note: This is a guest op-ed article submitted by Samuel Leach, Founder of Yield Coin]

Despite this success, Nakamoto’s vision is yet to be fully realized. Although “cryptos” and associated phrases have entered the popular language, and awareness of them is at an all-time high, uptake has been restricted to a narrow subset of society.

Bloomberg estimates that around a thousand users own approximately 40 percent of all bitcoin currently in circulation and cryptos have failed to supplant fiat currency. Before we see the mass adoption of cryptocurrencies, there are a number of obstacles that first need to be overcome.

While regulation is often treated as a pariah among many in the crypto community, if executed properly, it will bring beneficial change for all. Cryptocurrencies have only been in existence for a relatively short amount of time meaning many governments are still figuring out the best way to regulate them. The result of this has been a crypto market structured in a laissez-faire fashion. While it can be argued that this has fostered further innovation, it has undoubtedly led to several negative side effects.

At present, anyone could set-up a new cryptocurrency and raise significant capital without having to face repercussions if they fail to implement their plans. This has reduced overall confidence in the market, as it can be difficult to differentiate legitimate projects from nefarious ones. This is also preventing many institutional investors from entering the market, as the lack of regulatory guidelines will lead to compliance issues on their part.

A daily price swing of 10-20 percent is not uncommon among most cryptos, making them exceptionally volatile in comparison to fiat currencies; in comparison, the pound lost 4 percent of its value against the dollar on the infamous Black Wednesday. Finding a way to temper this instability would go some...

NEO Cypto trade recommendation $NEO #NEO

Author: Kiril Nikolaev / Source: Hacked: Hacking Finance

On our August 29, 2018 trade recommendation, we anticipated NEO/Bitcoin (NEO/BTC) to breakout from the large falling wedge on the daily chart. We emphasized the importance of buying only after the pair generates volume of 1 million NEO units. Without heavy volume, the breakout would not look convincing to breakout traders and trend followers. Hence, there wouldn’t be enough momentum to ignite a massive rally.

Though NEO/BTC broke out from the falling wedge as expected on August 31, the volume it printed was way below our requirements. As a result, the breakout rally was short-lived since bottom fishers saw the low volume breakout as an opportunity to take profits. The selling drove the market down. Nevertheless, this gives us a chance to buy the bottom before NEO/BTC takes off.

Technical analysis shows that NEO/BTC is respecting the historical support of 0.00245. This view comes after the pair successfully completed the retest when it dropped to as low as 0.00239 on October 15 but bulls came to the rescue and lifted the market above the support. We watched NEO/BTC from that point to see if the support will hold. The confirmation came on October 18 when volume suddenly surged. This was a signal that participants are comfortable accumulating at this level.

More importantly, the daily RSI appears to have printed a new higher low at 32.6. This is an encouraging sign as it shows that participants are no longer waiting for extreme oversold readings before entering long positions.

The strategy is to buy as close to 0.00245 support as possible. As long as the market remains above this level, it has a very good chance to rally to our initial target of 0.0034 and then 0.0046.

The process may...

The Faircoin price of $0.22 can be worth millions

Author: Ian Karamanov / Source: CoinStaker | Bitcoin News

Faircoin, this asset is worth only $0.22. Something so small can’t even register on the global financial radar. Even in crypto exchanges, if we look at daily trading volume it’s nothing more than a slight glitch.

Ranked at 1134 on CoinMarketCap, this little asset presents a very reliable lifeline for its users. According to Sporos, a crypto enthusiast based in Athens, faircoin can be found everywhere in the world. He says he hasn’t relied on banking services for no less than 8 years thanks to this asset. If we look at the events from the last decade or so, Sporos’ definitely did well to stay away from banks.

Located in an anarchist stronghold in Athens, Sporos runs a faircoin information center. There are over a few hundred similar centers located all around the world. The centers are stocked with many homemade products like honey, soap, perfume, olive oil, tea and even jewelry. Of course all the products vary depending on the location on the center, but they all have one thing in common. They can all be purchased with faircoin.

If the provided information is accurate, we’re looking at over 620 centers all around the world. Sporos refers to them as the ecosystem of faircoin. This ecosystem includes a transportation sharing app combined with an AirBnB alternative and faircoin-based financial institution. The institution is called the Bank of Commons and is completely tax-free.

Faircoin redefines being human

In this global network, nodes aren’t exactly nodes. Usually, nodes are the computers, but...