Industry sees crypto bottom as Bitcoin nears $4,100 and tokens gain 20%

Author: Joseph Young / Source: CCN

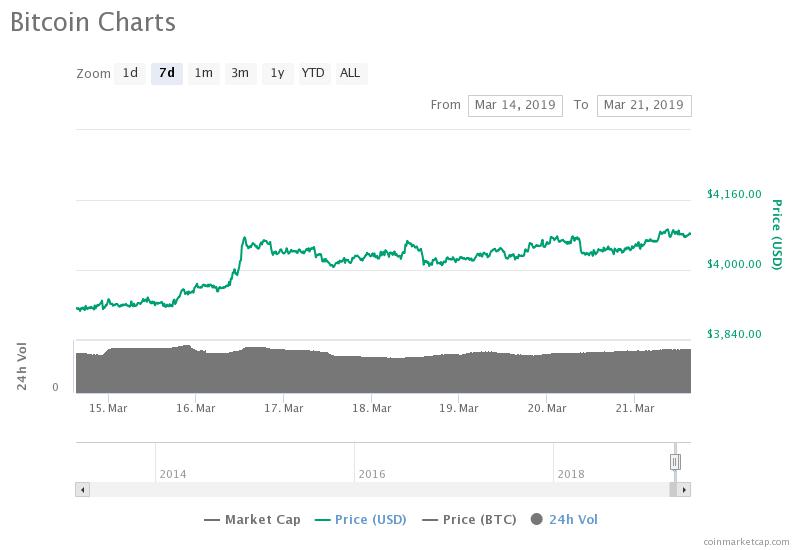

The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner...

Insights from the "future of crypto trading" meetup with FRST in Chicago

What do you get when you add a bitter cold and windy city, over 50 cryptocurrency enthusiasts, and three informative presentations? The Chicago Ethereum Meetup of course!

As you may have read, we made a short presentation to the group about our smart order router and algorithms we’re developing. We talked to founders of a handful of digital asset traders and we’re humbled by the feedback we received about our technology.

If you weren’t lucky enough to be at the meetup, don’t despair, I’ve embedded a video of my presentation below. Take a look at let us know what you think!

FRST’s presentation was mind-opening, it’s unreal to see how much information is available at the wallet and transaction level and how it can be used to trade cryptocurrencies more intelligently. You can read more about FRST here

The final presentation was by Andrew Gordon, an accountant specializing in cryptocurrency tax law. Tax time for crypto traders can be a nightmare, but he shared some great information about how to streamline and simplify the process. You can learn more about him here.

If there was one main takeaway from the meetup it’s that there are so many areas of the digital assets ecosystem that are currently unexplored. It’s said that 99% of the ocean floor is currently unexplored and I believe we are currently in the same place with blockchain and digital assets.

Bitcoin Price Trapped in Key Make-or-Break Trading Range

Author: Omkar Godbole / Source: CoinDesk

View

- Bitcoin is trapped in a trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively. Therefore, the outlook as per the weekly chart is neutral.

- A weekly close (Sunday, UTC) above $4,106 would confirm a longer-term bearish-to-bullish trend change and could fuel a rally toward $5,000.

- A weekly close (Sunday, UTC) below $3,404 could revive the sell-off from November highs above $6,500 and allow a drop to levels below $3,000.

- The odds of a drop to the lower edge of the trading range would improve if BTC invalidates a bullish candlestick pattern created on Feb. 27 with a move below $3,658.

Bitcoin is trapped in a key trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively

The cryptocurrency needs a break above the upper edge needed to confirm a longer-term bull reversal. Conversely, a move below the lower bound of the range could revive the bear market.

Prices fell below the 200-week EMA in the third week of November, bolstering the bearish view put forward by the high-volume breach of the crucial support at $6,000 on Nov. 14.

The ensuing sell-off, however, ran out of...

MainBloq to present with FRST at Chicago Ethereum Meetup today

Join FRST + MainBloq 6pm tonight at WeWorks in Chicago. MeetUp info HERE

Blockchain technology is complex, dynamic, and ever-evolving, which is why we’re thrilled to be presenting at the Chicago Ethereum Meetup about blockchain analytics alongside our partner FRST enterprise-grade trading tools for digital assets.

The FRST team members Karl Muth, Patrick Gorrell and Jonas Frost will be presenting about the personification of wallets and how their platform allows research into the history, trading strategies, holdings, and relationships of wallets and have that data can be applied to public blockchain transactions. We think FRST’s data is impressive and we’re excited to be presenting with them.

The FRST team members Karl Muth, Patrick Gorrell and Jonas Frost will be presenting about the personification of wallets and how their platform allows research into the history, trading strategies, holdings, and relationships of wallets and have that data can be applied to public blockchain transactions. We think FRST’s data is impressive and we’re excited to be presenting with them.

I will be presenting the first ever public look at our Smart Order Router — a piece of technology that we believe will revolutionize the trading of digital assets. We allow traders to access deeper pools of liquidity faster than anyone else through our direct, streaming connections to dozens of exchanges. I’ll also be talking about our development of trading algorithms—TWAP, VWAP, IWAP, Iceberg, et cetera.

At Mainbloq we’re all about making cryptocurrency trading smarter. These are just some of our first steps. Going to be in Chicago? Come to the Ethereum Meetup and say hello! See details below.

‘Bull Cross’ Points to Positive Bitcoin Market Shift

Author: Omkar Godbole / Source: CoinDesk

View

- Bitcoin’s three-day chart is showing a bullish crossover of the 5- and 10-day exponential moving averages for the first time since July. The crossover looks decisive as both EMAs are now trending north, validating the bearish-to-bullish trend change signaled by the high-volume triangle breakout seen on the 3-day chart.

- The cryptocurrency could test December highs above $4,200 in the near term.

- A minor pullback to $3,800 may be seen in the next 24 hours, as signs of bullish exhaustion have emerged on the hourly and 4-hour charts.

- The bullish case would weaken if BTC finds acceptance below $3,614 (the low of the previous three-day candle), but that currently looks unlikely.

A much-followed bitcoin (BTC) price indicator has turned bullish for the first time in seven months, indicating a trend change in the market.

On the three-day chart, the 5-candle exponential moving average (EMA) has crossed the 10-candle EMA from below – the first decisive bullish crossover since July 17, 2018.

Back then, BTC was trading above $7,300 and the crossover was followed by a rally to highs above $8,400 on July 24.

Moving average crossovers help identify shifts in momentum. A bearish-to-bullish trend change is confirmed when a short-term moving average crosses through a long-term average from below.

Many would argue that EMA crossovers are lagging indicators. While that is true, crossovers between the short duration averages help traders distinguish between bullish and bearish scenarios. The long-term MA crossovers like the “golden cross” (bullish crossover of the...

Mainbloq launches Streaming Smart Order Router for trading cryptocurrency

- Mainbloq offers best execution to sophisticated digital asset traders through their Smart Order Router which has direct, streaming connections to exchanges for the fastest and best execution.

- Their Smart Order Router is live and currently trading cryptocurrency for their clients.

- Each client receives a dedicated Smart Order Router to execute from.

- The Smart Order Router can be used stand-alone or can be integrated into other trading platforms via API.

NEW YORK, Feb. 12, 2019 /PRNewswire/ -- Mainbloq launched their Streaming Smart Order Router for trading digital assets. The Router has direct market access via streaming connections to exchanges enabling the fastest execution. It executes cross-exchange trades for the best price with the click of one button >> MORE HERE

Crypto-Fracking: Why advanced smart order routing is the next frontier for crypto

The power of smart order routing infrastructure on the cryptocurrency markets is exponential... and necessary.

Hydraulic Fracturing, also known as fracking, is a process where a pressurized liquid is injected into rocks forming tiny fractures to allow petroleum and natural gas to flow freely in order to extract it. There is debate over its impact on the environment, but there is no doubt it has revolutionized global energy. Fracking has created the ability to extract oil and gas where it was not possible before—it has literally created more liquidity in energy. Smart Order Routing can do the same for digital assets.

Traders looking to buy and sell cryptocurrencies at the best price need to traverse dozens of exchanges and chip away their position with no guarantee that they’re getting the best price at the moment they execute their trades. There is a better way.

At Mainbloq we’ve integrated a Streaming Smart Order Router into our TradeBloq execution management system that solves these problems. With the press of one button trades are executed across multiple exchanges to ensure the best price. Our SOR has direct, streaming connections to all of the major exchanges ensuring trades are executed faster than anyone else. Smart order routing reduces slippage since all trades executed near simultaneously, the market making bots don't have time to widen the spreads when they spot a large trade.

Before fracking, oil and natural gas could only be extracted from large, easily accessible wells. Fracking recalibrated the economics of extracting energy from smaller, less accessible sources. The same applied to digital assets—it wasn’t feasible for sophisticated traders to efficiently make large trades—that changes today. Our Smart Order Router gives traders the ability to press one button and extract slices of liquidity across dozens of exchanges and currency pairs, at the best price.

Smart Order Routing is just one small piece of what we’re creating at MainBloq. We’re building a best-in-class cloud-based modular platform joining data, tools, research, and insights for digital assets. It’s time that cryptocurrency got more sophisticated.

Ready to trade smarter on the MainBloq +Schedule a Demo

Ethereum Price Analysis: ETH/USD: Here come the bears "Daily Gravestone Doji Candlestick"

Author: Ken Chigbo / Source: Hacked: Hacking Finance

- The Ethereum price is at risk of giving back the large gains from December 2018 – January 2019.

- Saturday’s daily candlestick closure produced a bearish gravestone doji.

The Ethereum price has continued to be a victim of narrowing trading, however signs are starting to show of the bears readying to regain full control. ETH/USD has been stuck within consolidation mode since 11th January, which has very much been observed across the crypto market. Over the last six sessions however, the range has tightened up even further. This type of behavior signals that an explosive breakout is near. Odds appear to be stacked in favor of the market bears for the next move.

At the close of Saturday’s close, a bearish gravestone doji was produced. Going by the textbook, this typically suggests another drop is imminent. Another deep drop wouldn’t be too surprising, given the hard fall earlier in the month. A fast period of aggressive market selling is usually followed by some range-movement, which its way of having a cooling off period. The pickup in downside momentum, after such a development, this time with greater intensity, is something that could very well be seen.

Ethereum developers have postpone Constantinople hard fork, crypto price impacted

Author: Josiah Wilmoth / Source: CCN

The core developers of Ethereum have called for a delay to the activation of Constantinople, just hours before the long-awaited hard fork was scheduled to go live on the third-largest cryptocurrency’s network.

Ethereum Hard Fork Delayed

In a statement, the Ethereum Core Developers and Ethereum Security Community said that they decided to postpone the hard fork after security researchers identified a potential vulnerability in one of the software upgrades.

“Security researchers like ChainSecurity and TrailOfBits ran (and are still running) analysis across the entire blockchain. They did not find any cases of this vulnerability in the wild. However, there is still a non-zero risk that some contracts could be affected,” the statement read.

Because the risk is non-zero and the amount of time required to determine the risk with confidence is longer the amount of time available before the planned Constantinople upgrade, a decision was reached to postpone the fork out of an abundance of caution.

According to the statement, that potential vulnerability stemmed from EIP-1283, which introduces a cheaper gas cost for SSTORE operations. Researchers believe that it’s possible that had EIP-1283 been activated, certain smart contracts that are already running on Ethereum could have become vulnerable to reentrancy attacks.

ChainSecurity has published a more thorough explanation...

A New Kind of Crypto Exchange LIQNET.COM

Author: Press Release / Source: CCN

LIQNET.COM is quite different to any exchange you have seen before. Using its own LEN mechanism, the Singapore-based project pools orders from other platforms into one single interface and allows users to trade at the best prices and minimum spread. Why is liquidity important for an exchange?

According to the Blockchain Transparency Institute (BTI), more than 80% of the volume exchanges show is faked. Besides raising concerns about the transparency and business practices of current trading platforms, this underlines a fundamental problem of insufficient liquidity in a bear market. During abrupt market movements, crypto is famous for, low liquidity basically means that you will not be able to buy or sell a significant amount of coins and miss out on profits or even lose money. If you aim to sell a large amount of coins, doing this without toppling the price can be problematic. LIQNET with its liquidity aggregation may be an answer to the problem that has been plaguing the market for some time now.

Сalling LIQNET an exchange would be inaccurate, rather, it is an exchange aggregator. LIQNET uses public APIs of other crypto exchanges to collect purchase and sale bids into a single order book. This allows users to get the benefit of trading on several exchanges, eliminating...