The Cryptocurrency Volume Plague Could Actually Raise Odds of Bitcoin ETF Approval

Author: Joseph Young / Source: CCN

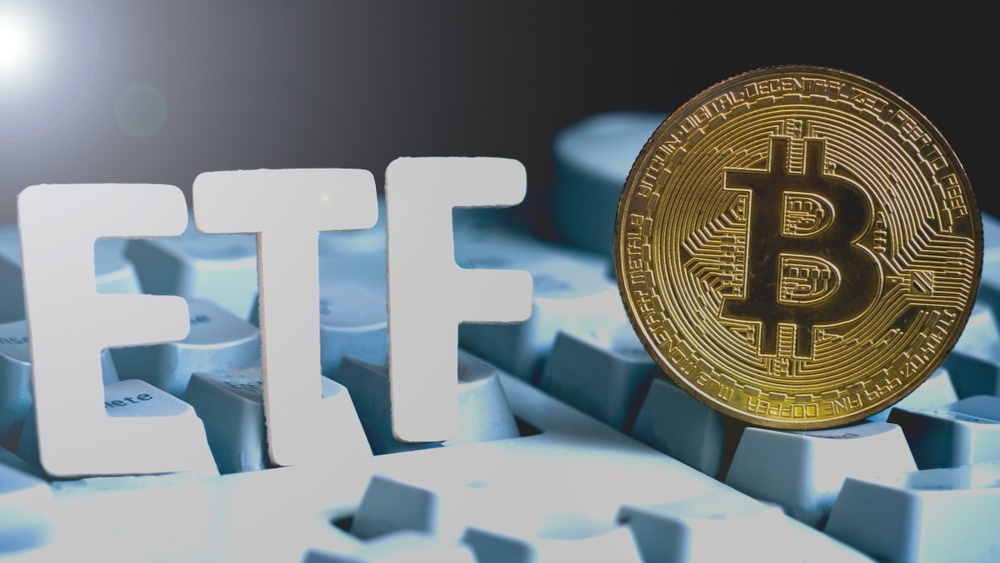

In March 2017, the U.S. Securities and Exchange Commission (SEC) denied the first ever bitcoin exchange-traded fund (ETF) proposal.

Since then, many bitcoin ETF applications have been filed by nearly ten companies, and many of them have been rejected by the SEC for similar reasons.

This week, in a presentation to the SEC, Bitwise revealed that the overwhelming majority of the trading volume in the bitcoin exchange market is fake and that a substantially large portion of the global bitcoin volume comes from the United States.

Ironically, the fake volume plague in the cryptocurrency exchange market may increase the probability of a bitcoin ETF approval.

The Fake Crypto Volume Paradox

Two years ago, when the SEC rejected the first bitcoin ETF proposal filed in the U.S., the commission emphasized three factors:

- Vulnerability to manipulation

- Lack of regulations in overseas markets

- Lack of surveillance

“The Commission believes that, in order to meet this standard, an exchange that lists and trades shares of commodity-trust exchange-traded products (“ETPs”) must, in addition to other applicable requirements, satisfy two requirements that are dispositive in this matter. First, the exchange must have surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity. And second, those markets must be regulated,” the SEC said at the time.

In the past two years, major overseas cryptocurrency markets in the likes of...

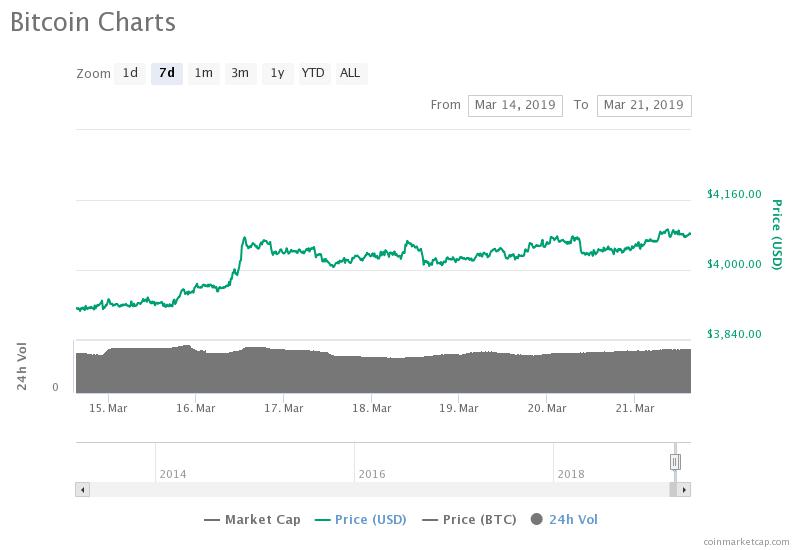

Industry sees crypto bottom as Bitcoin nears $4,100 and tokens gain 20%

Author: Joseph Young / Source: CCN

The valuation of the crypto market rose by $1.5 billion overnight as the bitcoin price closed on $4,100 and a handful of tokens recorded gains in the range of 10 percent to 25 percent.

Based on the global average price of bitcoin as shown on Coinmarketcap.com, the bitcoin price has remained above the $4,000 resistance level for more than seven days.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click .

Throughout the past several months, many traders expressed their concerns over the inability of bitcoin to break out of crucial resistance levels and if the dominant cryptocurrency can continue to move past $4,000, the sentiment around the market is expected to improve.

Is the Bitcoin Bottom In? Too Early to Tell But Industry Execs Believe So

Earlier this week, reports suggested that some analysts still foresee the bitcoin price testing its previous low in the $3,122 to $3,500 range before initiating a proper accumulation phase in the upcoming months.

The cautious optimism towards the price trend of bitcoin comes from its performance since September 2018. Since mid last year, bitcoin has shown a pattern of experiencing several months of stability and becoming vulnerable to a large drop thereafter.

Bitcoin could avoid a large retrace to the $3,500 region if it can continue to climb up in the $4,000 and $5,000 range and a growing number of traders have begun to forecast a gradual climb to key resistance levels.

— C3P0 [Wookiemood] (@__BTC3P0__) March 20, 2019

Anthony Pompliano, the co-founder and general partner...

Research: 75% of Bitcoin Exchanges Report ‘Suspicious’ Digital Currency Trading Volumes

Author: P. H. Madore / Source: CCN

A site called TheTie released a report today that estimates over 86% of all reported Bitcoin exchange volume is suspicious, while 75% of exchanges report extremely dubious volumes. The research uses a different formula than other reports have: it values each website’s visitors and compares that value to the reported figures.

Potential Fake Crypto Volumes High Across The Board

For example, Bithumb, which has been the subject of previous investigations, was expected to have a monthly volume of roughly $1.2 billion based on an average visit value of $13,418. Instead, Bithumb reports over $28 billion. This means their reported volume is nearly 2,000% higher than what would be expected.

TheTie introduces the data saying:

“The weighted average trading volume per web visit for Binance, Coinbase Pro, Gemini, Poloniex, and Kraken was selected as a baseline volume per user to calculate expected volume. This amounted to $591 per web visit. BitMEX was not included because it is a futures exchange. This does not account for mobile app or API usage to trade – web traffic is an assumption for simplicity. Relative outlier detection is quite notable, so the outright number isn’t the main objective.”

TheTie hedges its statements by saying these are “potential” indications of fake volume.

Altcoin Exchange Bittrex Among the Most Reliable Reporters

Mt. Gox’s Mark Karpeles Found Guilty, Given 2.6-Year Suspended Sentence

Author: Yogita Khatri / Source: CoinDesk

Mark Karpeles, former CEO of the long-defunct bitcoin exchange Mt. Gox, has been found guilty and given a suspended sentence of two years and six months.

According to a report from The Wall Street Journal on Friday, the Tokyo District Court found Karpeles guilty of wrongfully making electronic records connecting to Mt. Gox’s books, but innocent on charges of embezzlement and breach of trust.

However, Karpeles will be suspended for four years, meaning he won’t do time in jail if staying on good records in the next four years.

The court’s verdict comes almost five years after Mt. Gox filed for liquidation in April 2014 after claiming to have been hacked for 850,000 bitcoin, some of which was later found.

According to the WSJ report, Karpeles’ lawyers wrote in their final...

Bitcoin Price Trapped in Key Make-or-Break Trading Range

Author: Omkar Godbole / Source: CoinDesk

View

- Bitcoin is trapped in a trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively. Therefore, the outlook as per the weekly chart is neutral.

- A weekly close (Sunday, UTC) above $4,106 would confirm a longer-term bearish-to-bullish trend change and could fuel a rally toward $5,000.

- A weekly close (Sunday, UTC) below $3,404 could revive the sell-off from November highs above $6,500 and allow a drop to levels below $3,000.

- The odds of a drop to the lower edge of the trading range would improve if BTC invalidates a bullish candlestick pattern created on Feb. 27 with a move below $3,658.

Bitcoin is trapped in a key trading range defined by the 200-week simple moving average and the 200- week exponential moving average, currently at $3,404 and $4,106, respectively

The cryptocurrency needs a break above the upper edge needed to confirm a longer-term bull reversal. Conversely, a move below the lower bound of the range could revive the bear market.

Prices fell below the 200-week EMA in the third week of November, bolstering the bearish view put forward by the high-volume breach of the crucial support at $6,000 on Nov. 14.

The ensuing sell-off, however, ran out of...

Why Every Portfolio On The Planet Should Be Holding Bitcoin

Editor’s Note: Art Jonak is an investment analyst with both a wide and deep synthesis approach to research data. His commentary threads on titans like Netflix, Amazon and Facebook are a minor legend for their insight, detail and clarity. He also navigates venture funding, and emerging sector data, in a narrative, often with striking visualization, that reveals trends in their formation long before they are visible. It should not need to be said for investment disclosure that Art is holding crypto assets himself. He is obviously making a case of why everyone should.

Here is Art’s 2019 message thread for investing in Bitcoin, in particular. In our eyes, it slams the case for why every single portfolio on the planet should be holding Bitcoin, and treated as a portfolio asset class.

Here's one case for why some should consider adding Bitcoin to their investment portfolio:

Here's one case for why some should consider adding Bitcoin to their investment portfolio:

* Bitcoin is a non-correlated asset — This is the holy grail of any portfolio. Bitcoin’s current 180 day correlation to the S&P 500 is 0 and the correlation to the dollar index is near zero as well. Investing in non-correlated assets should reduce the risk and increase the returns of a portfolio according to modern portfolio theory.

* Bitcoin has an asymmetric return profile — There is much more upside than downside in owning the asset. The downside (loss of capital) is capped at the total amount of capital invested, yet the upside is ~100X+ (if Bitcoin only becomes gold equivalent).

The modern portfolio theory argument for investing in Bitcoin is quite strong. But how has theory played out in practice?

Bitcoin has been the best performing asset over the last 10 years. It has experienced a 1,300,000X+ increase in value from $0.003 to ~$4,000 today. It has beat the S&P 500 for the last 10 years, the last 5 years, and the last 2 years. As a fixed supply asset, I believe Bitcoin will continue to outperform traditional assets in the future as demand continues to increase too.

Although I believe in Bitcoin’s future outlook, most people should not put significant funds at risk in this investment opportunity. It is risky and speculative. They could lose 100% of the money that they invest. For that reason, each person needs to evaluate their current situation, their goals, and the amount of capital they would be willing to lose.

If the thesis plays out how many smart people anticipate though, an investment of 100 basis points or less would materially change the performance of your portfolio fund, which ultimately changes the quality of life you will live when you retire. Most institutions have permanent, long-term capital which allows them to stomach more volatility than most investors.

For example, an investment of 1% of assets at $4,000 BTC price would yield a 25% increase in your portfolio total assets if Bitcoin reached $100,000. If you decided to invest 0.1% of assets, the same price appreciation would increase total assets by 2.5%.

However, the exciting part is that many people believe Bitcoin will not only reach $100,000 one day, but rather be worth $1,000,000+. If that comes to fruition, a 0.1% investment today could lead to the same 25% increase in total assets for your portfolio. These types of trade-offs are the definition of an asymmetric return profile.

And still, most people's portfolios have 0% exposure to Bitcoin and crypto. Something to consider as we head into 2019.

The Good And The Bad Sides Of Initial Coin Offerings

Cryptocurrencies are the new craze in the world of finance. Anywhere you look, one financial enthusiast is trying to get a grip with the world of cryptocurrencies. They are digital currencies; they are not minted in a central bank or regulated by a sole administrator.

They, however, hold a whole lot of value and are used for transactions. Their secure and decentralized nature made them an almost indispensable asset for several industries.

This brings us to initial coin offerings (ICOs). They would not have been possible without the existence of cryptocurrencies. In the short time that they have been in existence, ICOs became the latest trend in business circles. Simply said, they are are the best way for a startup business to generate investments.

How Do ICOs Work?

Startups offer investors a chance to purchase their tokens at considerably low prices in exchange for valuable cryptocurrencies such as Bitcoin, Ripple, and Ethereum. Due to the low prices of tokens, successful ICOs usually end up raking in millions in investment for the startups. Depending on how successful the startup businesses turn out to be in the future, investors can sell tokens for huge profits.

When Did ICOs Come Into Existence?

This might be very surprising to you, but ICOs are very young. The first one ever took place in 2013 and was held by Mastercoin. The next big ICO was done by Ethereum, which raised over two million dollars worth of investments within the first twelve hours of the process. Today, this cryptocurrency is one of the world's most valuable digital currency.

ICOs became the norms for startups soon after that. By the end of 2016, over a hundred million dollars were raised this way. Last year, that total figure grew to an unprecedented $1.25 billion.

There is no denying it, ICOs have been very vital to the economic and business development of the world as a whole. However, like with every new idea, there are many people very skeptical about this way of funding startups. To be honest, this is a very controversial topic.

Many financial analysts have raised the fact that it is highly unregulated as a major turnoff. Such concern is backed up by the fact that many ICOs were followed by some serious scandals. There have been huge scams and cases where investors have lost entire investments.

However, there are also several important advantages of this way of funding, which continue to attract an increasing number of worldwide investors. Some of the advantages include:

-

Middlemen are cut out

-

ICOs are available regardless of your location and nationality

-

Offer cheap avenues of investments

-

Allow you to contribute to the technological development of the globe.

‘Bull Cross’ Points to Positive Bitcoin Market Shift

Author: Omkar Godbole / Source: CoinDesk

View

- Bitcoin’s three-day chart is showing a bullish crossover of the 5- and 10-day exponential moving averages for the first time since July. The crossover looks decisive as both EMAs are now trending north, validating the bearish-to-bullish trend change signaled by the high-volume triangle breakout seen on the 3-day chart.

- The cryptocurrency could test December highs above $4,200 in the near term.

- A minor pullback to $3,800 may be seen in the next 24 hours, as signs of bullish exhaustion have emerged on the hourly and 4-hour charts.

- The bullish case would weaken if BTC finds acceptance below $3,614 (the low of the previous three-day candle), but that currently looks unlikely.

A much-followed bitcoin (BTC) price indicator has turned bullish for the first time in seven months, indicating a trend change in the market.

On the three-day chart, the 5-candle exponential moving average (EMA) has crossed the 10-candle EMA from below – the first decisive bullish crossover since July 17, 2018.

Back then, BTC was trading above $7,300 and the crossover was followed by a rally to highs above $8,400 on July 24.

Moving average crossovers help identify shifts in momentum. A bearish-to-bullish trend change is confirmed when a short-term moving average crosses through a long-term average from below.

Many would argue that EMA crossovers are lagging indicators. While that is true, crossovers between the short duration averages help traders distinguish between bullish and bearish scenarios. The long-term MA crossovers like the “golden cross” (bullish crossover of the...

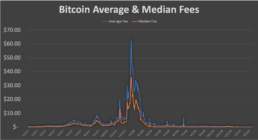

Bitcoin (BTC) transaction average & median fees

Author: Peter Ryan / Source: CoinDesk

Transaction fees make the bitcoin blockchain go round. The miners are compensated for their efforts, not only through inflationary block rewards but also through fees charged to users for adding their transaction to blocks. While fees on average make up about 4% of the total miner revenue per day, with the lion’s share coming from block rewards, sometimes economic shocks cause those fees to rise.

The average fee per transaction is approximately $1.63 with the median being $0.88 over the past five years. The fees are the prices charged for a transaction to get into the limited space of a 1 MB block that occurs every 10 minutes. This results in about 1,800 transactions (~556 average transaction size in bytes) that are able to fit into a block. If the standard 144 blocks are mined per day, we observe a ceiling of about 260,000 transactions per day. Thus there is always a backlog of unconfirmed transactions that reside in the mempool awaiting miners to select them for inclusion in the blockchain.

According to Blockchain.Info, there are about 3.4 million bytes awaiting inclusion in the mempool. Miners will usually include the transaction with the highest fees and work their way down as capacity dwindles to the lower fee transactions. Imagine you are commuting to work and...

How hackers can be stopped from Splitting Bitcoin Into 2 with SABRE Tech

If hackers felt like it, they could split bitcoin in two.

Author: Alyssa Hertig / Source: CoinDesk

It wouldn’t even be that hard, according to research from 2017. Thanks to insecure technology underpinning the internet, someone with the right credentials could exploit the Border Gateway Protocol (BGP) by faking their identity and confusing the network into sending floods of data somewhere it shouldn’t. “The internet’s biggest security hole,” as it’s been called, has been used for everything from snooping on government emails to stealing cryptocurrency.

As far as splitting bitcoin, the attack is as bad as it sounds. If executed successfully, one chunk of the network would be completely sliced off from the other. No one could communicate and send transactions to people who are a part of the “other” network.

That’s where researchers from the prestigious Swiss university ETH Zurich hope to help. As described in a new white paper, they’ve invented a relay network called SABRE that they hope will one day be built on top of bitcoin.

With the same name as the curved blade common in the Napoleonic era, SABRE sounds like it would be used to slice bitcoin in half. Instead, it hopes to do the opposite. Rather, the planned network would (metaphorically) wield a saber against impending attackers, stopping them in their tracks.

Eth Zurich computer network researcher Maria Apostolaki told CoinDesk:

“SABRE is a small relay network whose nodes are strategically located such that they remain connected to each other and connected to as many regular nodes as possible, even in the presence of a AS-level adversary that hijacks traffic.”

This network would “render the partition ineffective,” she said.

When SABRE is used, the risk of a split goes down, the researchers claim. Without SABRE, it’s possible for an ISP to attack and partition bitcoin with only a “small” routing attack. But, according to the researchers’ simulations on a group of five nodes, there’s only a 3.1 percent chance probability of the attacker could hijack the network and partition it. The probability also decreases as the number of nodes increases.

To be presented at The Network and Distributed System Security Symposium this month, the proposed layer is the result of years of research. Apostolaki has been researching this specific issue since 2016 since “blockchain applications are very common nowadays making research on their routing characteristics very impactful.”

The attack

The attack strikes at the root of the internet.

Every time you click a webpage, you’re unknowingly using BGP, an internet protocol that helps get data from Point A to Point B. Say you want to get to CoinDesk.com. Your...