CoinMarketCap to Revamp Listing Metrics After Fake Volume Research

Author: William Suberg / Source: Cointelegraph

Cryptocurrency market data resource CoinMarketCap (CMC) has promised to rearrange how it ranks member exchanges after research found overwhelming evidence of fake volume. The company confirmed the upcoming changes on social media on March 25.

CMC is arguably the industry’s best-known tracking service for the market cap of Bitcoin (BTC) and altcoins, as well as for the activity on exchanges trading them.

However, last week, research from cryptocurrency index fund provider Bitwise claimed that CMC hosts almost entirely fake volume statistics. This in turn deceives investors and inflates the profile of affected coins, Bitwise explained in the report.

Now, CMC has appeared to heed the warnings represented in the research, which Bitwise sent to United States regulators for consideration...

Silvergate ‘Bitcoin Bank’ crypto client base climbed 122% in 2018

Author: Mark Emem / Source: CCN

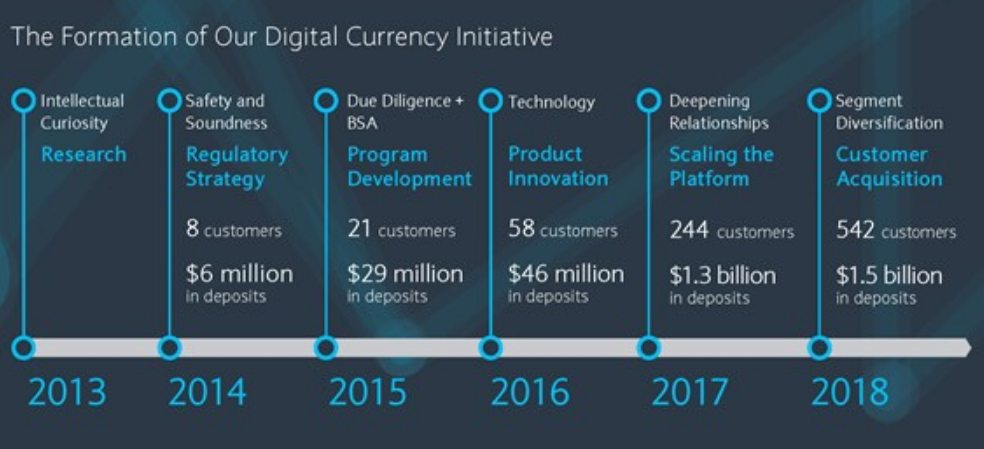

Silvergate Bank, which bills itself as the “leading provider of innovative financial infrastructure solutions and services to participants in the digital currency industry,” has disclosed in a preliminary prospectus filed with the U.S. Securities and Exchange Commission that despite the bearish conditions in the bitcoin market, its number of crypto industry clients surged in 2018.

Silvergate Crypto Client Deposits Rise to $1.58 Billion

By the end of last year, Silvergate revealed that it had 542 cryptocurrency-related customers. This was an increase of 122.1 percent from 2017 when the total number of customers was 244, per the prospectus. Total deposits also increased approximately by 8 percent from $1.46 billion to $1.58 billion.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

Additionally, Silvergate disclosed that it was also in the process of onboarding some 232 customers.

Key Clients? Bitcoin Exchanges and Institutional Investors

Among its most notable customers, digital currency...

Mt. Gox’s Mark Karpeles Found Guilty, Given 2.6-Year Suspended Sentence

Author: Yogita Khatri / Source: CoinDesk

Mark Karpeles, former CEO of the long-defunct bitcoin exchange Mt. Gox, has been found guilty and given a suspended sentence of two years and six months.

According to a report from The Wall Street Journal on Friday, the Tokyo District Court found Karpeles guilty of wrongfully making electronic records connecting to Mt. Gox’s books, but innocent on charges of embezzlement and breach of trust.

However, Karpeles will be suspended for four years, meaning he won’t do time in jail if staying on good records in the next four years.

The court’s verdict comes almost five years after Mt. Gox filed for liquidation in April 2014 after claiming to have been hacked for 850,000 bitcoin, some of which was later found.

According to the WSJ report, Karpeles’ lawyers wrote in their final...

MIT Bitcoin Expo: Legislators Discuss Regulation, Potential of Blockchain Technology

Author: Michael Taiberg / Source: Bitcoin Magazine

Hyperbitcoinization enthusiast and writer

On March 9–10, 2019, the Massachusetts Institute of Technology hosted a two-day event, the MIT Bitcoin Expo 2019. Put together by the student-organized MIT Bitcoin Club, the conference welcomed more than just Bitcoin voices from every corner of the industry. One of those voices was that of U.S. Securities and Exchange Commission (SEC) Commissioner Hester Peirce.

Peirce sat down with Gary Gensler, ex-chairman of the Commodity Futures Trading Commission, senior lecturer at the MIT Sloan School of Management and senior advisor to the director of the MIT Media Lab, to discuss the progress of the SEC’s efforts to regulate the cryptocurrency industry. Notably, Gensler and Peirce launched into a discussion on what regulators can do better to protect investors from fraud and malicious actors.

Before the debate began, both Gensler and Peirce expressed their appreciation for the emerging technology. “It’s a new way to have tamper resistant data amongst the consensus of multiple parties,” Gensler said. “My research is mostly around the business of blockchain technology and … trying to find where are the real use cases where traditional data structures don’t work as well.”

Peirce expressed her own support for the space in relation to the SEC’s ongoing efforts to properly regulate it. “We have rules on the books that we have to enforce, but on the other hand, we don’t want to stop people from doing things that are going to make society a better place to live, that are going to make people’s lives easier, and enable people to interact in ways that they have not been able to in the past.”

Later in the presentation, the two veteran regulators went on to discuss what the government can do to protect investors by possibly regulatinged cryptocurrency exchanges.

Gensler believes that “exchanges are the gateway to get good public policy, particularly around AML laws, but also around investor protection.” He continued, “In essence, that there’s not a manipulated market with frontrunning and manipulation with the order books and the like.”

The discourse was...

Overstock’s Blockchain Subsidiary Acquires Stake in Blockchain Banking Platform

Author: Ana Alexandre / Source: Cointelegraph

Retail giant Overstock.com, Inc.’s blockchain subsidiary, Medici Ventures, has acquired a stake in blockchain banking platform Bankorus, according to a press release published on March 11.

Medici Ventures has purchased a 5.1 percent stake in Bankorus, a blockchain banking platform that enables both individuals and institutions to buy, sell, lend and store digital assets. Jonathan Johnson, president of Medici Ventures, said that “the addition of Bankorus to Medici Ventures’ portfolio of companies will further our work in building the foundation of a blockchain-based technology stack for society.” The financial details of the acquisition were not forthcoming.

Medici Ventures has been largely investing in blockchain projects. Last December, the firm

IBM Digital Currency Chief Says They Are Leading in Blockchain Technology

Author: P. H. Madore / Source: CCN

IBM’s Jesse Lund, who heads the blockchain division, claims IBM is the leader in blockchain technology.

In a recent interview, Lund stated:

What IBM’s been doing as the leader in blockchain technology for the last three years is adding security and confidence to the system.

IBM And Stellar Partnership Challenge xRapid

Lund talks about IBM’s cross-border payments solution, which in part uses Stellar Lumens for settlement, and how one of the oldest technology companies in the world plans to revolutionize the remittance market. The solutions developed are challenging Ripple’s xRapid product for adoption, but all the products will have to work together to create a global and harmonious system.

Join CCN for $9.99 per month and get an ad-free version of CCN including discounts for future events and services. Support our journalists today. Click here to sign up.

He explains:

We’re building on a new idea, which is to be able to store monetary value electronically and be able to move that value around the world in real time… I think the problem with cross-border payments today, the inefficiencies are based on the fact that the way that banks communicate, the network that banks communicate on is separate from the network or the rails that money actually...

The Apple-Goldman Sachs Credit Card is a Poor Substitute for a Secure Bitcoin Wallet

Author: Wes Messamore / Source: CCN

The security design of bitcoin transactions already made the new Goldman Sachs and Apple credit card obsolete before it even came out.

Tripp Mickle, Liz Hoffman, and Peter Rudegeair reported for the Wall Street Journal Thursday:

“Apple Inc. and Goldman Sachs Group Inc. plan to start issuing this spring a joint credit card paired with new iPhone features that will help users manage their money.

“The card will be rolled out to employees for testing in the next few weeks and officially launch later this year, according to people familiar with the matter.”

The Verge’s Jon Porter writes:

“The main selling point of the card is expected to be deeper integration with the Apple Wallet app, which will allow users to manage balances and set spending goals.”

Someone Tell Apple: Credit Cards Are Very Stupid

I’ve always marveled that we hand our credit card or debit card to teenagers at restaurants to disappear with for a few minutes, with all the information on it to spend your money.

We tell total strangers over the phone our name, credit card number, its expiration date, and the super special three number security code on the back to have a pizza delivered.

This is insane.

It does show how trustworthy the people in our society generally are that a financial payment system whose security design is so broken hangs together as well as it does.

But this is a big planet, and there are a lot of people. Not all of them are honorable or trustworthy. Companies...

Virginia Police Department Pension Fund is Betting on Bitcoin

Author: P. H. Madore / Source: CCN

Fairfax County, Virginia has targeted part of its pension fund toward investments in the Bitcoin and cryptocurrency industry, as well as blockchain technology in general. Now, they’re explaining why.

Fairfax County Retirement Systems Director Jeff Weiler published a post in response to CCN and other media’s reporting on the county’s decision to invest in Morgan Creek’s latest offering, the Blockchain Opportunities Fund. Oversubscribed from its intended $25 million, the fund invests in blockchain companies. It captured $40 million from two Fairfax County pension plans and other institutions.

Less Than 1% Of Two Retirement Funds Allocated to Crypto Ventures

First things first, the post gives specifics about the amounts invested. In total, the Virginia retirement system dumped $21 million into the fund. $10 million is from the county employee’s retirement fund while $11 million is from the police officer’s fund. They represent 0.3% and 0.8% of the funds’ total assets, respectively.

The post’s intention is to assuage any concerns that might have arisen in the minds of retirees. As CCN clearly stated, the play was not strictly a Bitcoin buy. Instead, Morgan Creek will use the fund to invest in blockchain companies like Coinbase and Bakkt,...

Coinbase users can now withdraw Bitcoin SV balances to external wallets

Coinbase Finally Makes Bitcoin SV Funds Available for Withdrawal

If you’re a Coinbase user, you may have seen some new tokens on your account. The Bitcoin Cash chain split into two different chains back in November. It means that if you held Bitcoin Cash on November 15, you became the lucky owner of Bitcoin SV and Bitcoin ABC. And Coinbase just started handing out Bitcoin SV to its users if you’re involved in the split.

The split happened because Bitcoin Cash developers couldn’t agree on an upgrade. Some developers backed an upgrade to the code called Bitcoin ABC while others defended a more conservative update dubbed Bitcoin Satoshi Vision (Bitcoin SV).

Author: Ana Alexandre / Source: Cointelegraph

Major American cryptocurrency exchange Coinbase now allows its users to withdraw Bitcoin SV (BSV) balances to external wallets, according to an announcement published on Feb. 14.

BSV appeared following a hard fork in the Bitcoin Cash (BCH) blockchain in November of last year. The for resulted in two new coins; Bitcoin SV and Bitcoin ABC. The camp for Bitcoin SV (Satoshi’s Vision) was lead by Australian computer scientist Craig Wright, who has previously declared himself to be Bitcoin creator Satoshi Nakamoto.

After the hard fork, Coinbase users holding BCH received an equal amount of BSV, however the exchange has, until now, not provided an option for...

Blockchain Slashed Forex Trading Costs by 25% says HSBC Exec

Author: Daniel Palmer / Source: CoinDesk

An HSBC executive has said that the bank’s blockchain-based system has helped it cut the costs of settling foreign exchange trades.

Speaking to Reuters, Mark Williamson, chief operating officer of FX cash trading and risk management, who oversees the blockchain project, said that its HSBC FX Everywhere platform saved it 25 percent as compared with traditional methods.

Last month, the bank announced it had settled more than $250 billion in transactions using its HSBC FX Everywhere platform.

It said then that it had settled 3 million foreign exchange transactions and made a further 150,000 payments over the digital ledger system, which it has been using...